What's Affecting Markets Today

Pakistan Targets Several Locations Inside Iran

Pakistan has reportedly targeted seven locations within Iran, escalating tensions along their shared border. Explosions were heard in Iran’s Sistan and Baluchistan province near Saravan, as reported by Iranian state media. This escalation follows recent regional tensions in the Middle East and Iran’s claims of destroying Jaish al-Adl strongholds in Pakistan, which allegedly killed two children. Pakistan responded by recalling its ambassador from Iran and warning of serious consequences. Iran’s Foreign Minister stated that the strikes only targeted Iranian terrorists in Pakistan, seeking to ease tensions with its nuclear-armed neighbor.

Australian Economy Sheds 65,100 Jobs in December

Australian employment decreased by 65,116 in December, a notable shift from the previous month’s revised gain of 72,645 jobs. Despite the job losses, the unemployment rate remained steady at 3.9%, against expectations of a slight job increase. This development has implications for the Reserve Bank of Australia’s upcoming February meeting, as it evaluates the job market in relation to inflation targets. Traders are now adjusting their expectations for rate cuts in 2024, influenced by stronger economic indicators from the US and UK. The focus now turns to the December quarter consumer price index report due on January 31, ahead of the RBA’s meeting.

ASX Stocks

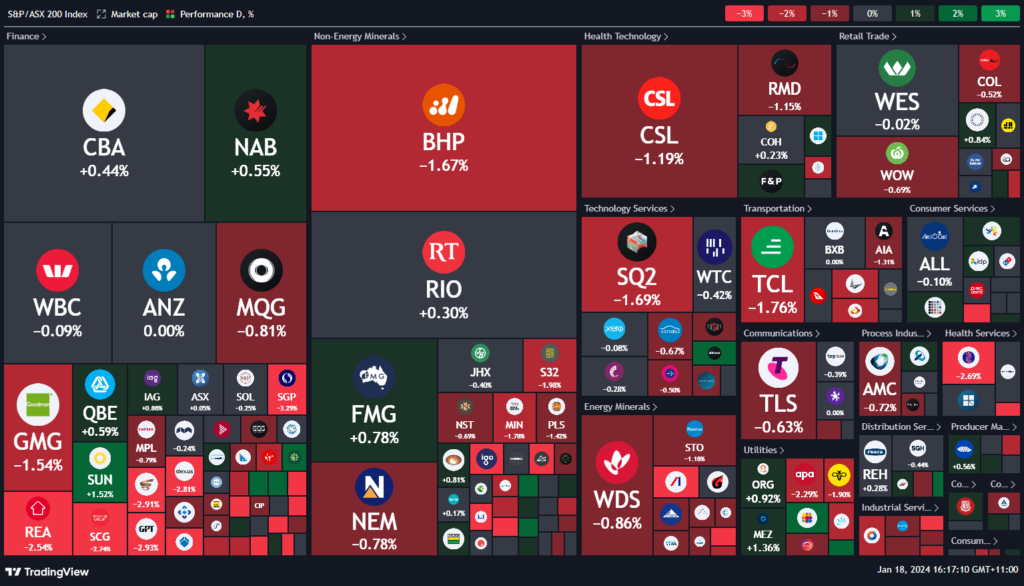

ASX 200 - 7,346.5 (-0.6%)

Key Highlights:

Australian shares faced a midday decline due to a broad sell-off, influenced by international economic reports that led traders to reassess interest rate cut expectations. The S&P/ASX 200 index dropped by 0.6%, with significant losses in materials, energy, and real estate sectors. The downward trend followed Wall Street’s lead, where traders scaled back rate cut expectations after unexpectedly strong US retail sales data and UK inflation figures. The likelihood of a March rate cut by the Federal Reserve has decreased significantly compared to last week.

In the commodities market, iron ore prices fell, oil slid, and gold faced a potential drop below $US2000 an ounce. This downturn coincided with China’s Premier Li Qiang’s statement at Davos indicating a reluctance to use major stimulus measures for economic growth. China’s reduced crude steel output further influenced the market, recording its weakest monthly performance since December 2017.

Notable ASX companies like BHP saw a decrease in stock value despite a rise in iron ore production. Interest rate-sensitive real estate stocks also suffered, with Scentre, Stockland, and Dexus experiencing declines.

Ampol shares dropped despite expecting higher full-year profits, as refinery earnings are set to reduce. APM Human Services plummeted after issuing a profit warning, with UBS downgrading its rating. Liontown Resources’ shares took a hit following Albemarle’s sale of its stake in the company after a failed takeover bid.

Leaders

EML – EML Payments Ltd (+23.15%)

IPX – Iperionx Ltd (+8.07%)

A1N – Arn Media Ltd (+6.52%)

SHV – Select Harvests Ltd (+5.88%)

CTT – Cettire Ltd (+5.79%)

Laggards

APM – APM Human Services Ltd (-40.00%)

WC8 – Wildcat Resources Ltd (-10.38%)

LTR – Liontown Resources Ltd (-10.29%)

SYR – Syrah Resources Ltd (-6.52%)

LRS – Latin Resources Ltd (-6.38%)