What's Affecting Markets Today

Uranium Bulls Cheer as Price Hits 16-Year High

The uranium sector is experiencing a significant rally, with prices reaching a 16-year high of $US65.50 per pound. This surge is a boon for funds like NGE Capital, bullish on uranium since 2018. Factors contributing to the price increase include production challenges at Cameco due to COVID-19, supply uncertainties in Niger, and project delays in the US. Additionally, a World Nuclear Association report predicts a doubling in global uranium demand by 2040, further fueling the bullish sentiment in the market.

Oil Price Jumps After US and UK Launch Airstrikes in Yemen

Oil prices surged following airstrikes by the US and UK against Houthi rebel targets in Yemen, a response to the group’s attacks on Red Sea shipping. West Texas Intermediate rose to above $US73 a barrel. The escalation in conflict and Iran’s recent seizure of an oil tanker have heightened tensions in the Middle East. These developments, combined with ongoing geopolitical strife, have contributed to the fluctuating oil prices, despite factors like rising non-OPEC+ supply and Saudi Arabia’s pricing cuts affecting the market.

Chinese Inflation Eases for the Third Month

China’s inflation continued to decline for the third consecutive month in December, setting the stage for a potential interest rate cut by the central bank. The consumer price index fell by 0.3%, and the producer price index dropped by 2.7% annually. These figures were slightly below economists’ predictions. The Australian dollar remained stable following this news. The People’s Bank of China is anticipated to reduce its one-year policy loan rate to combat deflationary pressures, with expectations of a 10 basis point cut to 2.4%, marking the first reduction since August.

ASX Stocks

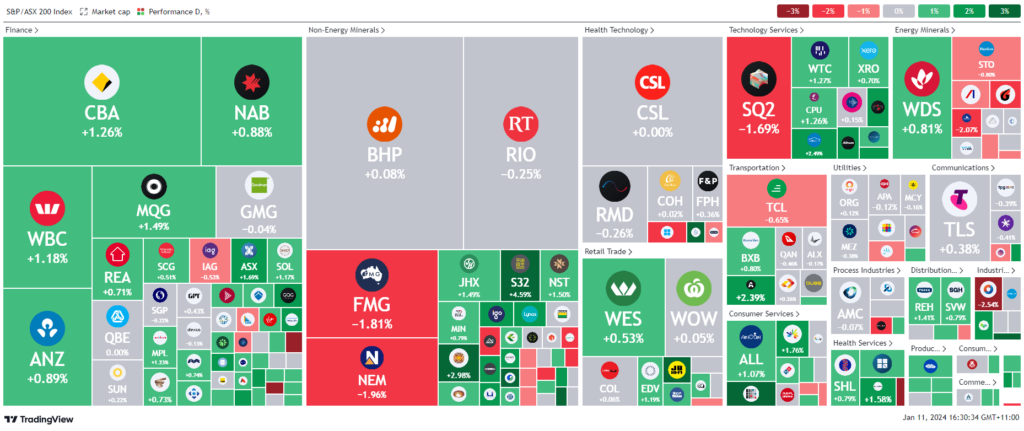

ASX 200 - 7,498.3 (-0.1%)

Key Highlights:

The Australian sharemarket experienced a slight decline in afternoon trading amidst a volatile Wall Street session and a surge in oil prices above $US73 per barrel. The S&P/ASX 200 dipped by 0.1% to 7497, and the All Ordinaries remained relatively unchanged. This downturn follows mixed signals from Wall Street, where US consumer price increases tempered expectations for a Federal Reserve rate cut in March.

The ASX’s decline was led by utilities, with AGL Energy notably falling for the eighth session. However, the energy sector saw a 0.9% rise, driven by the heightened oil prices following US and UK airstrikes on Houthi rebels in Yemen. Brent crude escalated by up to 2.5% to over $US79 a barrel. Companies like Beach Energy, Santos, and Woodside Energy benefited from this spike, along with uranium firms Boss Energy and Paladin.

The uncertain global situation also led to a rise in gold prices, with investors turning to this safe-haven asset. Gold producers such as Sandfire Resources, Silver Lake, and Northern Star saw increases in their stock value. Core Lithium was the top performer on the ASX 200, rebounding 10% after a previous 17% drop earlier in the week.

The Australian dollar hovered near US66.97¢, influenced by Chinese data showing a continuous decrease in inflation, which might lead to a rate cut by China’s central bank.

Leaders

SNZ – Summerset Group Ltd (+11.46%)

DYL – Deep Yellow Ltd (+6.83%)

BOE – Boss Energy Ltd (+4.85%)

NEU – Neuren Pharmaceuticals Ltd (+4.44%)

BGL – Bellevue Gold Ltd (+4.26%)

Laggards

HLS – Healius Ltd (-6.65%)

IMU – Imugene Ltd (-6.00%)

RED – RED 5 Ltd (-5.00%)

SGR – The Star Entertainment (-4.13%)

MGH – Maas Group Holdings Ltd (-3.64%)