What's Affecting Markets Today

Asian markets mixed

Asia-Pacific markets exhibited mixed performance on Wednesday as investors analyzed regional inflation data. China’s May inflation rate was 0.3%, falling short of the 0.4% forecast by economists surveyed by Reuters, remaining unchanged from April. The Hong Kong Hang Seng index dropped 0.76% following the CPI announcement, while the mainland Chinese CSI 300 experienced a slight decline.

Investors in Asia are also anticipating the U.S. Federal Reserve’s decision on Wednesday, which follows the U.S. May inflation report. India’s inflation is projected to rise marginally to 4.89% from April’s 4.83%, based on a Reuters poll.

Japan’s Nikkei 225 fell 0.79%, and the Topix dropped 0.85%. Japan’s corporate goods inflation accelerated to 2.4% in May, the fastest rate since August. Conversely, South Korea’s Kospi increased by 0.45%, and the Kosdaq rose 0.56%.

In the U.S., the S&P 500 and Nasdaq Composite reached new highs, driven by Apple’s surge to a record high, despite the Dow Jones Industrial Average falling 0.31%. Investors rotated from Nvidia to Apple, which announced new iPhone features.

ASX Stocks

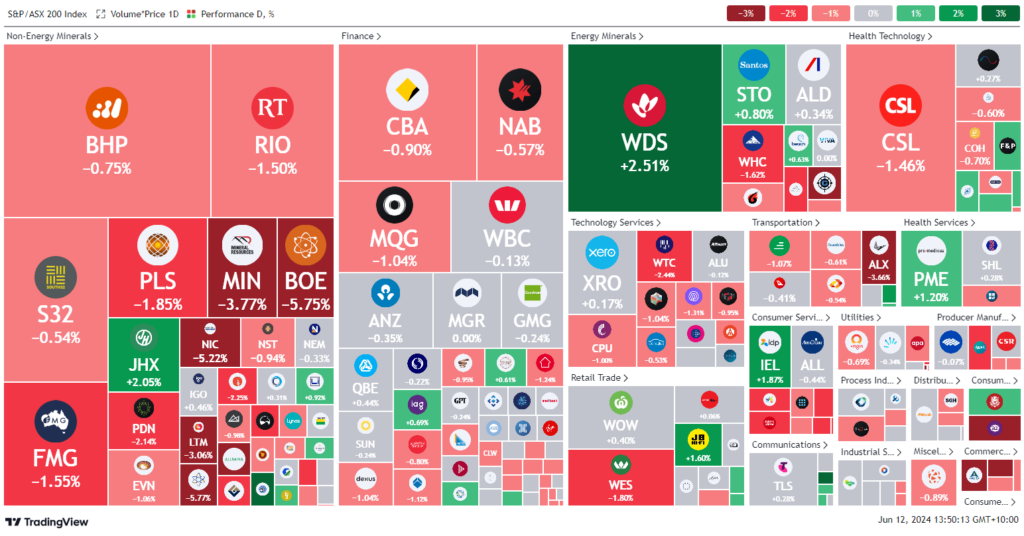

ASX 200 - 7,715.1 (-0.5%)

Key Highlights:

The Australian sharemarket extended its losses at lunchtime amid widespread selling, as investors remained cautious ahead of the U.S. Federal Reserve’s key interest rate decision. The S&P/ASX 200 Index dropped 0.7%, or 51.8 points, to 7703.6, with ten out of eleven sectors in decline.

Tuesday saw the market’s steepest fall in six weeks, plunging 1.3%. The materials sector, hit by a sharp overnight decline in iron ore prices, was among the worst performers. BHP fell 1.1%, Rio Tinto lost 1.7%, and Fortescue Metals dropped 1.3%.

Interest rate-sensitive tech stocks also declined, with WiseTech down 2.2% and NextDC falling 1.5%.

Macquarie upgraded Woodside to “outperform,” citing overly pessimistic market valuations. Woodside shares rallied 2.3%.

Automotive parts retailer Bapcor rose 3.4%, continuing its surge after a takeover bid from Bain Capital.

Super Retail appointed Judith Swales as chairwoman, replacing Sally Pitkin. Super Retail shares fell 0.7%.

Leaders

JDO Judo Capital Holdings Ltd 6.73%

EMR Emerald Resources NL 5.36%

DRO Droneshield Ltd 4.58%

HLS Healius Ltd 3.75%

TUA Tuas Ltd 3.25%

Laggards

BOE Boss Energy Ltd -5.52%

DYL Deep Yellow Ltd -5.41%

NXG Nexgen Energy (Canada) Ltd -5.12%

NIC Nickel Industries Ltd -4.89%

URW Unibail-Rodamco-Westfield -4.24%