Earnings

Goodman Beats Earnings Guidance as Data Centre Capacity Ramps Up

Goodman Group outperformed its full-year earnings guidance, reporting a 14% increase in operating earnings per security to 107.5¢. The industrial property and data center giant delivered an operating profit of $2.049 million, up 15% from FY23, driven by global demand for warehouse space and data centers near urban areas. Data centers now represent 40% of Goodman’s $13 billion global project pipeline. The company’s global power capacity also expanded to 5 gigawatts across 13 cities, reflecting the ongoing growth in e-commerce, cloud computing, and new technology adoption.

Origin Energy Shares Plunge as Profits, Outlook Miss Forecasts

Origin Energy’s shares dropped by up to 10.2% following a profit increase of nearly one-third, which failed to meet market expectations. Despite strong earnings from the energy generation and retailing sectors, analysts were disappointed with the weaker-than-expected forecast for FY24 and a softened outlook for the upcoming year. CEO Frank Calabria warned that profits in energy markets, including generation, retail, and trading, would decline, echoing a similar outlook from rival AGL Energy. The market’s reaction reflects concerns about the company’s future performance amid rising costs and lower-than-expected projections.

What's Affecting Markets Today

Employment Jumps 58k in Still-Tight Jobs Market

Australia’s labor market remains resilient despite economic cooling, with 58,000 people finding employment last month, surpassing expectations of 20,000. The Australian Bureau of Statistics (ABS) reported a record number of Australians either working or seeking jobs. This strong job growth sustains pressure on the Reserve Bank of Australia (RBA) to maintain high interest rates, as the labor market cools only gradually. The better-than-expected employment figures align with the RBA’s view that while the market is easing, it’s doing so at a slower pace than anticipated.

Iron Ore Price Hits Lowest Since 2022

Iron ore prices have plummeted to their lowest levels since 2022, driven by a decline in demand as China’s steelmakers cut output amid a market crisis. Futures in Singapore fell below $94 per tonne, marking a fourth consecutive day of losses. China’s steel production decreased by 9% year-over-year, reflecting the nation’s economic slowdown and ongoing property crisis, which have dampened steel demand. As the world’s largest importer of seaborne iron ore, China’s market struggles have significantly impacted global prices, with benchmark prices down by about a third this year.

ASX Stocks

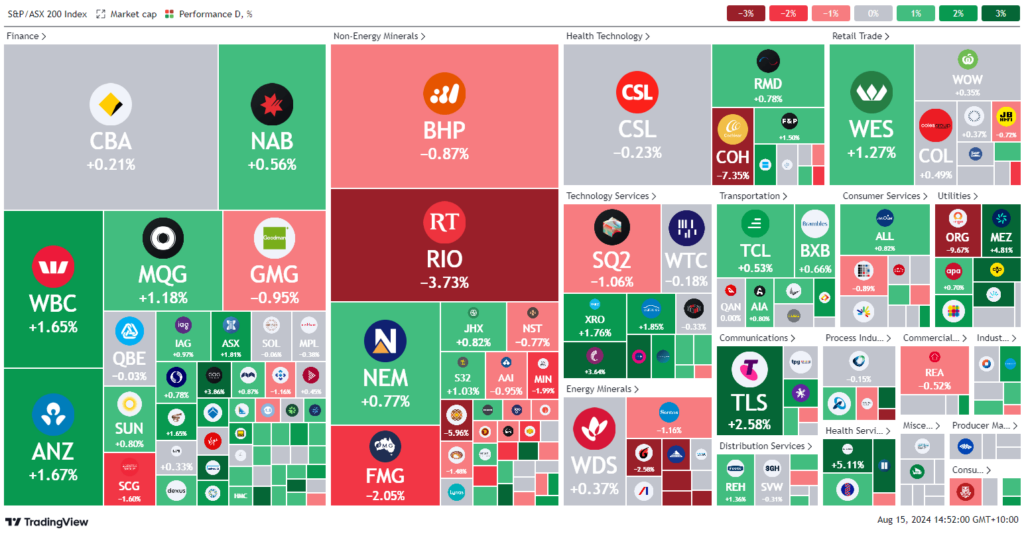

ASX 200 - 7,854.9 (+0.4%)

Key Highlights:

Australian shares rose by 0.3% at midday, driven by corporate profit reports from major companies, though the jobless rate edged up to 4.2% in July, slightly higher by 0.1%. Despite adding 58,200 jobs, largely due to mass immigration, market sentiment was mixed. Cochlear shares fell 6% after underwhelming guidance, and Origin Energy dropped 7.8% due to disappointing FY24 profits. The materials sector declined 1.6%, with BHP, Rio, and Fortescue weakened by concerns over China’s economic health. Goodman Group beat profit guidance, Magellan shares surged 8% on investment news, and Telstra’s profits fell 13% due to rising costs. Treasury Wine Estates increased its dividend despite a significant profit drop. Origin Energy reported strong profit growth but projected a weaker outlook for the coming year.

Leaders

LRS – Latin Resources (+52.08%)

PDI – Predictive Discovery (+12.82%)

NWH – NRW Holdings (+10.66%)

OBM – Ora Banda Mining (+8.89%)

MFG – Magellan Financial (+7.01%)

Laggards

NUF – Nufarm (-9.80%)

ORG – Origin Energy (-9.58%)

JMS – Jupiter Mines (-9.57%)

TPW – Temple & Webster (-8.86%)

MGX – Mount Gibson Iron (-8.33%)