What's Affecting Markets Today

Bitcoin Falls 7pc as Rally Wobbles

Bitcoin experienced a sharp decline, falling towards $US40,000 amid a wider crypto market sell-off. The largest cryptocurrency dropped by as much as 7.5% to $US40,521, later recovering slightly to $US42,095. This drop was echoed across smaller tokens like ether, XRP, polkadot, and avalanche, with a significant digital assets index shedding around 4%. Bitcoin’s rally this year has been fueled by expectations of US regulatory approvals for Bitcoin ETFs and predictions of Federal Reserve rate cuts in 2023. According to Richard Galvin of Digital Asset Capital Management, the recent fall appears to be more related to market deleveraging than any specific fundamental news.

‘Muddled Message’ from Latest US Jobs Report

The US jobs report for November showed mixed signals, with 199,000 jobs added, the unemployment rate dropping to 3.7%, and wages rising by 0.4%. While slightly stronger than anticipated, the report doesn’t significantly alter the view of a gradually weakening job market. According to Wells Fargo, the labor market has softened compared to a year ago, with average nonfarm payroll increases slower and wage growth more restrained. Jay Bryson from Wells Fargo believes the US economy is entering 2024 with balanced risks for the labor market and inflation, differing from previous years’ concerns over tight labor markets and high inflation. He anticipates the first rate cut by the Federal Open Market Committee in summer 2024, given further softening in the labor market and progress in controlling inflation.

First ECB Rate Cut Seen in April: Goldman

Goldman Sachs predicts the European Central Bank (ECB) will start cutting rates in April 2023, with quarter-point reductions at each policy meeting until early 2025. This forecast is based on unexpectedly rapid moderation in European inflation, rather than recessionary concerns. Core and headline inflation in the euro area dropped significantly in November, prompting Goldman to adjust the ECB’s deposit rate to eventually stabilize at 2.25% by early 2025. Although much of this rate pivot is reflected in current markets, Goldman Sachs still sees potential for equities to rise. The firm has increased its STOXX Europe target values for the next three, six, and twelve months, expecting a 7% price return over 12 months. This forecast aligns with anticipated earnings per share (EPS) growth in 2024 and 2025, with the price-to-earnings ratio aligning with Europe’s long-term average valuation.

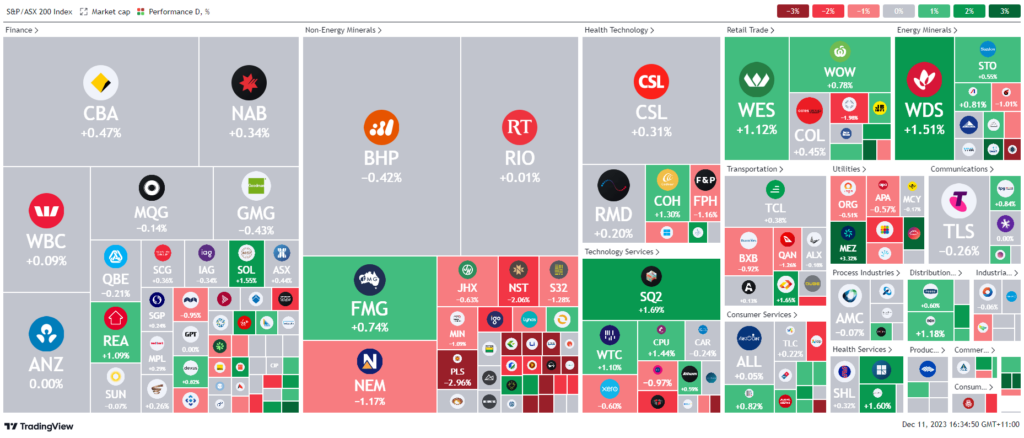

ASX Stocks

ASX 200 - 7,195.5 (0.01%)

Key Highlights:

The Australian sharemarket remained mostly flat as the trading day neared its end, with losses in mining stocks offsetting gains in the energy sector. The S&P/ASX 200 index saw a marginal decrease of 2.3 points to 7192.6, while the Australian dollar fell slightly to US65.75¢. The mining sector experienced a notable 0.8% drop, particularly in lithium and gold stocks. In contrast, the energy sector advanced by 1%, driven by Woodside’s 1.4% gain amidst ongoing merger talks with Santos, aiming to create an $80 billion entity.

Several merger and acquisition activities influenced stock movements. Sigma Healthcare’s shares remained steady following its merger announcement with Chemist Warehouse, set to form an $8.8 billion retail pharmacy giant. Kin Group raised its buyout offer for Pact Group, causing Pact’s shares to surge by 23%. Whispir shares declined by 1.9% amidst potential takeover talks with Pendula, surpassing an earlier offer from Soprano Design.

Oil prices stabilized, with Brent crude trading below $US76 a barrel and West Texas Intermediate around $US71, following seven weeks of decline. Wall Street ended positively, with the S&P 500 up by 0.4%, despite payroll data indicating a slower jobs market and impacting rate cut expectations for the following year.

Key events for the week include the US consumer price index and the Federal Reserve’s rate decision. The European Central Bank, the Bank of England, and Reserve Bank governor Michele Bullock’s speech are also notable. In company news, Platinum Asset Management appointed Jeff Peters as CEO, and Dexus promoted Ross Du Vernet to the same position. Bubs Australia’s shares climbed by 6% after projecting a doubling in US revenue for the 2024 financial year, while gold producers like West African, Bellevue Gold, and Gold Road Resources experienced stock price declines.

Leader

BPT – Beach Energy Ltd (+3.69%)

CEN – Contact Energy Ltd (+3.46%)

MEZ – Meridian Energy Ltd (+3.32%)

LOV – Lovisa Holdings Ltd (+2.96%)

LIC – Lifestyle Communities Ltd (+2.60%)

Laggards

SGR – The Star Entertainment (-8.65%)

BGL – Bellevue Gold Ltd (-7.71%)

DEG – De Grey Mining Ltd (-5.24%)

GMD – Genesis Minerals Ltd (-3.53%)

LTR – Liontown Resources Ltd (-3.26%)