Overnight – Dow reaches record high as Fed flags cuts in 2024

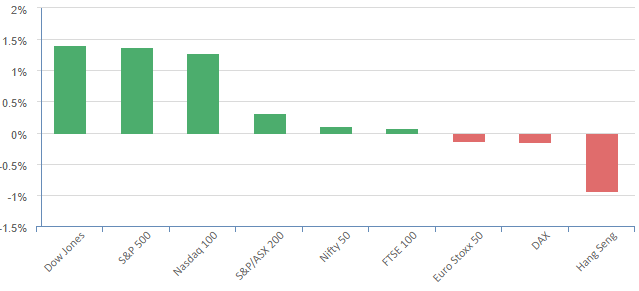

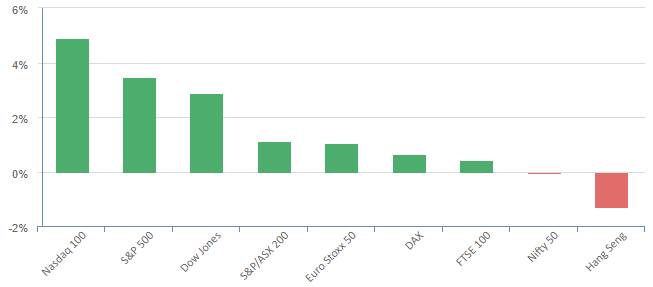

The Dow closed at record high Wednesday after the Federal Reserve’s decision to keep rates unchanged, but forecast deeper rate cuts for next year, pushed growth stocks including tech sharply as Treasury yields slumped.

Despite the DOW reaching record highs, the Russell2000, the small cap index, outpaced the DOW by more than double finishing up 3.66%, a pattern we expect to continue as the rate cycle is now done

