What's Affecting Markets Today

Investors Caution Rio Tinto on BHP’s Anglo American Bid

Investors have voiced concerns about Rio Tinto competing with BHP for Anglo American, advocating instead for a focus on smaller lithium and copper producers. Given the substantial $40 billion bid by BHP, experts suggest that Rio Tinto lacks the necessary financial leverage and should avoid entering a potentially costly bidding war. The alternative strategy aims to minimize financial exposure while enabling strategic growth in less contested markets.

BOJ’s Interest Rate Strategy Amidst a Weak Yen

The Bank of Japan (BOJ) faces a critical decision regarding interest rates as a response to the depreciating yen. Experts advise against raising rates to avoid stifling consumption and exacerbating the cost of living. With Japan’s economy showing fragile signs of recovery, maintaining stable interest rates could support continued consumer spending and service sector growth without triggering further economic disruptions.

Surge in Energy Stocks Linked to Oil Prices and China’s Recovery

Energy stocks on the ASX have seen a notable increase, primarily driven by rising oil prices and signs of economic recovery in China. The conflict escalation in the Middle East and strategic statements from U.S. leadership have further influenced market movements. Companies like Beach Energy and Santos have benefited, reflecting broader sector gains amidst these geopolitical and economic developments.

ASX Stocks

ASX 200 - 7,717.3 (-1.10%)

Key Highlights:

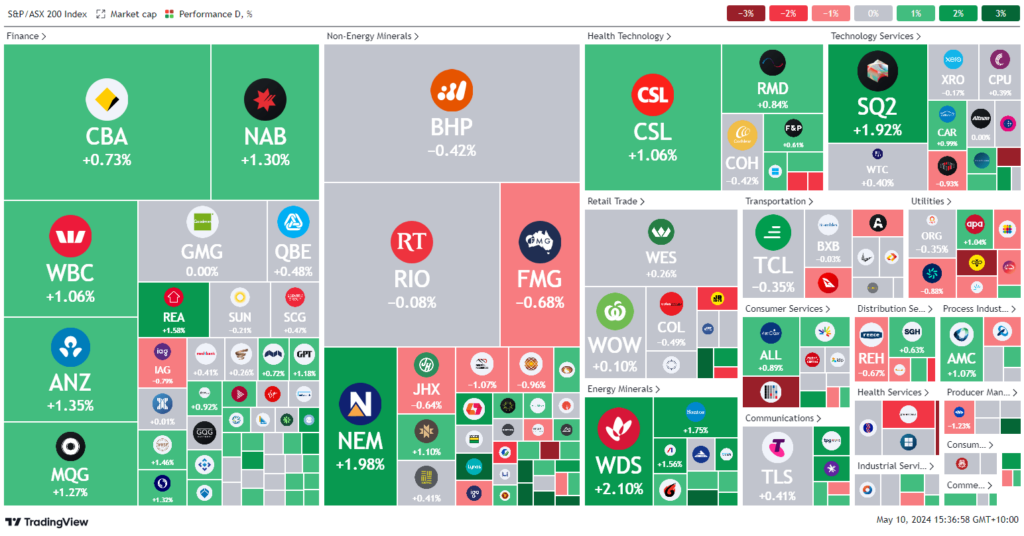

On Friday, the Australian Stock Exchange (ASX) experienced a positive uptick, mirroring a successful Wall Street session, with the S&P/ASX 200 index rising by 0.5% to 7759.5, propelled by optimism around China’s economic recovery and rising energy prices. Energy stocks led the gains, with notable increases from Beach Energy, Santos, and Woodside, reflecting broader market enthusiasm in this sector. However, tech and material sectors faced some declines, with companies like Life360 experiencing drops due to reaffirmed loss guidance.

In the banking sector, major players like Westpac, National Australia, ANZ, and CBA saw gains ranging from 1% to 1.4%, despite mining giants Rio Tinto and BHP recording slight losses amid takeover talks surrounding Anglo American. The financial landscape was also bolstered by rising gold prices, which climbed on the expectation that the Federal Reserve might lower interest rates, benefiting gold miners such as St Barbara, Gold Road Resources, and West African Resources.

Additionally, the Australian dollar remained stable, supported by a surge in Chinese iron ore imports, signaling robust demand. The market also saw movements in the insurance and banking sectors, with QBE confirming its positive full-year outlook and regional lender Suncorp Group reporting an increase in past due loans. Furthermore, the announcement of a share buyback by Helia energized its stock performance, highlighting a day marked by significant sectoral shifts and investor reactions to global economic cues.

Leaders

SXG – Southern Cross Gld (+22.02%)

KCN – Kingsgate Con. (+12.66%)

JMS – Jupiter Mines (+10.17%)

SYA – Sayona Min. (+8.75%)

IMU – Imugene (+7.86%)

Laggards

UOS – United Overseas Aus. (-13.12%)

SNZ – Summerset Grp Hldgs (-6.79%)

QAL – Qualitas (-6.25%)

LNW – Light & Wonder (-5.67%)

RMC – Resimac Grp (-4.95%)