What's Affecting Markets Today

Uranium Stocks Surge

Uranium stocks surged on Thursday following Kazakhstan’s unexpected increase in uranium extraction taxes, set to take effect in 2025-2026. The new tax rates, signed into law by President Kassym-Jomart Tokayev, will rise from 6% to 9% in 2025 and introduce a two-tiered system based on production output and uranium spot prices in 2026. This tax hike is anticipated to reduce supply growth from Kazatomprom, the world’s largest uranium producer. Consequently, uranium stocks like Paladin Energy, Boss Energy, and Deep Yellow saw significant gains, with shares opening 4-6% higher. The long-term outlook for uranium remains positive due to factors such as energy security, decarbonisation efforts, and increasing nuclear energy adoption, despite the sector’s volatility and recent price fluctuations.

Gold holds advance as Powell feeds rate cut hopes

Gold extended its gains as traders anticipate a rate cut from the Federal Reserve in September. This follows Chairman Jerome Powell’s testimony to Congress, where he indicated inflation is declining and a rate cut could happen without reaching below 2% inflation. Gold, trading above $2370, benefited from this outlook and has gained 15% this year, driven by central bank purchases, geopolitical tensions, and expectations of looser monetary policy. Spot gold increased slightly to $2373.35 an ounce, while silver edged up, and platinum and palladium remained steady.

Why these fundies are braving the lithium rout

A group of fund managers are investing in lithium stocks, expecting a recovery in the latter half of the year despite warnings of continued price drops. Currently, spodumene prices are below $1000 a tonne, down nearly 90% from 2022 highs. This price decline has driven ASX-listed lithium stocks into a bear market, with companies like Pilbara Minerals, IGO, and Mineral Resources all experiencing significant losses. However, fund managers see opportunity in the low valuations of select stocks, believing the market has been overly pessimistic.

ASX Stocks

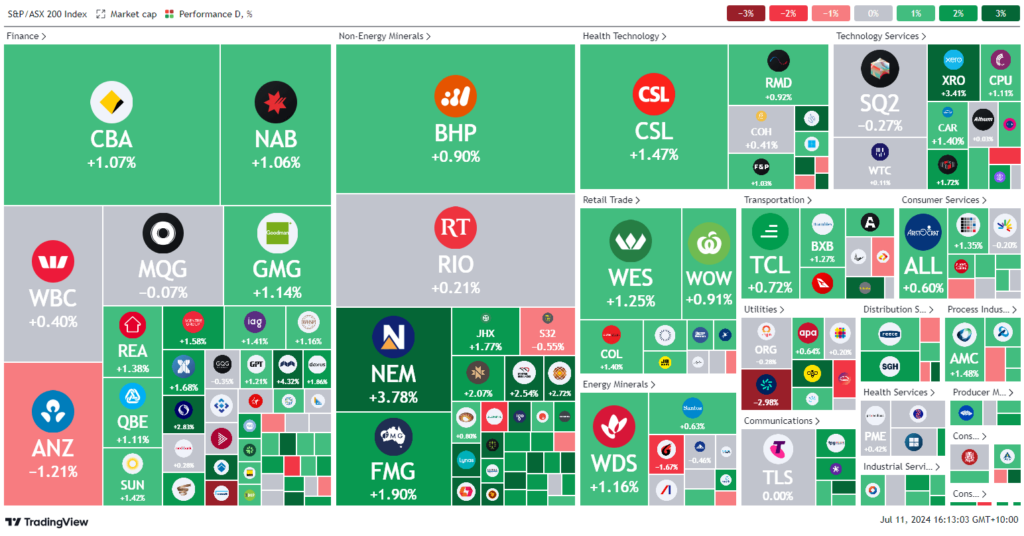

ASX 200 - 7,889.6 (0.9%)

Key Highlights:

Australian shares rallied by 1% at lunchtime, nearing 7900 points, driven by gains in the big four banks and mirroring a tech-led rally on Wall Street. All 11 sectors of the S&P/ASX 200 advanced, bringing the index close to its record intraday high of 7910.5 points set on April 2. The global market optimism is based on expectations of no recession and easing inflation. However, Stephen Miller of GFSM Funds Management cautioned that risks remain, particularly in Australia, where inflation is persistently at 4% and the economy is weak. He anticipates the Reserve Bank of Australia (RBA) may raise rates in August, increasing the risk of a market derailment.

Commonwealth Bank hit a record high of $130.17, and Bendigo Bank reached its highest level in over a decade. Technology and real estate sectors gained 1.6% and 1.7%, respectively, while mining stocks also rose despite a drop in iron ore prices. BHP and Rio Tinto both added over 1%, and gold miners benefited from rising gold prices, with Newmont shares up 3.3%. Uranium miners saw significant gains, with Boss Energy and Paladin both jumping 6.1%.

Investors await the US inflation report, expected to influence expectations for a Federal Reserve rate cut in September.

Leaders

CTT – Cettire Ltd (+16.18%)

LRS – Latin Resources Ltd (+12.90%)

SHV – Select Harvests Ltd (+11.58%)

SVM – Sovereign Metals Ltd (+11.28%)

TLX – TELIX Pharmaceuticals Ltd (+10.03%)

Laggards

OBL – Omni Bridgeway Ltd (-9.90%)

WA1 – WA1 Resources Ltd (-8.81%)

BDM – Burgundy Diamond Mines Ltd (-7.69%)

DXB – Dimerix Ltd (-7.22%)

MMI – Metro Mining Ltd (-6.90%)