📉 What is a Bear Market?

A bear market is generally characterized by a decline of 20% or more from recent peaks in major stock indices like the S&P 500 or Nasdaq. However, it’s not just about numbers—it marks a psychological shift for investors.

Bear markets are nothing new. Since 1945, the S&P 500 has gone through 15 bear markets, with:

- Average drop: -32%

- Time to bottom: ~11 months

- Recovery time: ~1.7 years

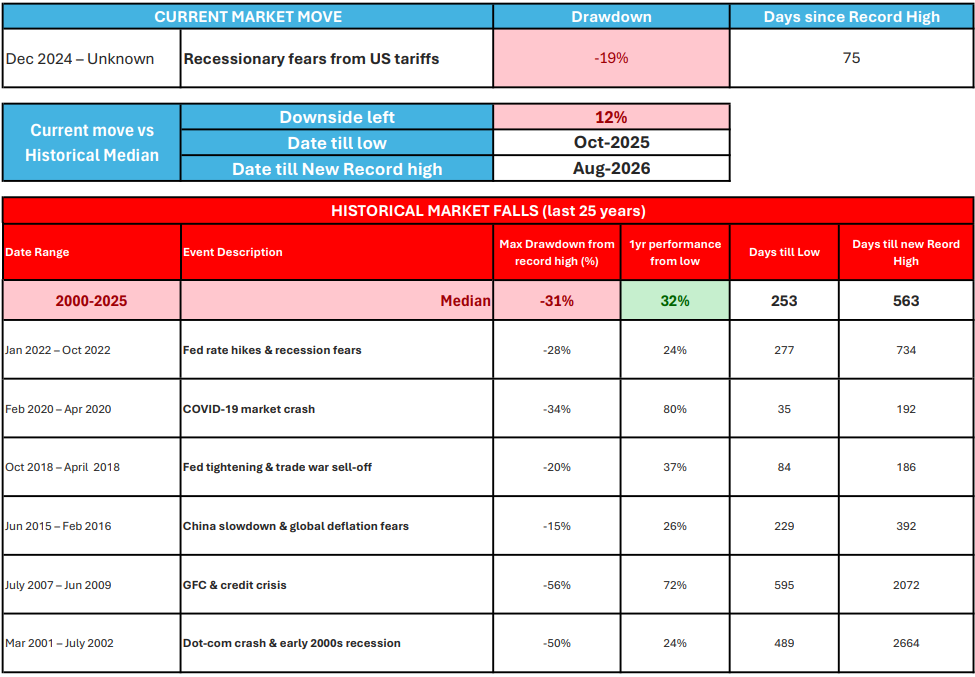

Last 25 years

As of Tuesday 8th of April 2025

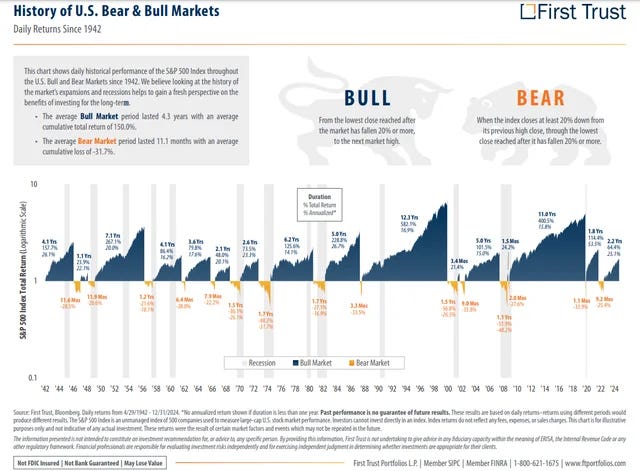

U.S. Market Cycles: Bear vs. Bull

Analyzing historical data can provide valuable insights into market trends and cycles. The chart below highlights daily performance of the S&P 500 Index since 1942, showcasing both expansions (bull markets) and downturns (bear markets).

- Average Bull Market: Lasts 4.3 years with cumulative returns of ~150%.

- Average Bear Market: Lasts 11.1 months with cumulative losses of ~31.7%.

Bear markets occur when an index closes at least 20% below its previous peak, continuing until the lowest point before recovery begins. Conversely, bull markets start from that recovery low and extend to new highs.

While these numbers fluctuate, the cycle remains consistent: markets fall, panic ensues, and recovery follows.

If this bear market aligns with historical averages, we might hit the bottom early next year and see new highs by late 2026. Though daunting at first glance, bear markets can be opportunities for savvy investors to buy quality stocks at discounted prices—a sentiment echoed by Shelby Cullom Davis:

“You make most of your money in a bear market; you just don’t realize it at the time.”

