What's Affecting Markets Today

Asia markets mixed

Asia-Pacific markets mostly declined on Monday following disappointing Chinese GDP data and concerns over an assassination attempt on former U.S. President Donald Trump. Quantum Strategy’s David Roche predicted a Trump presidential victory, with increased chances of a Republican sweep in both the House and Senate.

China’s economy grew 4.7% in Q2, below the 5.1% forecast by Reuters and lower than the 5.3% growth in Q1. June retail sales also missed expectations, rising 2% year-on-year versus the anticipated 3.3%.

Hong Kong’s Hang Seng index dropped 1.12%, driven by consumer non-cyclical and real estate stocks, while the mainland’s CSI 300 fell 0.15%. Analysts anticipate that the upcoming Third Plenum meeting will address high local government debt and promote advanced manufacturing.

South Korea’s Kospi and Kosdaq indices remained near flatline.

ASX Stocks

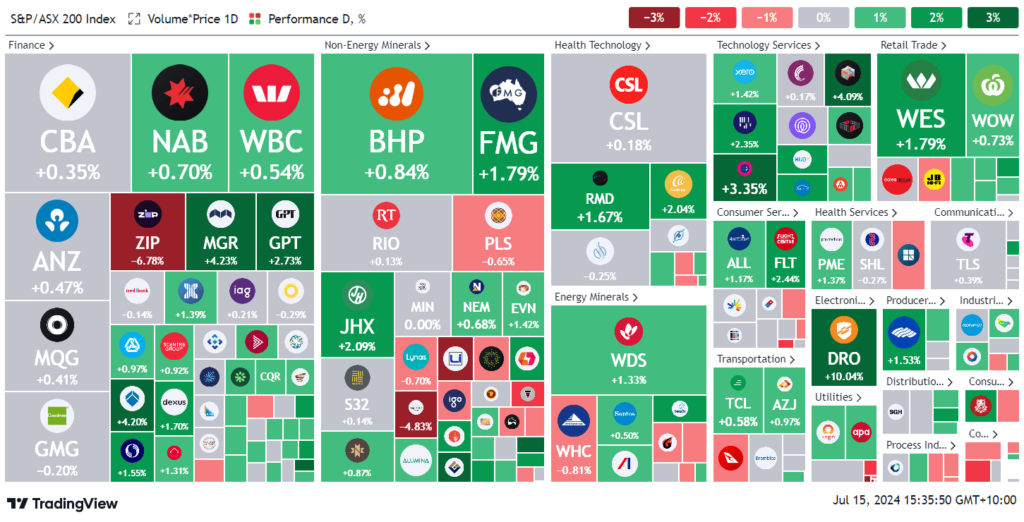

ASX 200 - 8,010.8 (+0.6%)

Key Highlights:

The Australian sharemarket climbed above 8000 for the first time amid a broad rally, buoyed by speculation of a potential US Federal Reserve rate cut. The S&P/ASX 200 Index rose 0.6%, or 45.8 points, to 8005.1 as of 2:39 pm AEST, with all 11 sectors in positive territory. This follows a strong lead from Wall Street, where the S&P 500 hit a new record high and the Dow Jones surpassed 40,000, driven by increased rate cut bets.

TMS Capital’s Ben Clark attributed the rally to positive sentiment around Fed rate cuts. BetaShares’ David Bassanese noted the local market’s potential in a global rotation away from US large-cap tech stocks. Interest-rate-sensitive tech stocks jumped 1.3%, with WiseTech up 2.4% and Xero up 1.1%. Materials gained, led by Fortescue Metals (+2%) and BHP (+0.9%).

Lifestyle Communities dropped 15% amid unethical conduct allegations. Aussie Broadband fell 14.3% after lowering FY25 earnings guidance and launching its low-cost brand, Buddy Telco.

Leaders

DRO Droneshield Ltd (+9.83%)

NAN Nanosonics Ltd (+6.35%)

SPR Spartan Resources Ltd (+4.05%)

SQ2 Block Inc (+3.99%)

MGR Mirvac Group (+3.98%)

Laggards

LIC Lifestyle Communities Ltd (-17.26%)

ABB Aussie Broadband Ltd (-14.57%)

ZIP ZIP Co Ltd (-6.49%)

ADT Adriatic Metals Plc (-5.29%)

BGL Bellevue Gold Ltd (-4.93%)