Overnight – Inflation continues to cool as Investors wait for Fed meeting

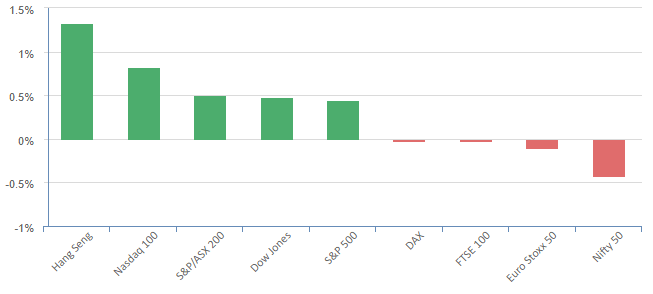

Stocks finished higher overnight led by tech as an ongoing slowdown in inflation kept hopes for an early rate cut next year alive just as the Federal Reserve readies its monetary policy decision slated for Wednesday.

Annual headline consumer price growth edged down to 3.1% last month, decelerating from 3.2% in October, according to data from the Bureau of Labor Statistics on Tuesday. Month-on-month, the reading inched up by 0.1%. Economists had forecast the measures at 3.1% and 0.0%, respectively.

The closely watched “core” figure, which strips out volatile items like food and energy, rose by 4.0% annually, in line with the prior month. On a monthly basis, underlying price gains came in at 0.3%, a marginally faster pace than 0.2% in October. Both matched estimates.

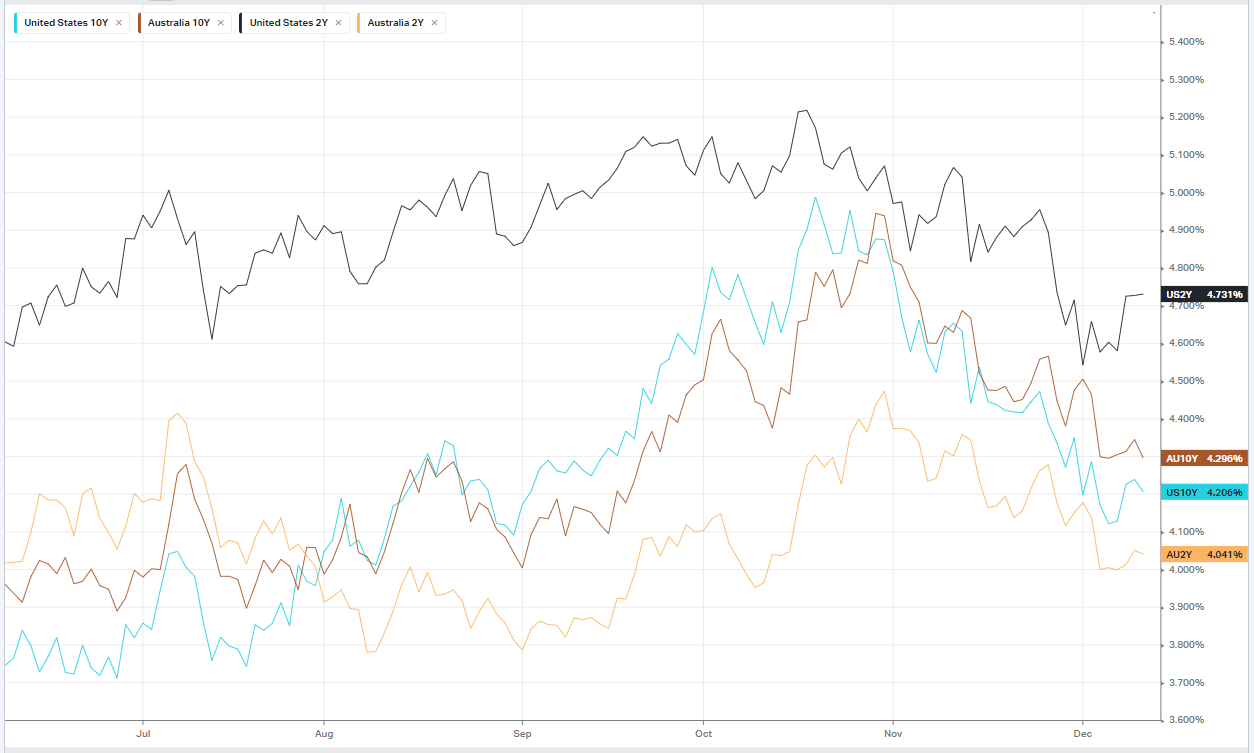

Following the data, bets on rate cut in the first half of the year remained supported, with about 50% of traders betting on cut in May. Treasury yields fell, with the yield on the 10-year Treasury fell 3.3 basis points to 4.206%.

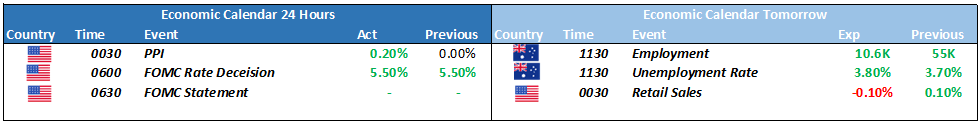

The Fed kicked off its two-day meeting Tuesday that is expected to culminate in decision to keep rates unchanged. The Fed’s projections, or so-called dot plots, will likely garner the bulk of investor attention amid expectations for the Fed to increase the number of cuts next year.

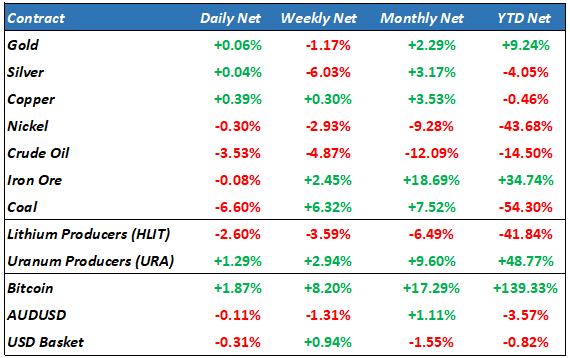

Energy stocks fell more than 1% after oil prices tumbled on Tuesday, as worries over excess supply offset the impact of an attack on a commercial chemical tanker by Iran-aligned Houthis.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7247 (-0.01%)

With the lack of any significant data until the Fed press conference at 630am and AU employment data 1130 tomorrow morning, today is likely to be directionless and thin. The ASX will be in a holding pattern until years end if both of those figures are revealed to be in-line with expectation

Locally, Treasurer Jim Chalmers will unveil a mid-year economic and fiscal outlook statement at 10:30am