What's Affecting Markets Today

Federal Budget tonight

Tuesday’s federal budget will forecast a surplus of $9.3 billion for this financial year, after which the bottom line will plunge into successive deficits that will be larger than forecast six months ago.

Economists have also warned that any handouts that temporarily bring down household bills will not rein in underlying inflation, undermining the efforts of the Reserve Bank of Australia.

Lithium and nickel miners, which have lobbied for tax breaks from the government, are also said to be among the big winners from the budget.

IGO, Liontown Resources and Chalice Mining are all on the rise, with Piedmont Lithium leading the charge, up 7.7 per cent to 21¢.

Holding pattern ahead of US Inflation data

The tepid trading activity followed a lacklustre session on Wall Street overnight, before the release of US producer price data later tonight and consumer price data on Wednesday. Any signs of sticky inflation are likely to further diminish expectations of interest rate cuts by the Federal Reserve, and are likely to rattle markets.

Inflation is also expected to remain well above the Fed’s 2% annual target rate, giving the central bank little impetus to immediately begin trimming rates.

Geopolitics sends wheat higher

The past week has seen a mind boggling rally in wheat prices of 7.3%. Prices are now up 26 per cent since April 19.

“A massive short covering by funds has intensified a rally fuelled by Russian advances in Ukraine and weather challenges around the world,” CBA Head Ag analyst, Dennis Vozsnesenski said in a note to investors. “We believe the magnitude of the rise will be dependent on how much lower the Russian crop falls and how much headway Russia makes in Ukraine

This comes ahead of earnings updates from key ASX listed agriculture companies over the next week kicking off Thursday with Graincorp and Incitec Pivot. Elders will also deliver earnings next Monday

ASX Stocks

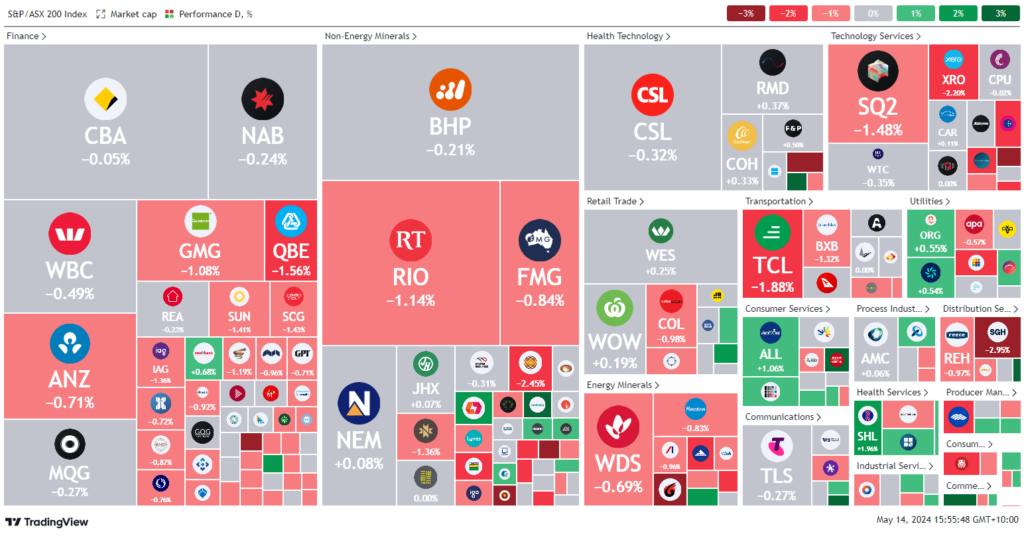

ASX 200 - 7,723.1 (-0.3%)

Key Highlights:

Ahead of the federal budget, Australian shares saw modest declines, with the S&P/ASX 200 dropping by 0.4 percent as the market reacted to a flat performance on Wall Street and awaited crucial inflation data from the US. The real estate sector felt the brunt of the losses, dipping 0.9 percent, influenced by interest rate sensitivities.

Economist Satish Ranchhod of Westpac described the situation as a “holding pattern,” as US traders awaited producer and consumer price data. Similarly, Australian markets were subdued in anticipation of a federal budget projected to show a $9.3 billion surplus, before tipping into larger-than-expected deficits in subsequent years.

Market focus centers on the government’s ability to balance inflation pressures with necessary cost-of-living aids. Lithium and nickel sectors on the ASX, buoyed by intense lobbying and recent price dips, showed resilience. Notably, Piedmont Lithium surged 7.7 percent.

The Australian dollar hovered around US66.07¢ as the budget loomed. In company news, GUD Holdings led the gains, up 9.9 percent, after confirming its earnings forecast. Conversely, ARN Media and Seven Group faced declines, with ongoing negotiations and strategic acquisitions impacting their stock values. Additionally, Neuren Pharmaceuticals and Credit Corp benefited from favorable analyst ratings, climbing 6.6 percent and 4.3 percent, respectively.

Leaders

GUD-G.U.D. Holdings Ltd (+11.87%)

AGI-Ainsworth Game Technology Ltd (+9.20%)

RAC-Race Oncology Ltd (+9.03%)

SYA-Sayona Mining Ltd (+8.54%)

CXO-Core Lithium Ltd (+6.90%)

Laggards

AFP-Aft Pharmaceuticals Ltd (-10.39%)

MEI-Meteoric Resources NL (-7.14%)

PNR-Pantoro Ltd (-6.98%)

MYX-Mayne Pharma Group Ltd (-5.80%)

HTA-Hutchison Teleco. (Australia) Ltd (-5.41%)