What's Affecting Markets Today

US Markets see worst day in months on Fedex Slump

On Wednesday, U.S. markets faced a notable downturn, ending their winning streaks in one of the most challenging sessions in months. However, U.S. Treasury yields continued to decline. Despite this, Europe’s Stoxx 600 rose by 0.19%, while the FTSE 100 surged 1.02% to reach a three-month high, driven by favorable inflation data in the UK.

UK inflation dropped to 3.9% in November, below economists’ expectations of 4.4%, signaling the lowest annual reading since September 2021. Citigroup is set to close its global distressed-debt unit as part of CEO Jane Fraser’s restructuring efforts, following the recent shutdown of municipal-bond trading operations. Tesla is projected to attract the highest individual investor dollars in 2023, surpassing the SPDR S&P 500 ETF Trust. Despite concerns about a potential market breather, some attribute the recent downturn to technical factors, emphasizing the need for caution amid an overbought market. FedEx’s disappointing forecast and second-quarter results also raised concerns, impacting the broader market despite Treasury yields’ decline. The S&P 500, Dow Jones, and Nasdaq all experienced notable declines, breaking their winning streaks.

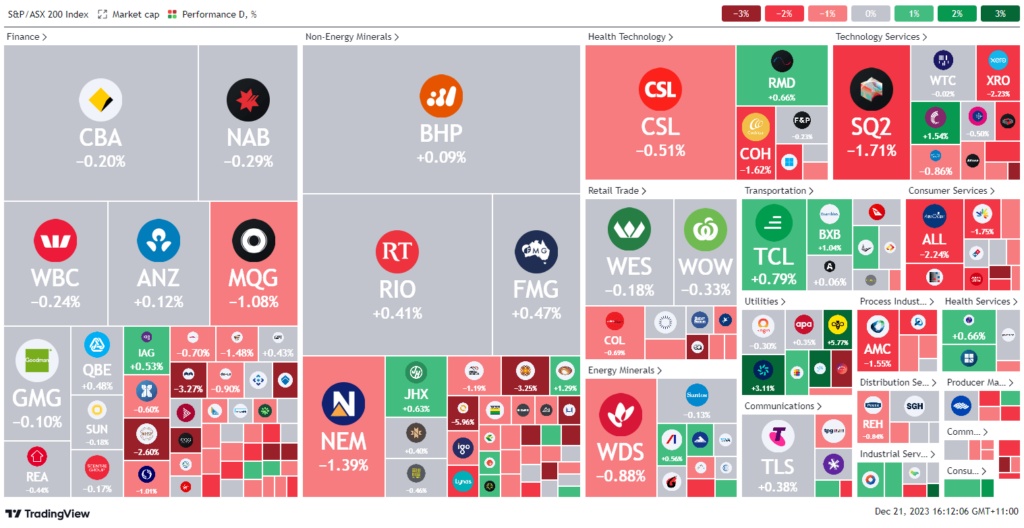

ASX Stocks

ASX 200 - 7,504 (-0.40%)

Key Highlights:

Australian shares experienced a downturn today, mirroring a late Wall Street sell-off, driven by profit-taking among traders. The S&P/ASX 200 dropped 0.4%, or 27.1 points, to 7510.4, retreating from the previous session’s 10-month peak. Most sectors, especially technology and real estate, registered declines. Gold and lithium explorers, such as Newmont (-1.6%) and Allkem (-5%), weighed down the materials sector, though Rio Tinto reached an intraday high of $135.4 due to robust iron prices anticipating winter restocking demand in Asia.

The seasonal stockpiling trend in Asia preceding the Chinese New Year, supporting iron ore prices, which rose 24% this year. On Wall Street, a pre-Christmas nervousness led to a late-session downturn, with the Dow Jones (-1.3%), S&P 500, and Nasdaq (-1.5%) closing lower.

Stocks in focus included Pacific Smiles, up 1.4% after rejecting Genesis Capital’s undervalued takeover bid. Conversely, Liontown plummeted 8% amid a legal dispute over a WA mine royalty. Pilbara Minerals (-2.7%) announced cost-cutting plans, while Bubs Australia, at 13.5¢, secured $17 million for US expansion. Transurban rose 0.4% after securing $800 million in 10-year debt for debt repayment and capital return. ANZ Group remained unchanged as its CEO expressed optimism at the AGM about expanding mortgage market share.

Leaders

MCY – Mercury: +5.77%

CTT – Cettire: +3.94%

DYL – Deep Yellow: +3.88%

RED – RED 5 Ltd: +6.45%

WBT – Weebit Nano Ltd: +5.73%

Laggards

APE – Eagers Automotive -8.22%

LTR – Liontown -7.89%

TPW – Temple & Webster Group Ltd: -4.44%

CEN – Contact Energy Ltd: -4.08%

MAF – Ma Financial Group Ltd: -2.75%