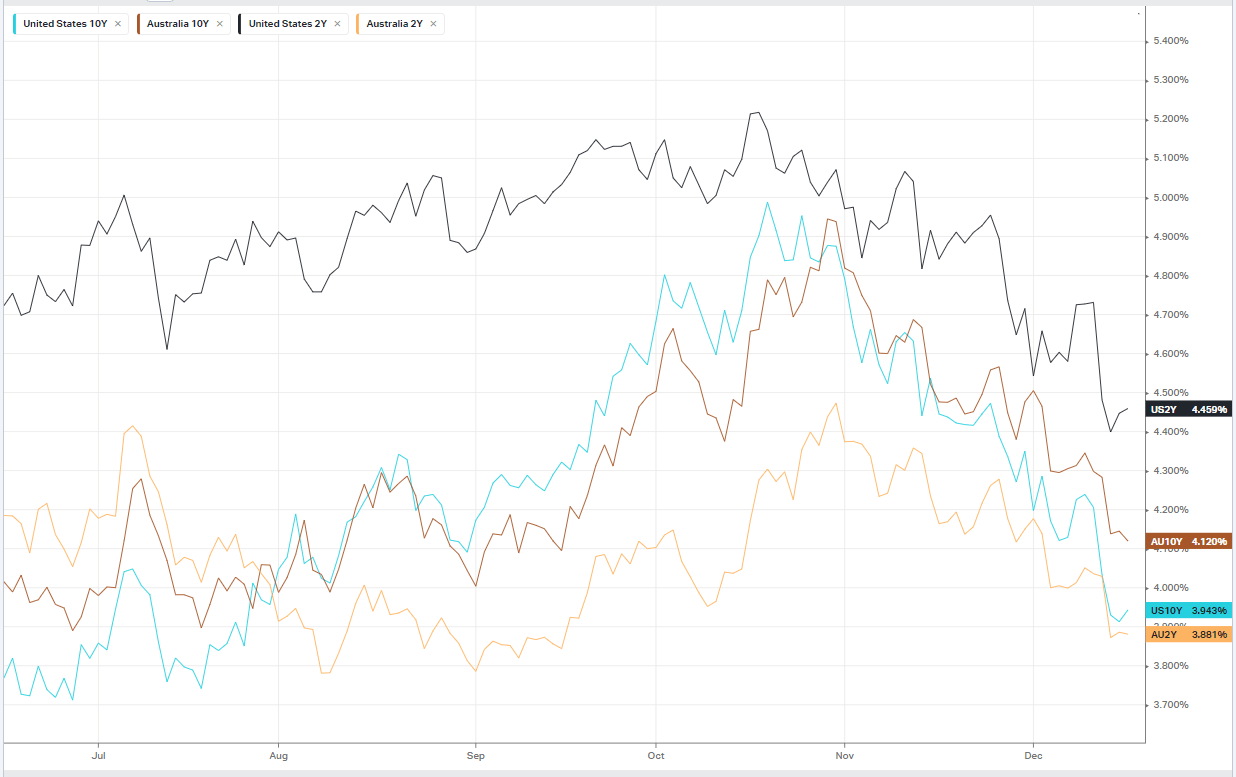

Overnight – Investors ignore repeated Fed warnings not to expect rate cuts anytime soon

