Overnight – Santa buys the dip into the holidays

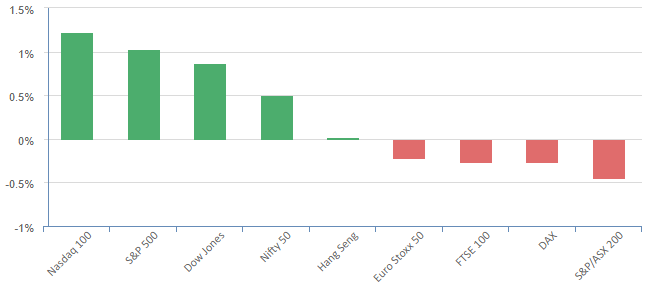

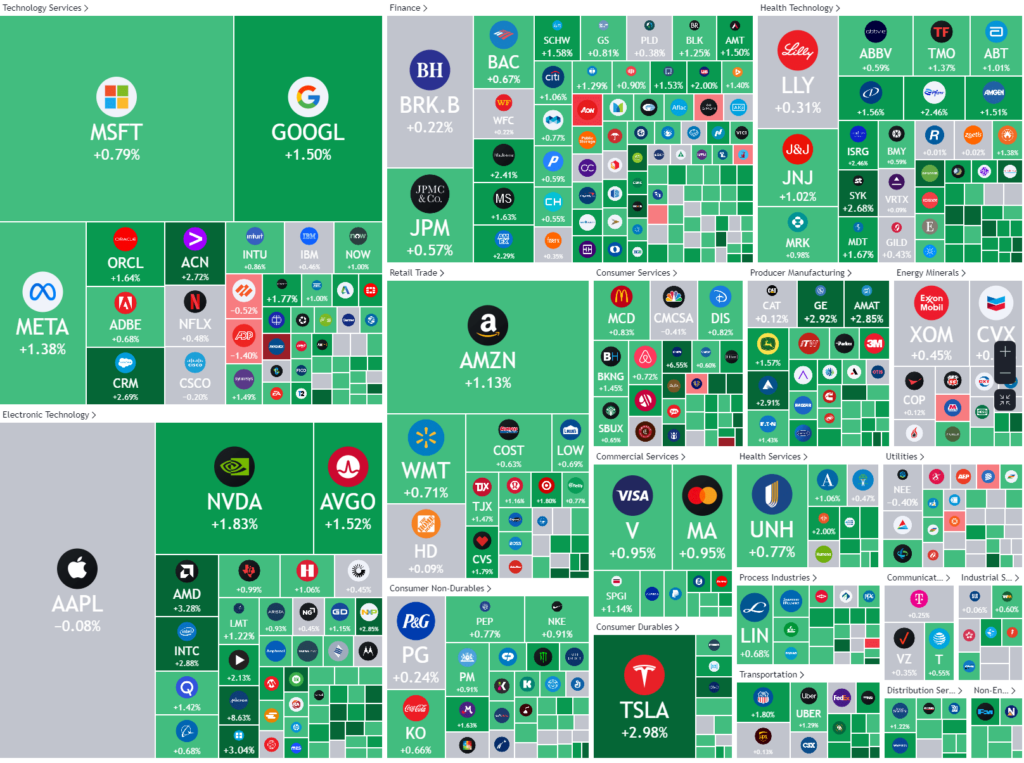

Stocks bounced overnight as investors bought the dip in stocks following a selloff a day earlier, underpinned by a Micron-led rise in tech as the chipmaker reported better-than-expected quarterly results.

Micron Technology with the chipmaker’s stock rising over 8% after forecasting quarterly revenue above market estimates on Wednesday, on signs of memory chip recovery in 2024 after one of the most significant downturns in years.

Apple gave up gains after it removed its models of its Apple Watch including the series 9 and ultra 2 from its website amid a patent dispute with Masimo over the blood oxygen feature on the watches.

On the economic front, the final revision of GDP for Q3 fell to 4.9% from prior estimate 5.2%, while initial jobless claims rose 2,000 to 205,000 in the week ending Dec. 16, missing expectations of 214,000.

The Philadelphia Fed said Thursday its manufacturing index rose to a reading of -10.5 from -5.9 in August as the contraction in manufacturing activity continued.

S&P 500 - Heatmap

The Day Ahead

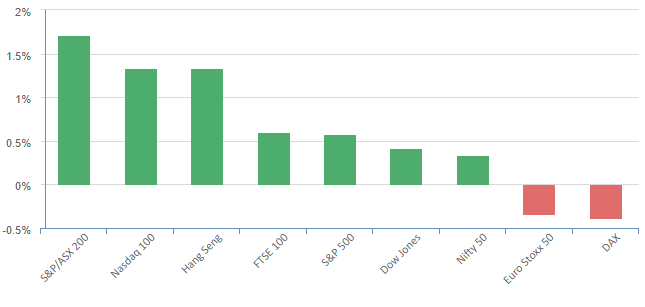

ASX SPI 7512 (+0.30%)

The MPC Team will be here over the Christmas break!

IF THE ASX IS OPEN, WE ARE OPEN.

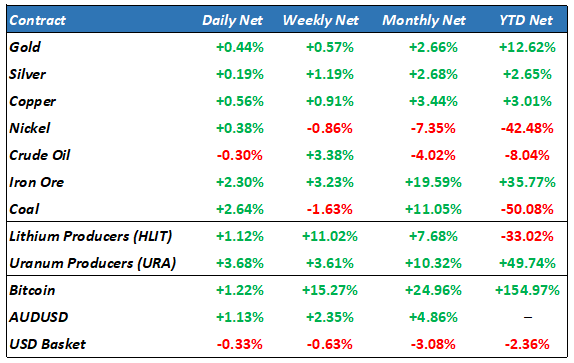

The bounce in the US is a nice way for most to end their trading year. The commodity rally should help the materials sector, while the firm offshore lead should support the rest of the market.

Overall, it has been a great rally to end the year and most likely an opportunity to take some capital off the table into an uncertain year in 2024

Company news:

- Synlait Milk warned that increased borrowing costs and changes in margins will likely drive its half-year net profit lower amid an ongoing dispute with a2 Milk.

- a2 Milk Companyis confident that its commercial disagreement with Synlait Milk will not affect its earnings and affirmed fiscal 2024 guidance.

- ANZ Groupand gold giant Newmont both pay investors dividends.

- Lynas Rare Earths will be in focus after China banned exports of some rare earth processing technology.

- Waypointsaid the value of its real estate portfolio of 402 properties fell 5 per cent to $151 million for the six months to December and noted that the weighted average capitalisation rose to 5.68 per cent from 5.4 per cent.