Structured Investments

The Power of Alternatives

Learn the secrets of smart investing that major investment firms such Macquarie, BlackRock, Citi, USB and Morgan Stanley keep to themselves.

“Adding a 20% allocation of alternatives to a traditional 60/40 portfolio increased the annualized returns by up to 10% over a 10-year period while simultaneously reducing portfolio volatility by 10%”

BlackRock

Global Asset Manager

“During market downturns, portfolios with alternatives experienced 30% smaller losses compared to a pure 60/40 portfolio, according to a study by Morningstar. This is because alternatives, like real estate and commodities, often move differently from stocks and bonds, offering better protection during bad markets.”es to a traditional 60/40 portfolio increased the annualized returns by up to 10% over a 10-year period while simultaneously reducing portfolio volatility by 10%”

Morningstar

Investment Research

Why choose structured investments?

Customised strategies

Potential for enhanced returns

Risk management

Diverse Exposure

Flexible Investment Options

What you get access to?

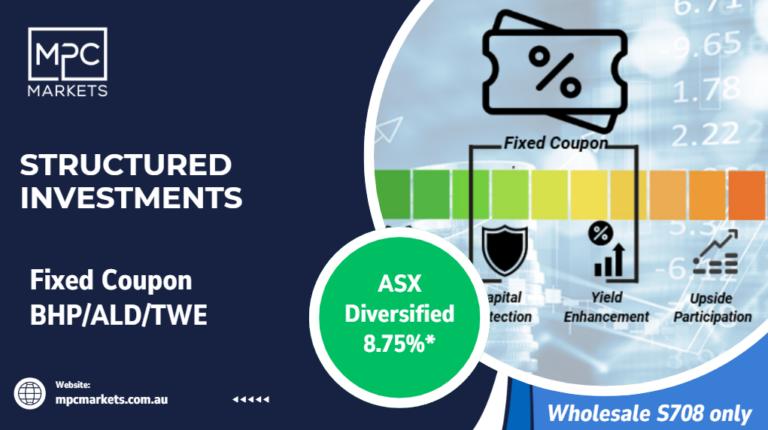

Fixed coupon notes

With fixed coupon notes, you gain access to investments offered at a discounted entry price, which enhances potential returns. These notes provide a steady yield starting from 2.5% and include volatility protection features to shield your investment from market fluctuations, ensuring a more stable return.

Discount-entry notes

Discount-entry notes allow you to invest at a lower initial cost, which can improve your investment's overall potential. They offer competitive yields while you wait and come with built-in safeguards against market volatility, helping to protect your investment from unexpected market swings

Smart-entry notes

Smart-entry notes offer the advantage of strategic entry points with efficient investment strategies that optimise returns. These notes are designed to enhance growth opportunities and capture value through smart investment decisions, providing a sophisticated approach to portfolio management.

Enhanced growth notes

Enhanced growth notes focus on capturing superior performance and value. They are designed to maximise your investment's growth potential through advanced strategies that target higher returns, making them an attractive option for those looking to enhance their investment portfolio.

Our latest Structured Investments

Structured Investments C2 Gateway Series

The C2 Gateway Series is a structured financial product designed to provide both tax optimization and leveraged market exposure, making it a strategic tool for wholesale, professional, and sophisticated investors aiming to enhance capital deployment while managing tax liabilities.

latest Updates

Outstanding Fixed Coupon of 13%, backed by ASX200 stocks

Get around 13%pa backed by ANN, MQG & WHC, paid quarterly for up to 2 years

Watchlist Buying: GMG, MQG, IXJ

End of Phase 2 – Dollar cost averaging in high quality names

Pre-Market Pulse 14th April – US Stocks miraculously end week higher after trump turmoil

U.S. stocks ended the week on a positive note, with major indexes rising despite ongoing trade tensions and economic uncertainty.

Portfolio “Shopping list”

in periods like the last week, having a plan will yield us a better result in the long term

Bear Markets can be an opportunity, learn how

Often you make most of your money in a bear market; you just don’t realize it at the time.

Bulls vs Bears EP63: “Art of the surrender?”, Trump backpedals on Tariffs

“Bulls vs Bears,” provides a comprehensive overview of current market trends, economic developments.

Our approach

With a proven track record in stock advisory, we specialize in analyzing market and investment preferences to craft structured investment recommendations that meet specific growth in portfolio.

Our experienced team conducts rigorous evaluations of structured investment products from leading issuers. We select those that offer the optimal balance of risk and return for your investment strategy.

For investors seeking market solutions, we collaborate closely with experts to design structured investments that meet financial targets and market views.

We continuously monitor the performance of your structured investments and provide regular updates. Our proactive approach ensures your investments remain aligned with your financial goals.

Our dedicated advisors offer clear, transparent advice throughout the investment process. We provide the insights and support you need to make informed decisions and maximise the benefits of your structured investments.