The key takeaway? Bear markets are an inevitable part of investing. The real challenge lies in how you respond when they occur.

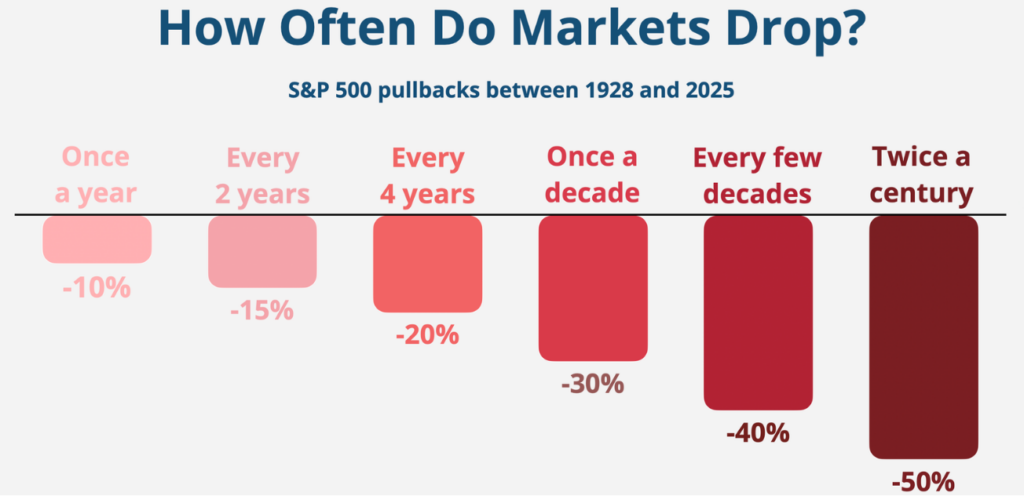

📊 What history tells us

Here is the historical frequency of drawdowns identified since 1928:

While bear markets may feel endless in the moment, history shows they’re temporary setbacks amid long-term upward trends. Outliers like the inflation-driven crisis of 1973-74, the dot-com crash in 2000, and the Great Recession in 2008 took longer to recover but were exceptions rather than the rule.

Importantly, rebounds often begin before conditions feel safe—a point emphasized by Peter Lynch:

“Every economic recovery since WWII has been preceded by a stock market rally. And these rallies often start when conditions are grim.”

Waiting for perfect conditions can cause investors to miss early gains. Staying invested during turbulent times is often the wiser choice.

Volatility is simply part of investing—a necessary tradeoff for higher returns over time. As Morgan Housel aptly puts it:

“Volatility is a feature, not a bug.”

Bear markets will always bring uncertainty—whether due to recessions, inflation, or geopolitical events—but history shows that patient investors tend to emerge stronger.

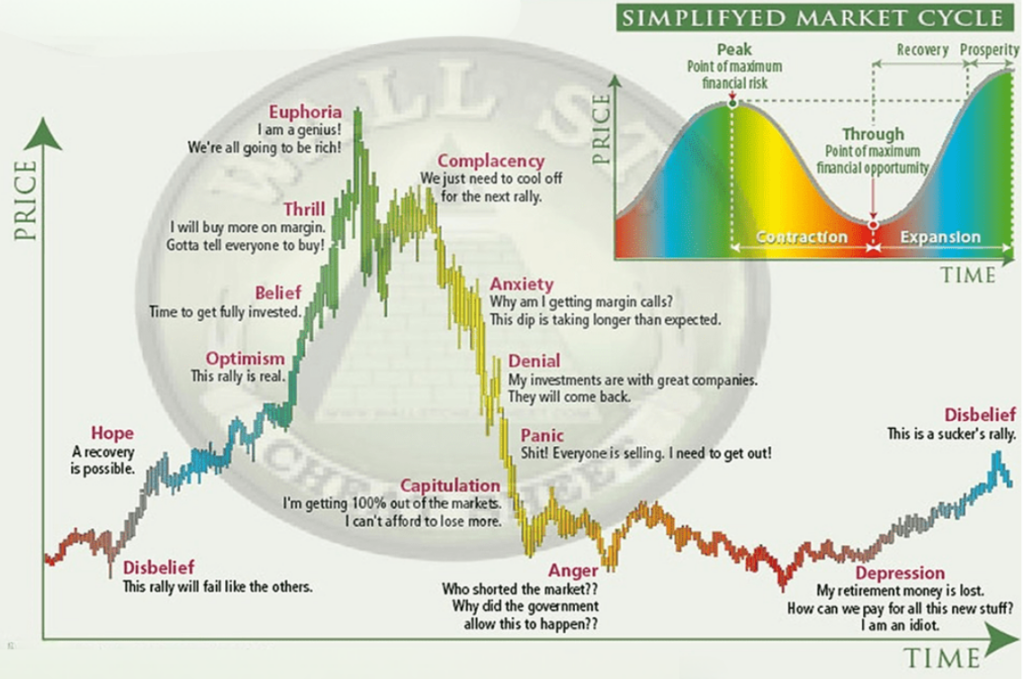

The Emotional Cycle of Investing:

Market cycles trigger predictable emotional responses—from optimism during rallies to panic during downturns. Understanding this cycle can help investors avoid making rash decisions at critical moments.

