Earnings

Temple & Webster (TPW) +24%

The results for FY24 largely met or exceeded expectations, with strong revenue growth, robust EBITDA margins, and effective cost management. While there were some areas of slight underperformance, such as the decrease in revenue per active customer, the overall financial health and strategic direction of the company were in line with the optimistic forecasts from analysts.

CSL (CSL) -5%

CSL’s results largely met or slightly exceeded expectations, particularly in terms of revenue and NPAT growth. The company’s dividend was slightly below some expectations but aligned with the broader range. The strong performance in the CSL Behring division, driven by immunoglobulin sales, was a significant contributor to these results.

Challenger (CGF) +7%

Challenger Limited’s financial results for FY2024 exceeded market expectations, particularly in terms of profitability, EPS growth, and stronger-than-expected dividends, despite slightly lower total Life sales. The company’s performance was marked by an increase in ROE and has been positively received by most analysts. However, the statutory net profit was lower due to asset and liability experiences and other one-off items, and the Funds Management division underperformed slightly compared to the previous year, which may have fallen short of market expectations.

What's Affecting Markets Today

Asia markets mostly higher

The Nikkei 225 surged 2.72%, surpassing 36,000 for the first time since August 2, while the broader Topix gained 2.25%. The rally was fueled by strong performances in Japan’s technology and financial sectors, with Rakuten Group and Trend Micro soaring over 8% and 6%, respectively. The momentum comes as Japan’s parliament prepares to discuss the Bank of Japan’s recent interest rate hike in a special session next week, according to Reuters.

Japan’s producer price index rose 3% in July, accelerating from 2.9% in June. In contrast, South Korea’s Kospi dipped 0.2%, and the Kosdaq fell 1.57%. Hong Kong’s Hang Seng index opened with a 0.4% gain, while mainland China’s CSI 300 edged up 0.06%.

In Southeast Asia, Singapore’s economy grew 2.9% in Q2 year-on-year, driven by strength in wholesale trade, finance, insurance, and information and communication sectors, aligning with earlier GDP estimates. The city-state forecasts 2024 GDP growth of 2% to 3%.

ASX Stocks

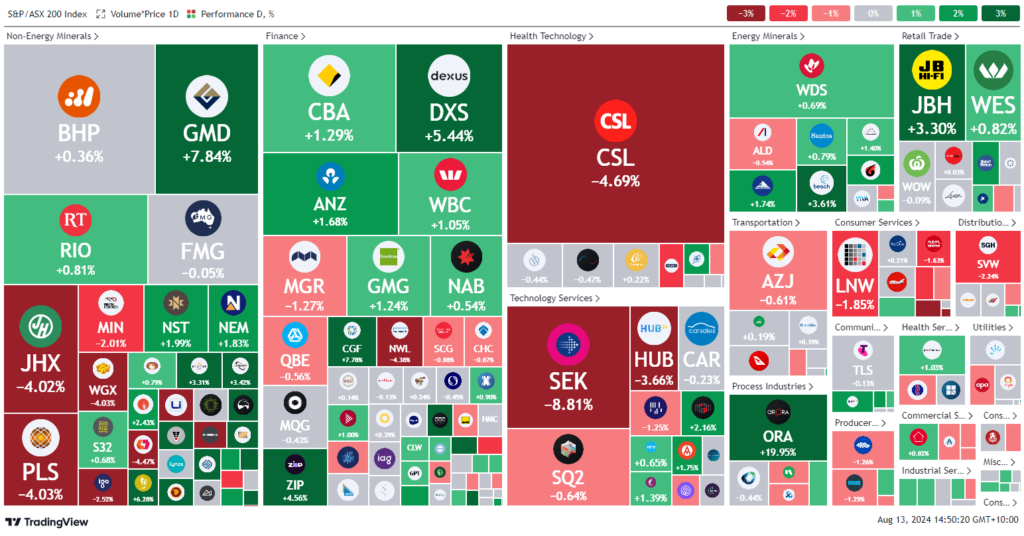

ASX 200 - 7,818.9 (+0.1%)

Key Highlights:

Australian shares edged higher in early afternoon trade, with the S&P/ASX 200 Index up 0.3% or 21.5 points to 7835.2, extending gains for a fifth consecutive day. Real estate and mining sectors led the advance, while healthcare lagged, falling 2.6%. CSL shares dropped 4%, despite projecting double-digit earnings growth, marking one of its largest daily declines this year. Seek was the biggest laggard, plunging nearly 10% after weaker regional job ads impacted earnings.

Challenger surged 6.5% on a 17% rise in FY24 normalised net profit. Rising oil prices boosted energy stocks, with Woodside up 0.9% and Beach Energy climbing 2.1%. Major banks also performed well, led by ANZ’s 1.4% gain, while Rio Tinto added 1.4%, BHP rose 0.8%, and Fortescue increased 0.6%.

Australia’s wage growth slowed to 0.8% in Q2, below forecasts, with annual growth at 4.1%, easing concerns over inflation. The Australian dollar edged up to US65.90¢.

Leaders

TPW Temple & Webster Group Ltd (+24.11%)

ORA Orora Ltd (+19.69%)

SGM Sims Ltd (+9.29%)

GMD Genesis Minerals Ltd (+7.84%)

CGF Challenger Ltd (+7.70%)

Laggards

SEK Seek Ltd (-9.22%)

NWL Netwealth Group Ltd (-5.29%)

LTR Liontown Resources Ltd (-5.23%)

NAN Nanosonics Ltd (-5.03%)

AD8 Audinate Group Ltd (-4.93%)