What's Affecting Markets Today

Asian markets stronger

Asia-Pacific markets advanced on Thursday after the U.S. Federal Reserve maintained the federal funds rate at 5.25% to 5.5% and adjusted its “dot plot” to project only one rate cut this year, down from three in March. The 2025 outlook anticipates four rate cuts totaling one percentage point, up from three.

South Korea’s Kospi led gains, rising 1.39%, with the small-cap Kosdaq up 0.6%. Japan’s Nikkei 225 gained 0.56%, while the Topix was slightly lower. Hong Kong’s Hang Seng index opened 1.23% higher, driven by electric vehicle stocks despite EU tariffs on Chinese EV makers. BYD surged over 6%, with Nio and Li Auto up 2.77% and 1.85%, respectively. The CSI 300 in mainland China increased by 0.12%.

The Fed’s statement noted inflation easing but still elevated, with modest progress towards the 2% target. U.S. markets responded positively, with the S&P 500 closing above 5,400 for the first time, while the Nasdaq hit a record high.

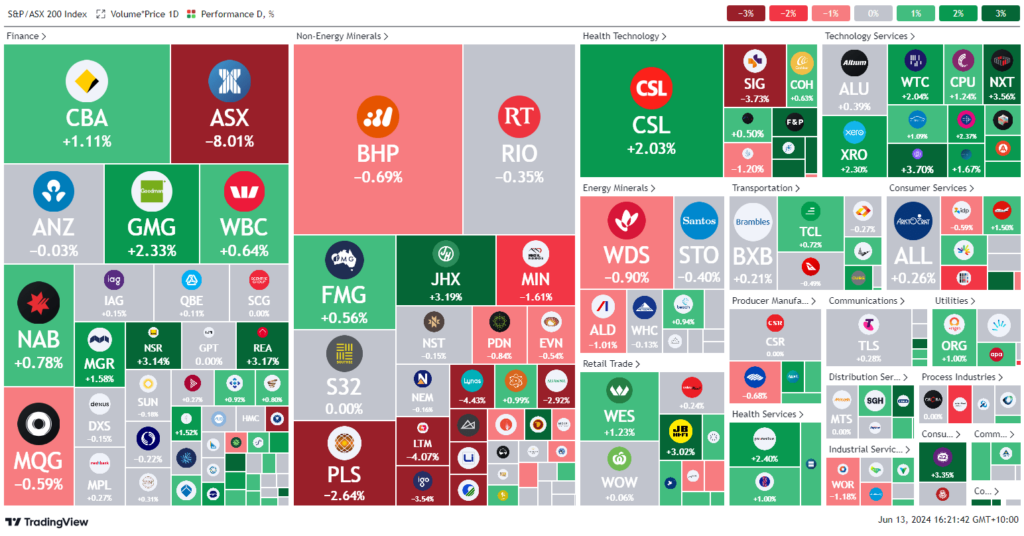

ASX Stocks

ASX 200 - 7,749.7 (+0.4%)

Key Highlights:

Australian shares rose 0.6% to 7,761 points in the afternoon, ending a two-day losing streak driven by softer commodity prices. Gains in interest rate-sensitive sectors, including property, banking, and tech, led the rebound. Australia’s jobless rate fell by 0.1% to 4% in May, which did not alter interest rate expectations ahead of the Reserve Bank’s June 18 meeting.

On the ASX, WiseTech surged 2.7% to nearly $100 per share, boosting the tech sector by 2%. Goodman Group led property stocks, climbing 2.8%. The big four banks also saw gains, with Commonwealth Bank up 0.8% and National Australia Bank reaching a peak since 2015 at $35.23. Uranium stocks rebounded as Boss Energy rose 5.5% and Paladin added 2.7%.

In corporate news, Sigma fell 6.2% after the competition regulator raised concerns about its proposed merger with Chemist Warehouse. Targeted divestments might address regulatory issues, suggesting a reasonable probability for transaction approval.

Leaders

SPR Spartan Resources Ltd 8.71%

CDA Codan Ltd 7.30%

DRO Droneshield Ltd 5.86%

TPW Temple & Webster Group Ltd 5.35%

ASK Abacus Storage King 5.13%

Laggards

ASX ASX Ltd -8.01%

ERA Energy Resources of Australia Ltd -7.14%

LYC Lynas Rare EARTHS Ltd -4.43%

LTR Liontown Resources Ltd -4.39%

SIG Sigma Healthcare Ltd -4.15%