Ultimately, most underperformance stems not from choosing bad stocks but from reacting poorly when fear takes hold. The antidote? A clear plan that removes guesswork and keeps you grounded during turbulent times.

🧠 The psychology of downturns

It’s not the math—it’s the mind games.

Markets fall all the time. But a bear market? That’s when it feels personal.

- 🔻 Your portfolio shrinks.

- 🔻 The headlines get darker.

- 🔻 Every bounce feels fleeting.

You don’t know how bad it’ll get. Or how long it’ll last.

The real pain isn’t the drop—it’s the uncertainty.

Here’s why:

- 🔮 We extrapolate. A 20% drop feels like it’s heading to 50%.

- 🕰️ We feel the need to act—even if doing nothing is smarter.

- 🧠 Our brains crave patterns—but markets rarely tell a clear story.

- 📉 We confuse volatility with a permanent loss of capital.

🏗️ Staying Invested: Discipline Over Prediction

When prices drop, discipline becomes your greatest asset—not your ability to predict market movements. You don’t need to time the bottom; you need a system you can follow even during tough times.

Peter Lynch famously said:

“The most important organ in investing is not the brain; it’s the stomach.”

Build Your System:

A structured approach reduces emotional decision-making:

- Keep a journal to track your investment behavior and patterns.

- decide beforehand when to buy or sell based on predefined rules.

Here are four simple rules that can help protect your portfolio:

- Invest a fixed amount regularly regardless of market conditions.

- Avoid adding to losing positions—keep them small.

- Hold onto winners patiently.

- Invest with at least a five-year horizon to allow compounding to work its magic.

Why this works:

- It limits exposure to any single stock.

- Encourages investing even during periods of panic.

- Spreads risk over time instead of going “all-in.”

- Ensures consistency through market ups and downs.

Having a personalized playbook like this can transform moments of fear into opportunities for resilience.

📈Finding Opportunities in Bear Markets

Bear markets often set the stage for future bull runs—but only if you’re prepared to seize opportunities when they arise.

Steps for Identifying Opportunities:

- Focus on quality: Look for companies with strong fundamentals—healthy cash flow, competitive advantages, and growth potential.

- Deploy capital gradually: Avoid rushing in; instead, invest incrementally as prices fall further.

- Revisit your watchlist: Stocks you wished you owned at lower prices may now be within reach.

- Prioritize long-term payoff: Target companies with outsized potential returns that could outperform over time.

- Build positions slowly: Bear markets often come in waves, offering multiple entry points.

By staying disciplined and focusing on high-quality investments, bear markets can become periods of strategic accumulation rather than fear-driven selling.

an example of a previous “Shopping list”

Green= buying opportunity, Orange = possible buying opportunity, Red = be patient

Key takeaways for investors

A bear market feels like chaos. But for long-term investors, it can be a gift in disguise.

The late Charlie Munger encapsulates it all in a single sentence: “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to be a common shareholder.”

In investing, consistency beats brilliance—and bear markets reward those who stay prepared and optimistic despite short-term challenges.

Survival isn’t about brilliance. It’s about behavior.

Here’s your survival checklist:

- ✅ Zoom out. Bear markets are temporary. History shows they happen every few years—and eventually give way to recoveries. The pain is short-term. The rewards are long-term.

- ✅ Stay calm. Market cycles are emotional roller coasters. But investing success comes from discipline, not reaction. You don’t need perfect timing—you need staying power.

- ✅ Have a plan. Whether you automate your investing, deploy cash gradually, or stick to monthly contributions, the key is to remove guesswork. Let the rules carry you in good and bad markets.

- ✅ Focus on resilience. Look for businesses that can endure and adapt—with strong balance sheets, loyal customers, and long growth runways. These are the companies that come out stronger on the other side.

- ✅ Buy selectively. When valuations compress, future returns expand. Bear markets offer rare chances to build positions in high-quality names—often at decades-low prices.

- ✅ Be patient. The best opportunities won’t feel obvious at first. But compounding happens quietly. What matters isn’t the next few months—it’s the next few years.

Got a question about this article? Ask the Author

ASK A QUESTION

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.