Overnight – Market Cautiously Optimistic

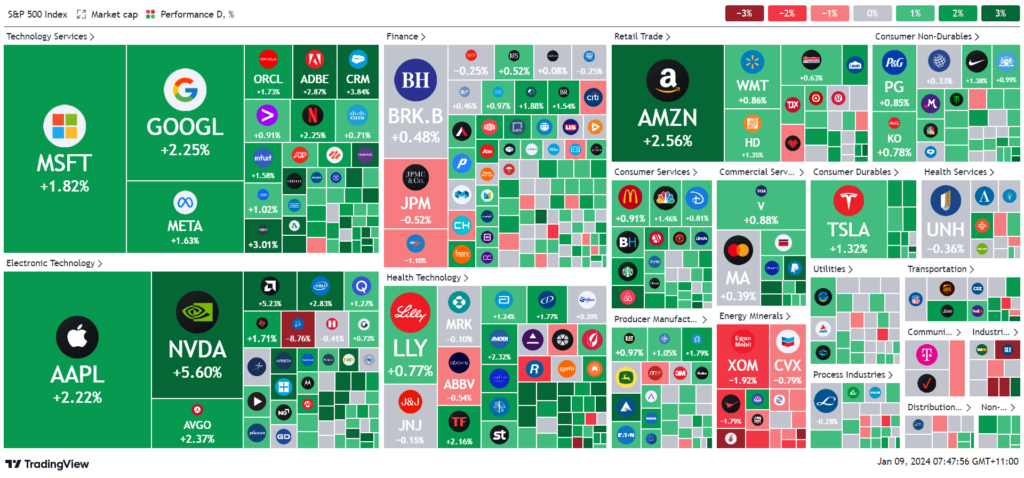

In the U.S. stock market, technology stocks have shown a strong rebound in early 2024, with Nvidia leading the surge. This growth in tech stocks, including significant players like Apple and smaller tech firms such as AMD and Crowdstrike, is attributed to innovations and positive corporate announcements. For instance, Nvidia’s new graphics chips, aimed at enhancing AI capabilities for personal computers, have been well-received.

Bitcoin has experienced a notable increase, crossing $US47,000 for the first time since April 2022. However, not all sectors are flourishing; Boeing faced a decline due to reputational damage following a recent incident.

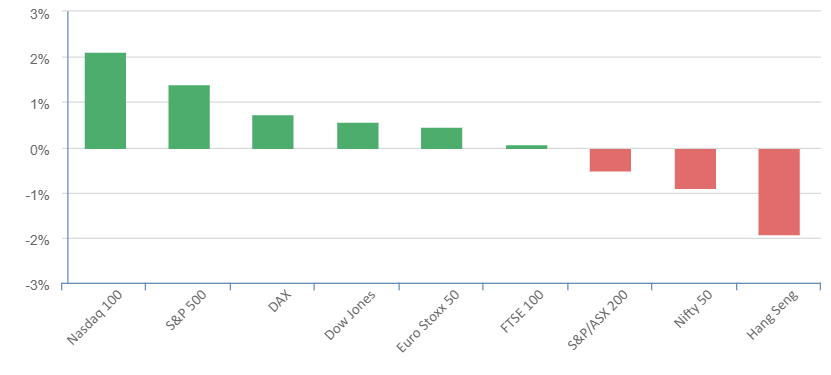

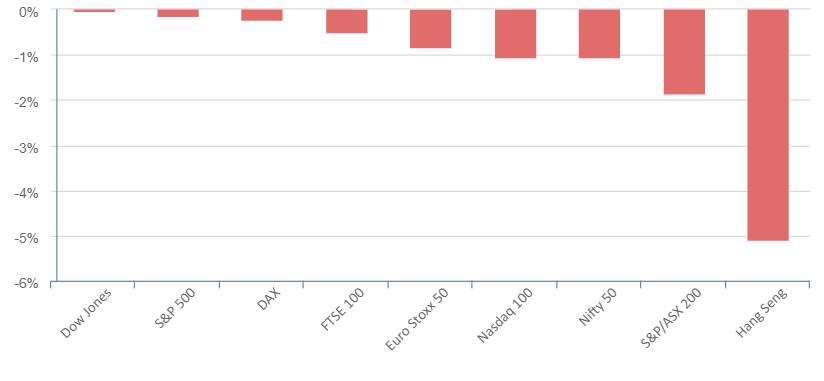

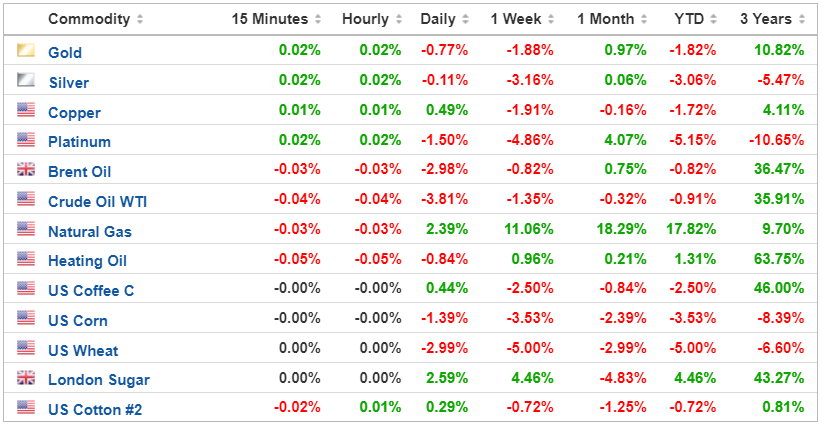

In commodities, there’s a downturn with Brent oil, iron ore, and gold prices all slipping. The general market trend is positive, as evidenced by the performance of major indices like the Dow Jones, S&P 500, and Nasdaq, all reporting gains.

