Overnight – Stocks lower on “Santa rally” profit taking

Stocks snapped a nine-day winning streak with a sharp reversal into the close as investors appeared to take some profit from the recent 7-week “Santa rally”. Early in the session the major indices pushed towards all-time highs, triggering the broadest selloff in markets since March.

Stocks were in the green intraday following signs of consumer strength and pick up in housing activity. The confidence index jumped to a reading of 110.7, the highest level since July 2023 and the second highest level in the last 2 years, driven by labor market optimism. Existing home sales unexpectedly picked up pace in November to a six-month high from the prior month to a seasonally adjusted annual rate of 1.56m units. Economists were expecting a 0.6% increase to 5.44 million homes. The move comes just as data showed 30-year mortgage rates fell to the lowest level since June.

Alphabet (Google) closed 1% higher, though well off session highs as the tech giant is reportedly mulling a plan to restructure its ad sales business by ramping up the use of automation including machine learning. Apple, Meta and Microsoft gave up gains amid a broader market selloff into the close

Oil prices advanced slightly after earlier hitting their highest level in nearly three weeks, as traders dealt with worries about disruptions in the Red Sea after Yemen’s Iran-aligned Houthi militants stepped up attacks on commercial ships.

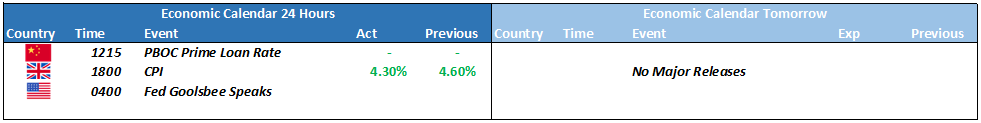

The dollar rose against other major currencies, while sterling fell sharply after UK inflation plunged in November to its lowest rate in more than two years at 3.9%. That was far lower than the 4.4% economists polled by Reuters had expected, making it less of an outlier globally.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7478 (-0.97%)

The ASX is likely to be fairly thin and quiet leading into the Christmas break. The top 20 ASX could be vulnerable, sitting close to record highs, while the small caps are likely to give back some ground. Futures contracts on the ASX200 expire today which could bring some volatility in the morning session.

Like most investors, we will be focused some profit taking after the recent stellar run

- ANZ hosts an annual general meeting.

- ASX200 Futures expire today at lunchtime.