Since the 29th of Dec – 2024 kicks off with an Earthquake and Geopolitical issues

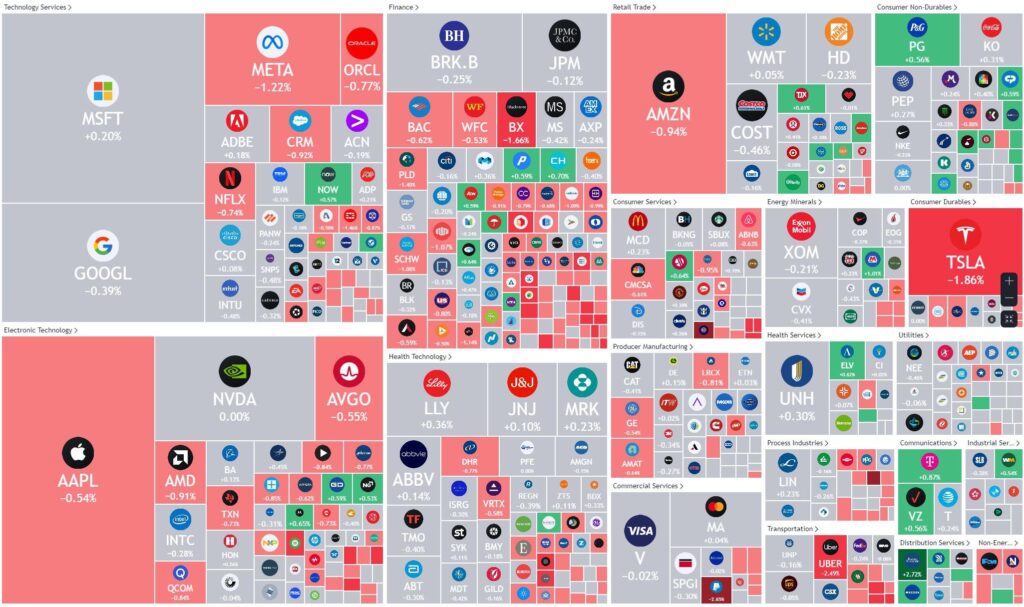

US Stocks fell away from record highs on Friday in the last trading session of 2023 as investors banked their “Christmas rally” profits, particularly in the “magnificent 7”

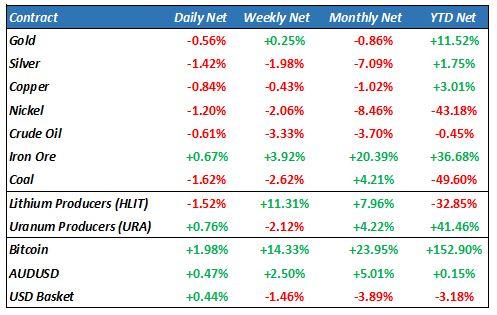

Commodities finished lower as the USD bounced after a weaker year and month.

In the early hours of 2024, a 7.6 magnitude earthquake hit north central Japan under 100 miles from Nagano, forcing 100,000 people to flee to emergency centers in fear of a tsunami, which was later downgraded.

Houthi rebels in the Red Sea have been attacked by US Naval forces, sinking 3 boats, escalating an already fragile situation between Iran, the US and her allies, also pausing shipping through the red sea for at least 48 hours, one of the worlds most important routes.

Mike Turner, chairman of the House Intelligence Committee called on President Joe Biden “to look at what actions need to be taken in Yemen to be able to prevent the Houthis to continue to put commercial and military vessels at risk”. Noting Iran’s support for Hamas, Hezbollah and the Houthis, Mr Turner told ABC’s This Week that the Biden administration should be more aggressive “in responding to escalation by Iran”.

Any escalation may force gold, USD and oil prices higher, as investors look for a safe haven

S&P 500 - Heatmap

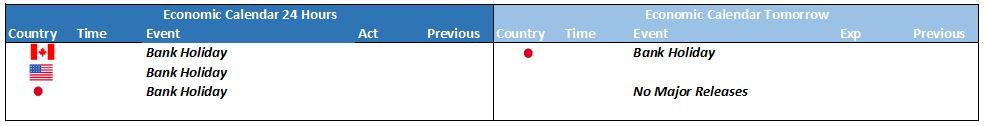

The Day Ahead

ASX SPI 7584 (-0.30%)

The ASX is likely to head lower in the first session of 2024, while energy and gold stock may hold up on the geopolitical situation brewing.

A reminder we are near record highs where very little needs to go wrong to see the market fall, particularly in thin markets