Alternate Investments

Innovative solutions for strategic growth

We specialise in structured investments that offer bespoke solutions tailored to your financial goals and risk tolerance. Structured investments are advanced financial instruments that combine various asset classes and derivatives to create custom investment strategies, providing unique opportunities for growth, income, and risk management.

Why choose structured investments?

Customised strategies

Potential for enhanced returns

Risk management

Diverse Exposure

Flexible Investment Options

Our approach

We start by thoroughly understanding your financial goals, risk appetite, and investment preferences. This allows us to recommend structured investments that align with your specific requirements.

Our experienced team conducts rigorous evaluations of structured investment products from leading issuers. We select those that offer the optimal balance of risk and return for your investment strategy.

For investors seeking highly customised solutions, we collaborate closely with you to design structured investments that meet your unique financial targets and market views.

We continuously monitor the performance of your structured investments and provide regular updates. Our proactive approach ensures your investments remain aligned with your financial goals.

Our dedicated advisors offer clear, transparent advice throughout the investment process. We provide the insights and support you need to make informed decisions and maximise the benefits of your structured investments.

What you get access to?

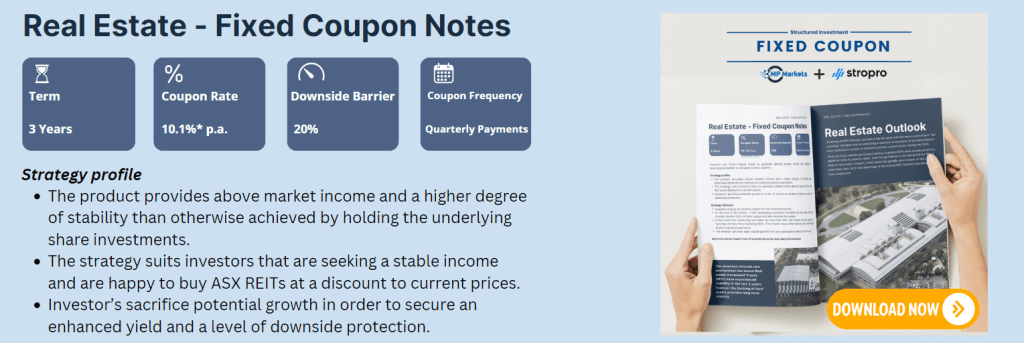

Fixed coupon notes

With fixed coupon notes, you gain access to investments offered at a discounted entry price, which enhances potential returns. These notes provide a steady yield starting from 2.5% and include volatility protection features to shield your investment from market fluctuations, ensuring a more stable return.

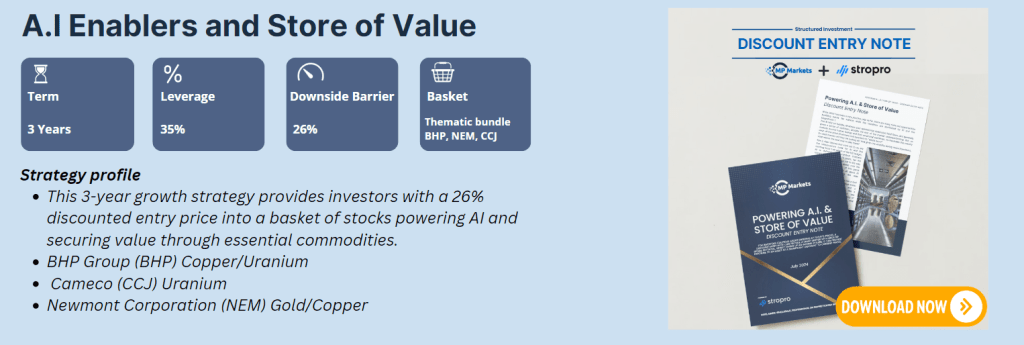

Discount-entry notes

Discount-entry notes allow you to invest at a lower initial cost, which can improve your investment's overall potential. They offer competitive yields while you wait and come with built-in safeguards against market volatility, helping to protect your investment from unexpected market swings

Smart-entry notes

Smart-entry notes offer the advantage of strategic entry points with efficient investment strategies that optimise returns. These notes are designed to enhance growth opportunities and capture value through smart investment decisions, providing a sophisticated approach to portfolio management.

Enhanced growth notes

Enhanced growth notes focus on capturing superior performance and value. They are designed to maximise your investment's growth potential through advanced strategies that target higher returns, making them an attractive option for those looking to enhance their investment portfolio.