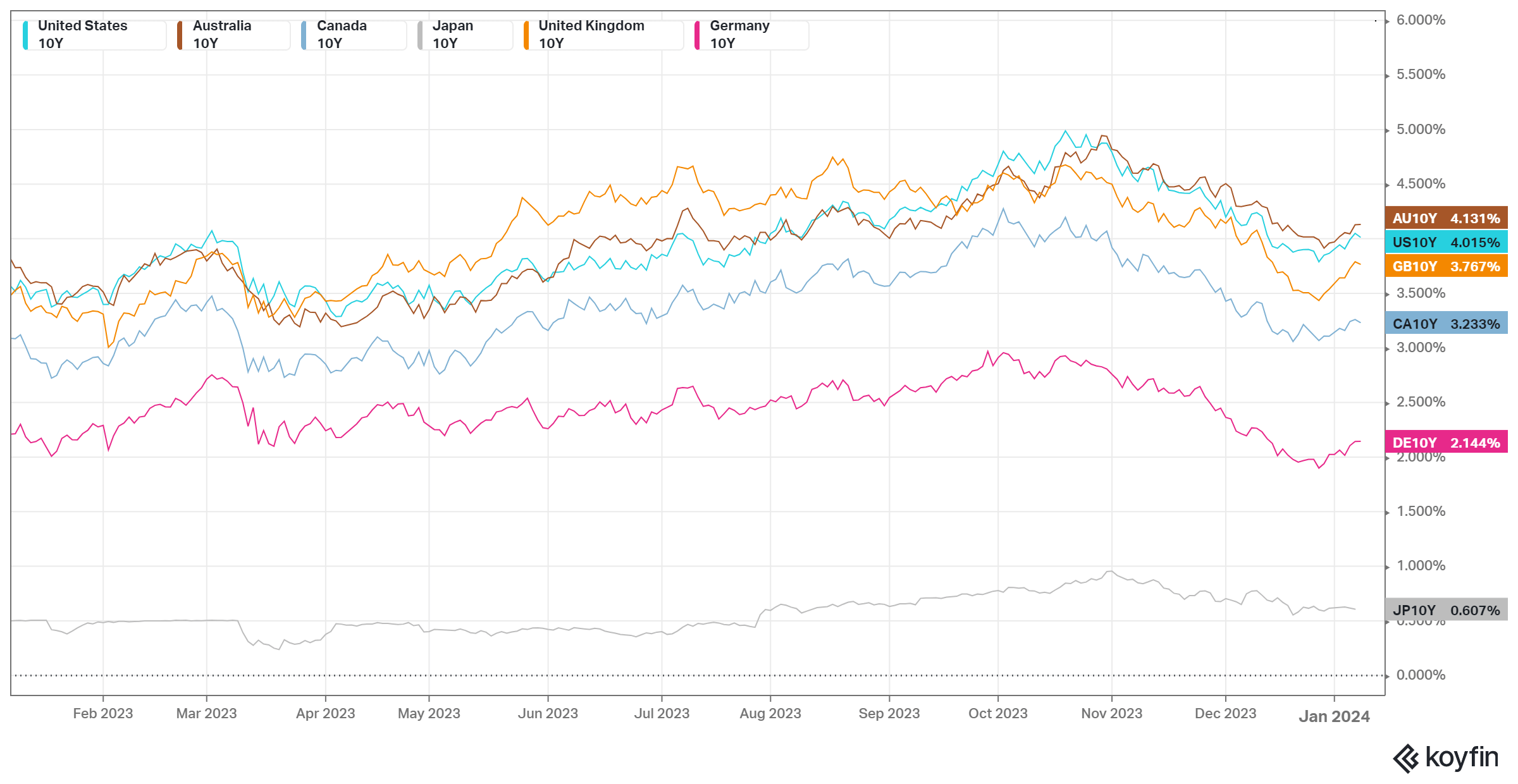

Financial institutions like Morgan Stanley and Goldman Sachs offer a cautious yet optimistic outlook, with expectations of U.S. rate cuts in 2024. JPMorgan, however, warns of potential overvaluation in U.S. equities, suggesting that the current market might be more optimistic than economic fundamentals warrant. This mix of technological optimism and broader economic caution paints a complex picture of the current U.S. market landscape.

S&P 500 - Heatmap

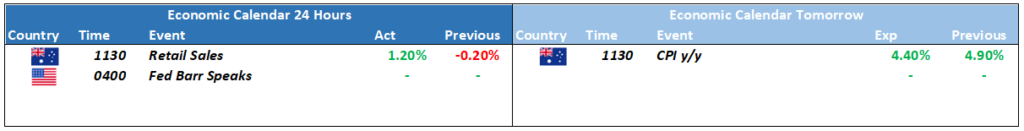

The Day Ahead

ASX SPI 7509.5 (0.85%)

Australian shares are set for a positive opening, mirroring gains in New York’s technology sector. This uplift follows a turbulent start to 2024, with Nvidia leading the charge among the prominent tech stocks, collectively known as the Magnificent Seven. Bitcoin also experienced a significant surge, exceeding $US47,000 for the first time since April 2022.