What's Affecting Markets Today

Asian markets mixed

Asia-Pacific markets presented a mixed performance on Tuesday, despite the S&P 500 and Nasdaq Composite achieving new highs on Wall Street overnight. Traders in the region are keenly awaiting the U.S. Federal Reserve’s decision on Wednesday, following the May inflation report. Investors are particularly interested in the Fed’s updated projections on rate cuts, with markets currently pricing in a single rate cut in November, as per the CME FedWatch Tool.

Australia, Hong Kong, mainland China, and Taiwan resumed trading after a public holiday. Taiwan’s Weighted Index surged 0.46% to record highs, driven by technology and utility stocks. Japan’s Nikkei 225 rose by 0.42%, with the Topix up 0.37%. South Korea’s Kospi gained 0.57%, and the Kosdaq increased by 0.73%. Conversely, Hong Kong’s Hang Seng index fell 1.16% at the open, and mainland China’s CSI 300 dropped 0.51%. In the U.S., the S&P 500 climbed 0.26%, the Nasdaq Composite rose 0.35%, and the Dow Jones added 0.18%.

ASX Stocks

ASX 200 - 7,755.6 (-1.3%)

Key Highlights:

Australian shares declined over 1% by midday Tuesday, led by miners, as investors anticipated the U.S. Federal Reserve would resist immediate rate cuts in its upcoming policy meeting. European uncertainties, including significant far-right gains in eurozone elections and French President Emmanuel Macron’s snap parliamentary election call, also weighed on sentiment.

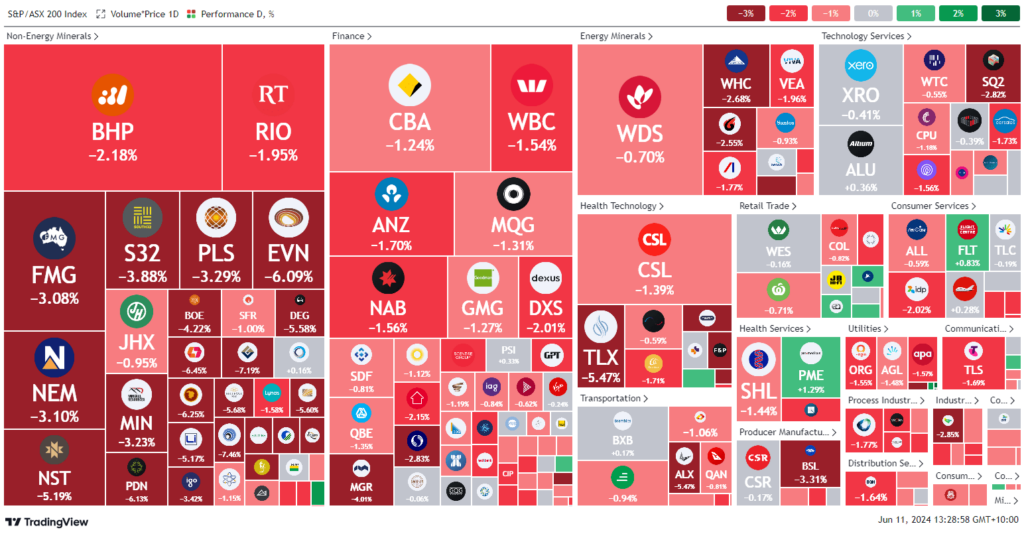

The S&P/ASX 200 dropped 1.3%, or 99.8 points, to 7760.2, reversing some of last week’s 2% gain fueled by central bank optimism. The All Ordinaries similarly fell 1.3%. All 11 sectors declined, with materials and utilities leading the sell-off. Major miners BHP, Rio Tinto, and Fortescue retreated, despite Monday’s iron ore price rebound in Asia.

Gold miners faced pressure after gold prices dipped below $2300 an ounce. West African Resources plunged over 9%, while Ramelius, St Barbara, and Bellevue Gold fell more than 7%.

Bond yields rose, with three-year yields up 9 basis points to 3.99% and ten-year yields adding 10 basis points to 4.34%. ANZ postponed its rate cut forecast to February 2025. Bapcor surged nearly 14% after an unsolicited buyout offer from Bain Capital.

Leaders

WAF West African Resources Ltd -8.63%

RSG Resolute Mining Ltd -8.55%

EMR Emerald Resources NL -8.12%

RMS Ramelius Resources Ltd -7.50%

GMD Genesis Minerals Ltd -7.16%

Laggards

WAF West African Resources Ltd -8.63%

RSG Resolute Mining Ltd -8.55%

EMR Emerald Resources NL -8.12%

RMS Ramelius Resources Ltd -7.50%

GMD Genesis Minerals Ltd -7.16%