Overnight – US Stocks hit record highs as Fed dampens rate cut calls

The Dow and Nasdaq clinched record closes Friday, amid optimism for rate cuts next year even as a Federal Reserve official attempted to pour cold water on aggressive rate cuts next year.

All three indexes registered their seventh consecutive weekly gains, marking the S&P 500’s longest streak of weekly gains since September 2017, and the Dow’s longest since late 2018-early 2019.

Euphoria over the U.S. Federal Reserve’s dovish pivot was dampened a bit after New York Federal Reserve President John Williams pushed back against rate cut expectations, reiterating that the central bank remains focused on bringing inflation down to its 2% target.

New York Fed President John Williams told CNBC in an interview Friday that talk of rate cuts is still “premature” and the central bank could still tighten policy if needed. The New Fed president’s remarks rein in some of the aggressive bets on rate cuts markets are expecting for next year, boosting Treasury yields.

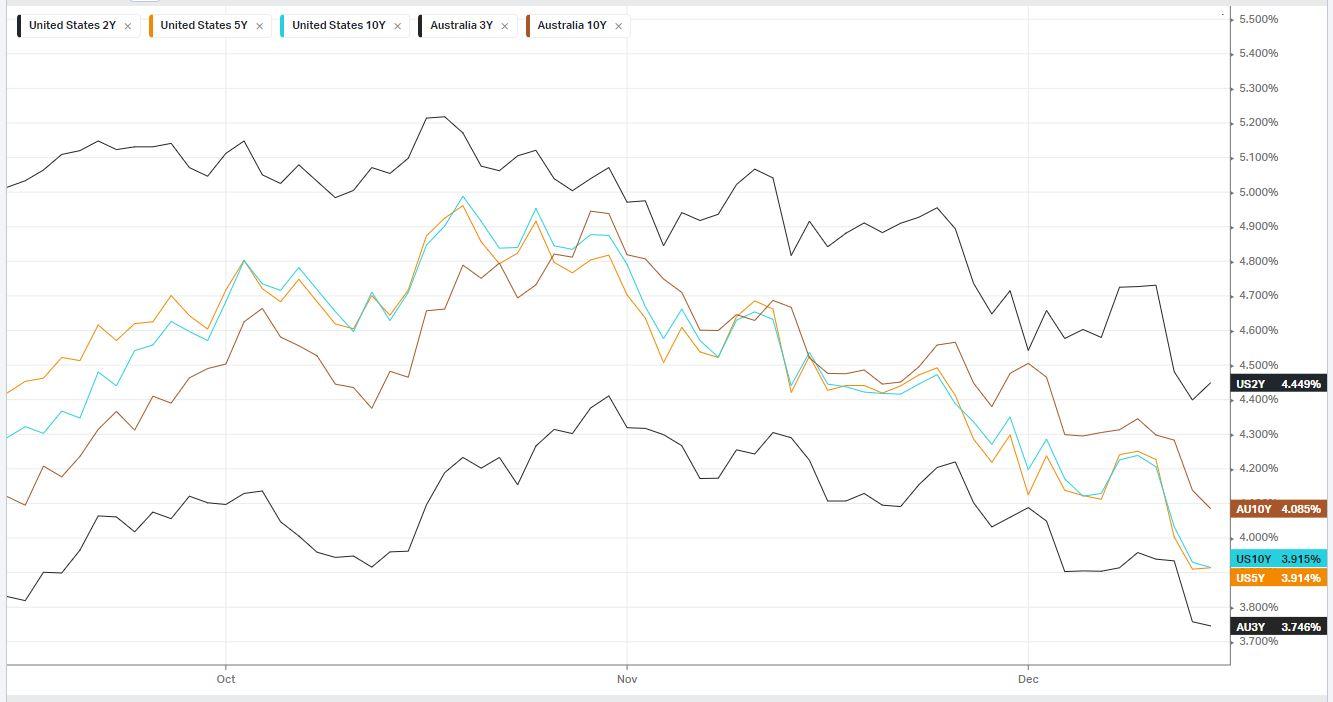

The yield on the 2-year Treasury, which is sensitive to Fed policy decision, rose 5 basis points to 4.451%, while the U.S. 10-year yield fell 2 bps to 3.915%.

On the economic front, manufacturing activity fell more than expected in December, but services activity, which makes up the bulk of the inflation, increased by more than expected.

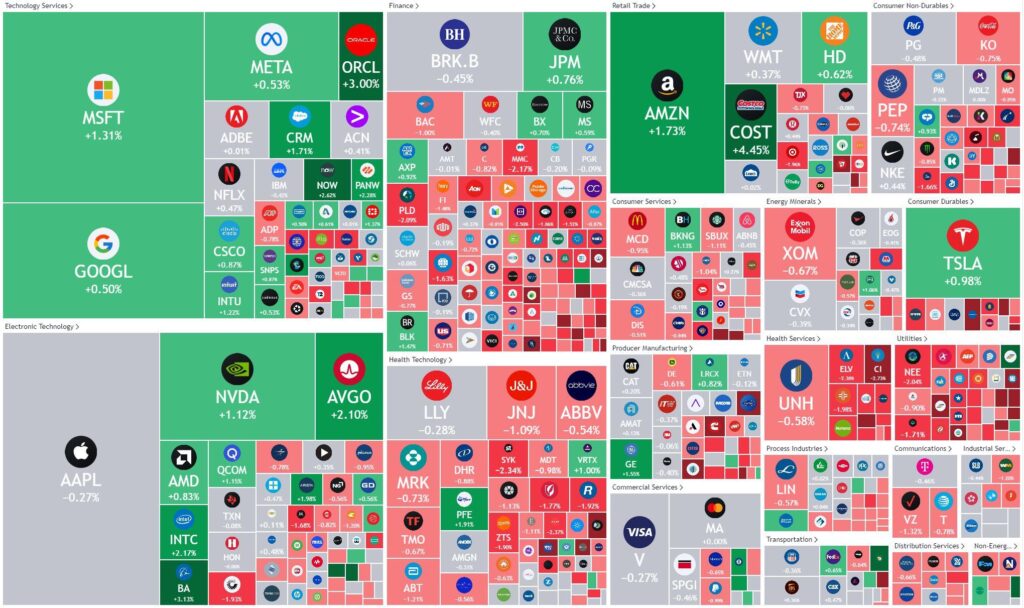

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7381 (-0.99%)

Last weeks optimism seems to have run a little dry with SPI futures giving back 1% on Friday night. We are likely to see some profit taking in the large caps, while the small caps should remain firm.

Markets are likely to be thin until mid January now as investors pack up for Christmas