Overnight – Small caps rally eclipses fresh record highs in Dow

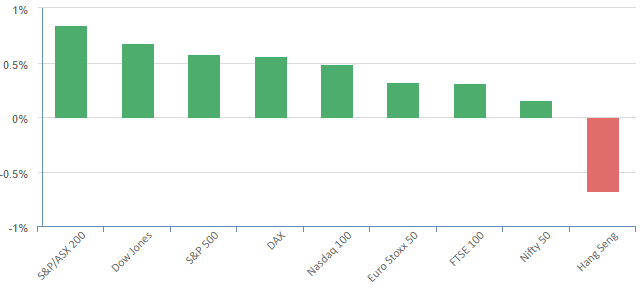

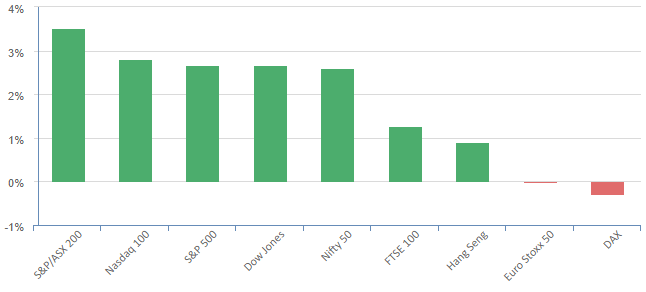

The Dow notched up another record high overnight, however, the small-caps continued to play catch up this month, outpacing the “Magnificent-7” heavy Nasdaq and S&P by double. The Small-cap index, the Russell 2000 has rallied 13% in the past month to highs not seen since March 2022. The other major indices have only managed 6% gains in this time as it appears investors are switching out of the Magnificent 7 into smaller companies.

In further echoes of 5 Fed speakers recently, Atlanta Fed President Raphael Bostic said on Tuesday there was “no urgency” to begin cutting rates, given the strength of the economy and the slow rate at which inflation is cooling down toward the central bank’s 2% annual target. Again, this was ignored by investors, who are choosing their own narrative at present

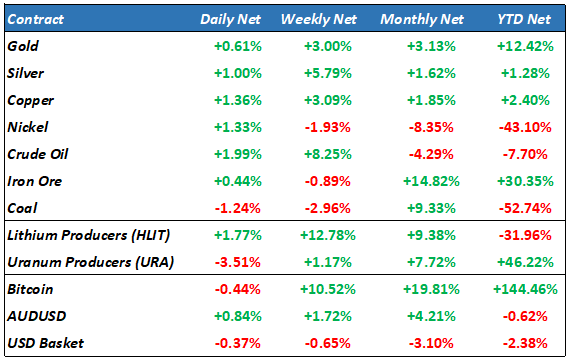

Materials and energy led the market higher, with the latter supported by a rise in oil prices even as the U.S. announced plans to expand a naval task force to protect shipping through the Red Sea.

Fears over disruptions to trade caused by a series of missile and drone attacks on ships in the Red Sea by the Iran-aligned Yemeni Houthi militant group continued to underpin oil prices following a 2% gain a day earlier. The attacks have forced several major oil shippers to halt crude oil shipments through the Red Sea following attacks on ships in the region. Around 12% of world shipping traffic passes through the Suez Canal, heading mostly from the Mediterranean to the important Asian market. The US announced the creation of a multinational operation to safeguard Red Sea commerce, including countries such as the United Kingdom, France, Italy, Norway and Spain.

S&P 500 - Heatmap

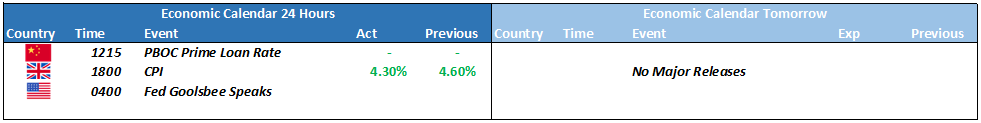

The Day Ahead

ASX SPI 7538 (+0.46%)

Energy and materials should lead the way higher today, with oil and gold higher. The small caps should outperform as the ASX top 20 at near record highs, likely to struggle to find much more momentum. Financials and Healthcare were also solid performers overnight, which is most likely going to be most prominent in the <$2B market cap stocks

The local market volumes are significantly down from the daily averages this year, an indication that the ASX has already closed up for Christmas after a tumultuous year, that is looking like finishing unchanged. Over the next few sessions, stocks with any company specific news are likely to overreact in the thin conditions which is a double edged sword, the best tactics being, running stocks with positive news longer with a trailing stop, on the flipside, you will need to be aggressive in cutting any stocks with negative news

- Incitec Pivot hosts an annual general meeting.

- Elders pays investors its dividend.