What's Affecting Markets Today

Gold Resets Peak

Gold reached a new record high of US$2932.05 an ounce on Friday, surpassing its previous session’s peak. This surge reflects strong investor sentiment amid heightened geopolitical risks, particularly related to US trade and tariff policies. Market participants expect that these pressures, along with economic uncertainties, could drive gold above the US$3000 mark later this year. As gold continues to attract attention as a safe-haven asset, its rising price underscores the broader trend of investors seeking stability during turbulent global economic times. The record-setting price further reinforces gold’s role in portfolio diversification and risk management in an unpredictable market environment.

Iron Ore Holds Above US$106 a Tonne

Iron ore prices have stabilized above the US$106 per tonne level, even as recent sessions showed minor fluctuations. On Friday, the Singapore benchmark futures contract inched 0.1% lower to US$106, following a more significant drop of over 1% the day before. Despite these small declines, prices have remained resilient above US$106 since last Friday, buoyed in part by a weak US dollar. This stability indicates ongoing demand and suggests that the commodity market is absorbing short-term volatility. Market analysts continue to monitor economic indicators and currency movements as they assess the outlook for iron ore, anticipating that current trends could shape future pricing dynamics.

Trump Warns BRICS Nations Could Face 100% Tariffs

President Trump issued a stark warning that BRICS nations—specifically Brazil, Russia, India, and China—could incur 100% tariffs if they attempt to establish a currency that challenges the US dollar. This statement came amid intensifying trade tensions and followed criticism of trade practices, particularly toward India, which already faces some of the highest US tariffs on its exports. In anticipation of his White House meeting with Indian Prime Minister Narendra Modi, the Indian government is preparing counteroffers involving increased procurement in sectors like liquefied natural gas, defense equipment, and jet engines, along with potential tariff cuts in various industries. The exchange highlights the complex interplay between trade policy and international economic strategy.

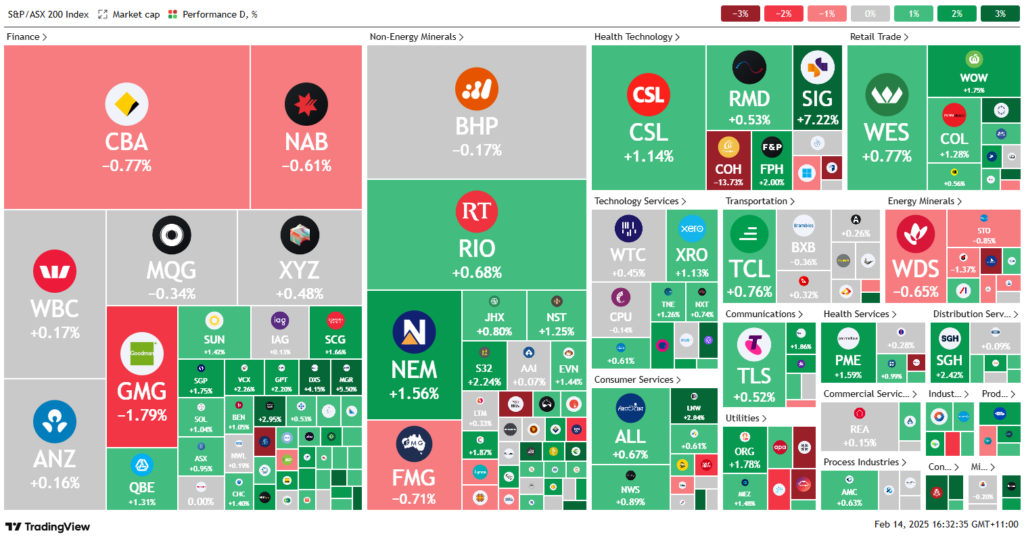

ASX Stocks

ASX 200 - 8,555.8 (+0.20%)

Australian shares experienced an early boost but were trimmed by midday as profit-taking in Commonwealth Bank shares slowed gains. The index, which had risen as much as 0.8%, was up 0.3% at 8,567 points, while the All Ordinaries Index climbed 0.4%. Most sectors advanced, with defensive stocks like Origin Energy, Treasury Wine Estates, and Woolworths leading, even as concerns lingered over new US reciprocal tariffs targeting trade partners through value-added tax adjustments and potential GST impacts.

Earnings Update:

Earnings reports revealed mixed results. Cochlear’s shares plunged 13.2% after downgrading its full-year profit forecast, and AMP’s half-year profit nearly halved to $150 million, dragging its shares down 14.2%. In contrast, Avita Medical surged 11.6% on a 29% rise in commercial revenues and positive 2025 guidance. Mirvac gained 4.3% despite a 6% profit decline, while WAM Capital reported a robust 45% increase in half-year profit to $148.9 million. GQG also gained after doubling its net flows, and Unibail-Rodamco-Westfield slipped 4.2% despite exceeding earnings per share forecasts.

Leaders

TPW – Temple & Webster Group Ltd (+11.77%)

IMR – Imricor Medical Systems Inc (+10.69%)

SM1 – Synlait Milk Ltd (+10.45%)

IMU – Imugene Ltd (+10.26%)

SIG – Sigma Healthcare Ltd (+7.22%)

Laggards

AMP – AMP Ltd (-14.86%)

COH – Cochlear Ltd (-13.73%)

CVL – Civmec Ltd (-13.12%)

CU6 – Clarity Pharmaceuticals Ltd (-9.09%)

DXB – Dimerix Ltd (-4.95%)