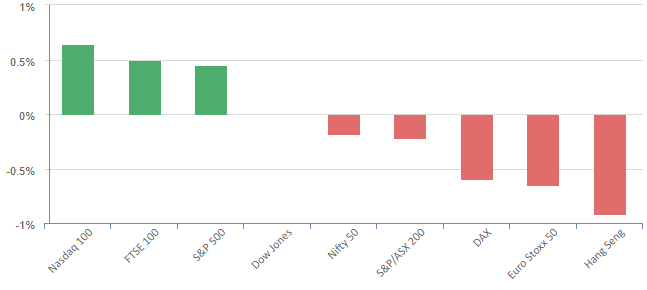

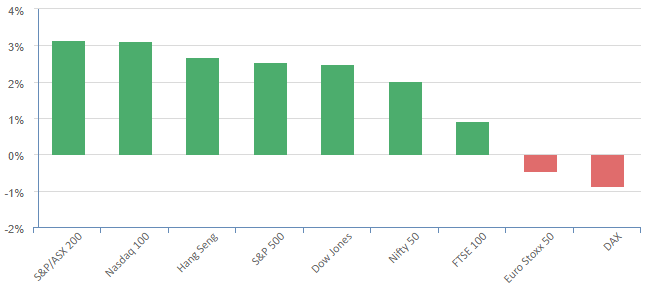

Stocks rallied overnight ignoring warnings from Federal Reserve officials to cool expectations of sooner rather than later rate cuts.

Chicago Fed President Austan Goolsbee said earlier Monday he was “confused” with how the market reacted in the wake of last week’s Fed meeting, adding that Fed members “don’t debate specific policies speculatively about the future.”

Fed President Loretta Mester, meanwhile, also attempted to push back, saying that the Fed’s next policy phase isn’t “when to reduce rates … It’s about how long do we need monetary policy to remain restrictive in order to be assured that inflation is on that sustainable and timely path back to 2%. The comments echoed those of New York Fed President John Williams late last week, who stated that policymakers were not “really talking about” interest rate cuts “right now.

United States Steel stock soared 27% after Nippon Steel said it would buy its U.S. rival in a deal worth $14.9 billion including debt, months after the steelmaker put itself up for sale. The Japanese company will pay $55 per share in an all-cash transaction, a 40% premium to U.S. Steel’s Friday closing stock price.

Adobe stock rose 2.5% after the Photoshop and Illustrator maker ended its $20 billion cash-and-stock deal for cloud-based designer platform Figma, citing problems getting approvals from antitrust regulators in the European Union and the UK.

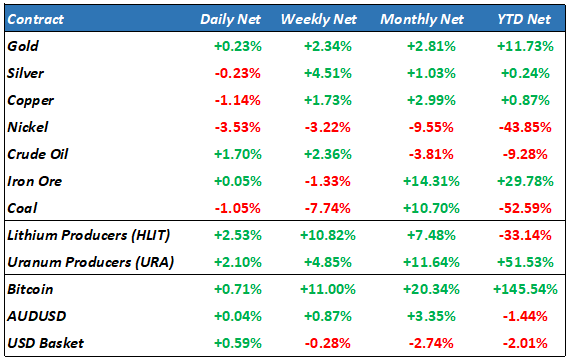

Oil rose nearly 2 per cent on Monday as investors worried about disruptions to maritime trade and supply costs after the Iran-aligned Yemeni Houthi militant group attacked ships in the Red Sea.

A Norwegian-owned vessel was attacked in the Red Sea on Monday and oil major BP said it had temporarily paused all transit through the water. Other shipping firms said over the weekend that they would avoid the route.

S&P 500 - Heatmap

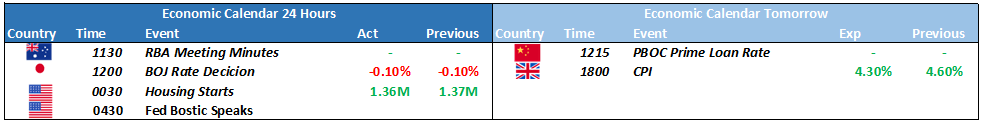

The Day Ahead

ASX SPI 7446 (+0.08%)

We are in for another quiet day on the ASX, particularly in the large caps as many of the top 20 sit very close to record highs with little room to rally further. This may make investors go down the market-cap size to get value with the small caps in Australia still lag their global peers, 5% from 52-week highs, while the Russel2000 makes fresh 52-week highs. M&A activity yesterday with a bid for ABC and LNK is a sign that private equity is seeing value in the small to mid-cap companies, which could see some support across the board.

- Origin Energywill pump another £280 million ($530 million) into British energy retailer and tech platform Octopus Energy, boosting its stake in a company that may have played a role in thwarting the EIG-Brookfield $20 billion take-private bid for ASX-listed Origin.

- Allkem hosts an AGM. Kelly Partners andRicegrowers both trade ex-dividend.