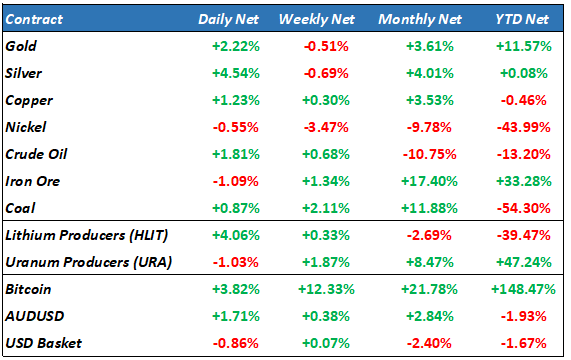

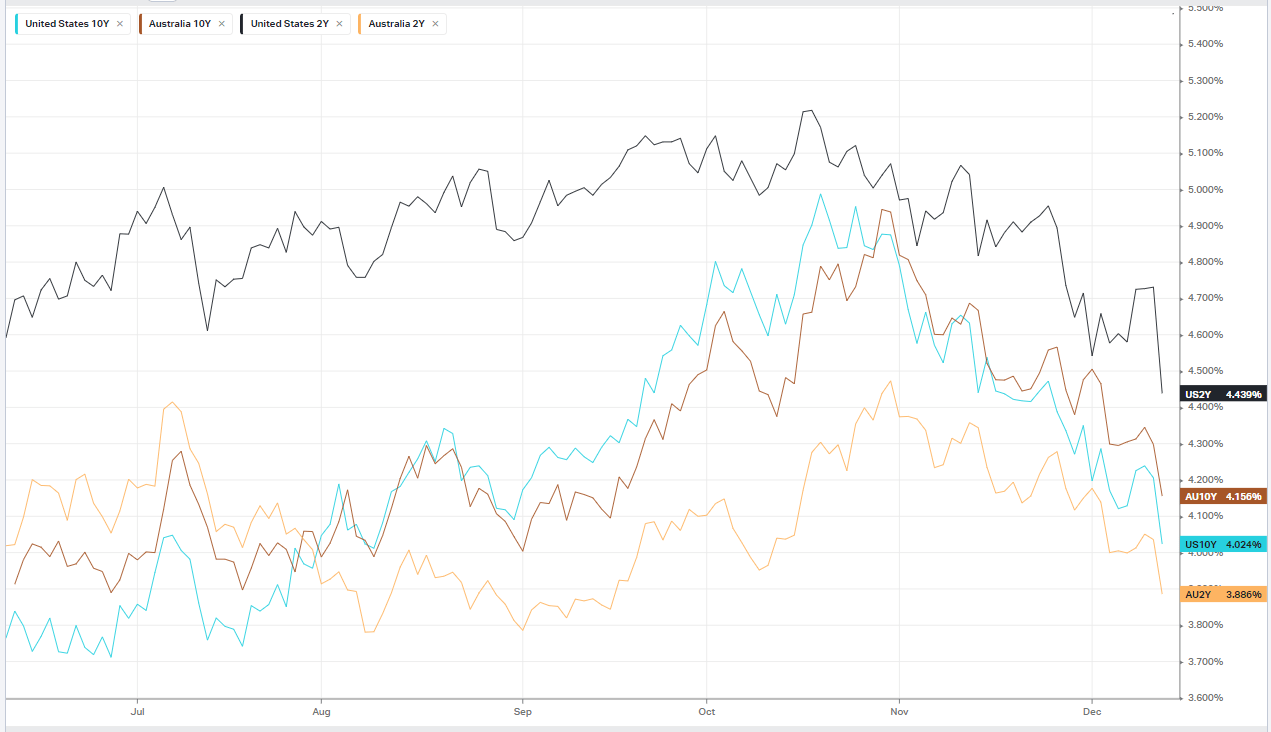

Treasury yields fell sharply following the Fed decision, with the yield on the two-year Treasury falling 28 basis points to 4.447% and 19 basis points on the 10-year Treasury to 4.024% The move lower in Treasury yields, which trade inversely to price, is expected to continue into the holiday through year end into early 2024, Miley said, paving the way for further gains in stocks.

The November producer prices were unexpectedly unchanged in November as a decline in the cost of energy products more than offset higher food prices, confirming that the country remained on a disinflationary path. Signs of ongoing disinflation come just a day after the November consumer prices continued to show slowing price pressures.

Oil settled higher Wednesday, after data showed U.S crude inventories fell by much more than expected last week. The Energy Information Administration reported Wednesday that U.S. oil inventories fell by 4.3M barrels in the week ended Dec. 8, compared with expectations for a decline of 650,000 barrels.

S&P 500 - Heatmap

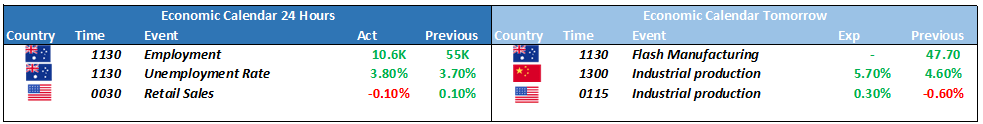

The Day Ahead

ASX SPI 7356 (+1.08%)

Today will be the day of the small cap as equity investors celebrate the end of the hiking cycle and rate cuts next year. While the big end of town has been holding up the market for most of this year, investors will be enticed into going down the risk curve. Lithium should have a great day with lithium futures rallying 10% to limit up, after the ASX close. Gold and silver stocks should also perform strongly.

AU Employment will be released at 1130, however we don’t see this number pulling the handbrake on todays rally

- BHP: CEO Mike Henry has sold $18.5 million worth of shares as part of the reorganisation of assets after his divorce.

- IGO: The miner warned of another write-down amid losses at its nickel project.

- Sigma: After jumping as much as 40 per cent on Wednesday, the hype around the company’s reverse takeover by Chemist Warehouse may be a sign of Christmas exuberance, writes Chanticleer.

- Westpac and Elders both have annual meetings today.