What's Affecting Markets Today

Asia markets mostly higher

Asia-Pacific markets opened mostly higher on Monday, following a turbulent week marked by significant sell-offs and a sharp recovery, particularly in Japanese stocks. In Asia, traders are focused on upcoming inflation and industrial output data from India.

According to a Reuters poll, economists expect India’s year-on-year CPI inflation to drop significantly to 3.65% in July, down from 5.08% the previous month. Additionally, India’s industrial output for June is projected to slightly decrease to 5.5% from May’s 5.9%.

In other markets, South Korea’s Kospi and its small-cap Kosdaq both gained 1%. Mainland China’s CSI 300 remained flat, while Hong Kong’s Hang Seng index slipped 0.2% in early trading. Japan’s markets were closed for a public holiday.

ASX Stocks

ASX 200 - 7,812.2 (+0.4%)

Key Highlights:

The Australian sharemarket advanced on Monday, marking its second consecutive day of gains, driven by strong earnings from JB Hi-Fi amidst a busy week of corporate results. The S&P/ASX 200 Index rose 38.7 points, or 0.5%, to 7816.4, following a Wall Street rebound as global markets stabilize after last week’s significant downturn.

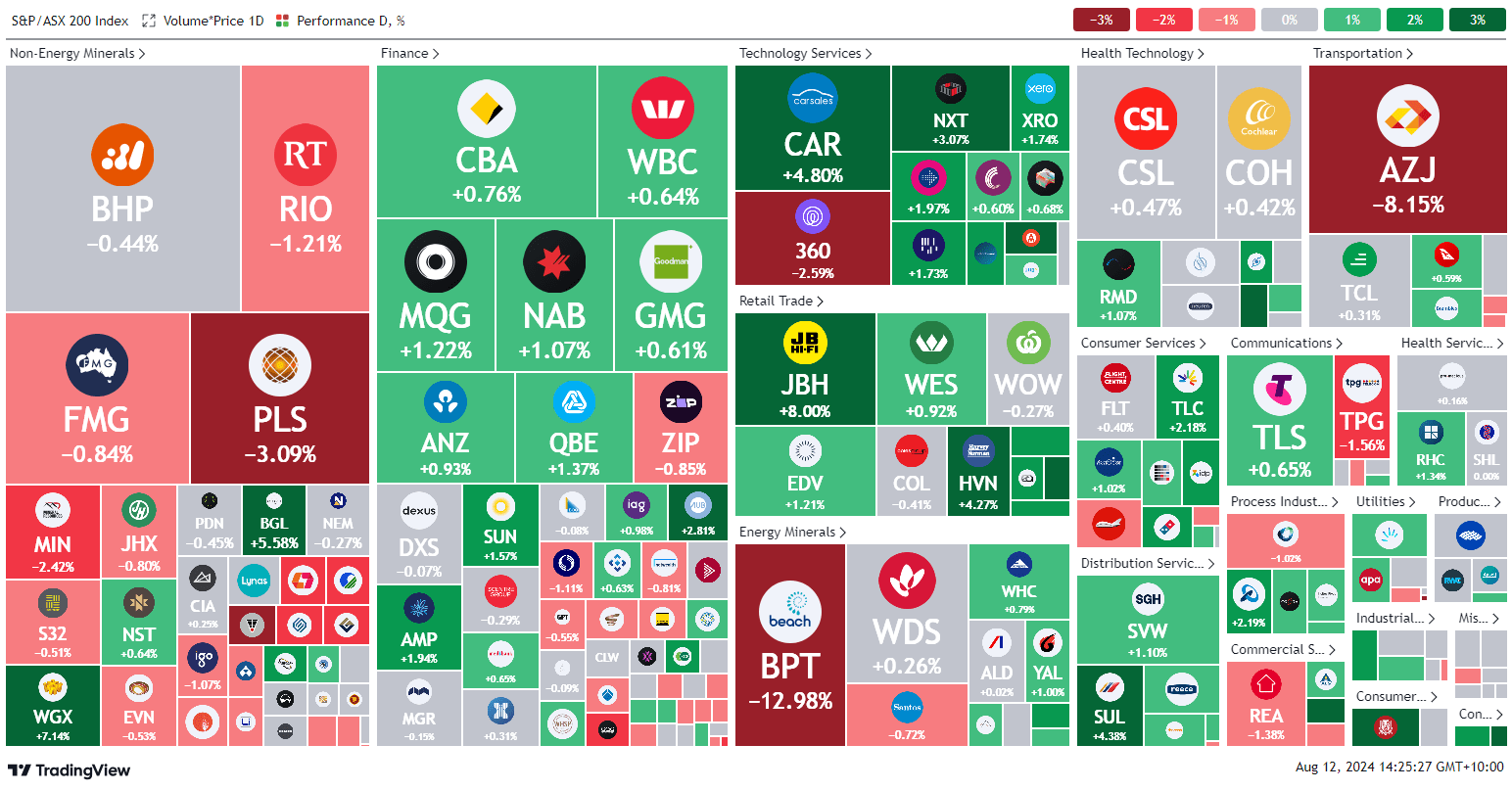

On the ASX, nine of the 11 sectors were in positive territory, led by consumer discretionary stocks, which climbed 1.6%. The tech sector also gained, rising 1.3%. Matt Wacher, Chief Investment Officer at Morningstar Asia Pacific, highlighted the importance of company reports in gauging the macroeconomic outlook, noting that signs of cooling economic activity could support the Reserve Bank’s recent decision to hold interest rates steady.

JB Hi-Fi surged 8.7% after announcing a special 80¢ dividend and better-than-expected profit, despite a 16.4% decline in net profit to $438.8 million for the year ended June 30. The retailer also acquired E&S Trading Co., expanding its kitchen, laundry, and bathroom product offerings. The results lifted other consumer discretionary stocks, with Harvey Norman up 3.9% and Super Retail gaining 4.4%.

CAR Group rose 3.7% after reporting a 41% increase in FY24 revenue, while Aurizon fell 7.5% on soft FY25 guidance despite a $150 million share buyback. Beach Energy shares dropped 11.2% following a downgrade at its Enterprise gas field and a $475.3 million net loss for FY24.

Leaders

JBH JB Hi-Fi Ltd (+8.45%)

WGX Westgold Resources Ltd (+7.33%)

BGL Bellevue Gold Ltd (+6.01%)

DDR Dicker Data Ltd (+5.94%)

AD8 Audinate Group Ltd (+5.46%)

Laggards

BPT Beach Energy Ltd (-11.58%)

AZJ Aurizon Holdings Ltd (-7.87%)

RDX REDOX Ltd (-3.79%)

AAC Australian Agricultural Co (-3.55%)

DRO Droneshield Ltd (-3.21%)