What's Affecting Markets Today

Asia markets mixed

Asia-Pacific markets showed mixed performance on Friday following the release of U.S. inflation data for June, which hit its lowest level in three years, potentially giving the Federal Reserve leeway to cut interest rates. The U.S. consumer price index rose by 3% year-on-year, down from May’s 3.3%. Core inflation, excluding food and energy, increased by 0.1% monthly and 3.3% annually, below forecasts.

The yen strengthened against the dollar after the data release, with speculation of potential intervention by Japan’s Ministry of Finance. The yen traded at 158.55 against the dollar at midnight Tokyo time, strengthening further to 158.23. Japan’s top currency diplomat, Masato Kanda, indicated readiness to act in the forex market, though he did not confirm any intervention.

Japan’s Nikkei 225 plunged 1.97% after three days of record highs, and the Topix fell 0.93%. South Korea’s Kospi declined 1.27%, and the Kosdaq slipped 0.32%. Conversely, Hong Kong’s Hang Seng index rose 1.54%, while China’s CSI 300 decreased by 0.24%

ASX Stocks

ASX 200 - 7,950 (+1.2%)

Key Highlights:

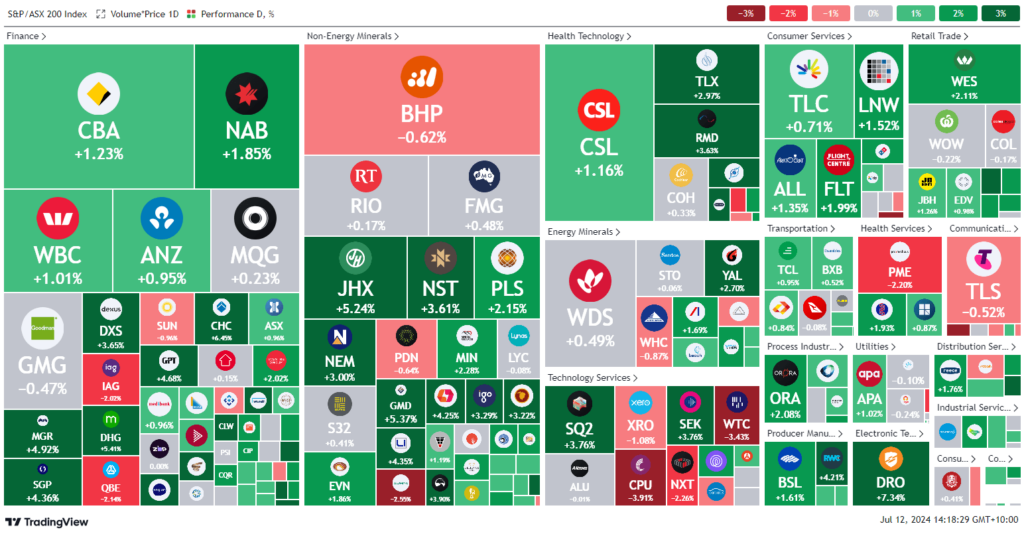

Australian shares surged 1 per cent to a record high of 7969 points by midday, driven by data showing the US entered deflation in June, increasing expectations for imminent rate cuts by the US Federal Reserve. Year-on-year US inflation was at 3 per cent, but prices dropped 0.1 per cent from May to June. This news led to a decline in US bond yields and a rotation from mega-cap tech stocks to smaller caps, which benefit more from lower rates.

NAB reported, “Post CPI, US money markets priced in a September quarter-point Fed cut with 100 per cent confidence and a small chance (~10 per cent) of a July move. Markets now anticipate 60bps of cuts by year-end.”

In Australia, the tech sector dipped 1.2 per cent, while real estate rose 2.3 per cent. The Small Ords Index gained 1.3 per cent. The Australian dollar reached its highest since January, buying US67.6¢.

Commonwealth Bank shares hit a record high of $131.60, surpassing BHP’s market cap, which fell 0.6 per cent. Rio Tinto rose 0.6 per cent amid acquisition speculation. NAB shares reached $36.89, the highest since the GFC, while Rex shares remained flat due to a boardroom split.

Leaders

CU6 – Clarity Pharmaceuticals Ltd (+8.26%)

SPR – Spartan Resources Ltd (+8.16%)

MSB – Mesoblast Ltd (+7.69%)

DRO – Droneshield Ltd (+7.34%)

CHC – Charter Hall Group (+6.58%)

Laggards

CPU – Computershare Ltd (-3.67%)

WTC – Wisetech Global Ltd (-3.33%)

CSC – Capstone Copper Corp (-3.30%)

MAQ – Macquarie Tech Group Ltd (-2.92%)

ERA – Energy Resources of Aus (-2.63%)