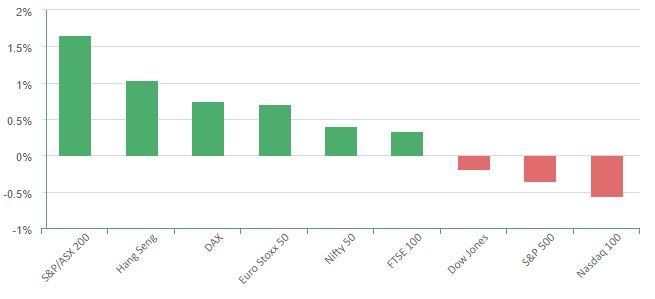

Overnight – Equities slip as early signs economy is slowing are adding up

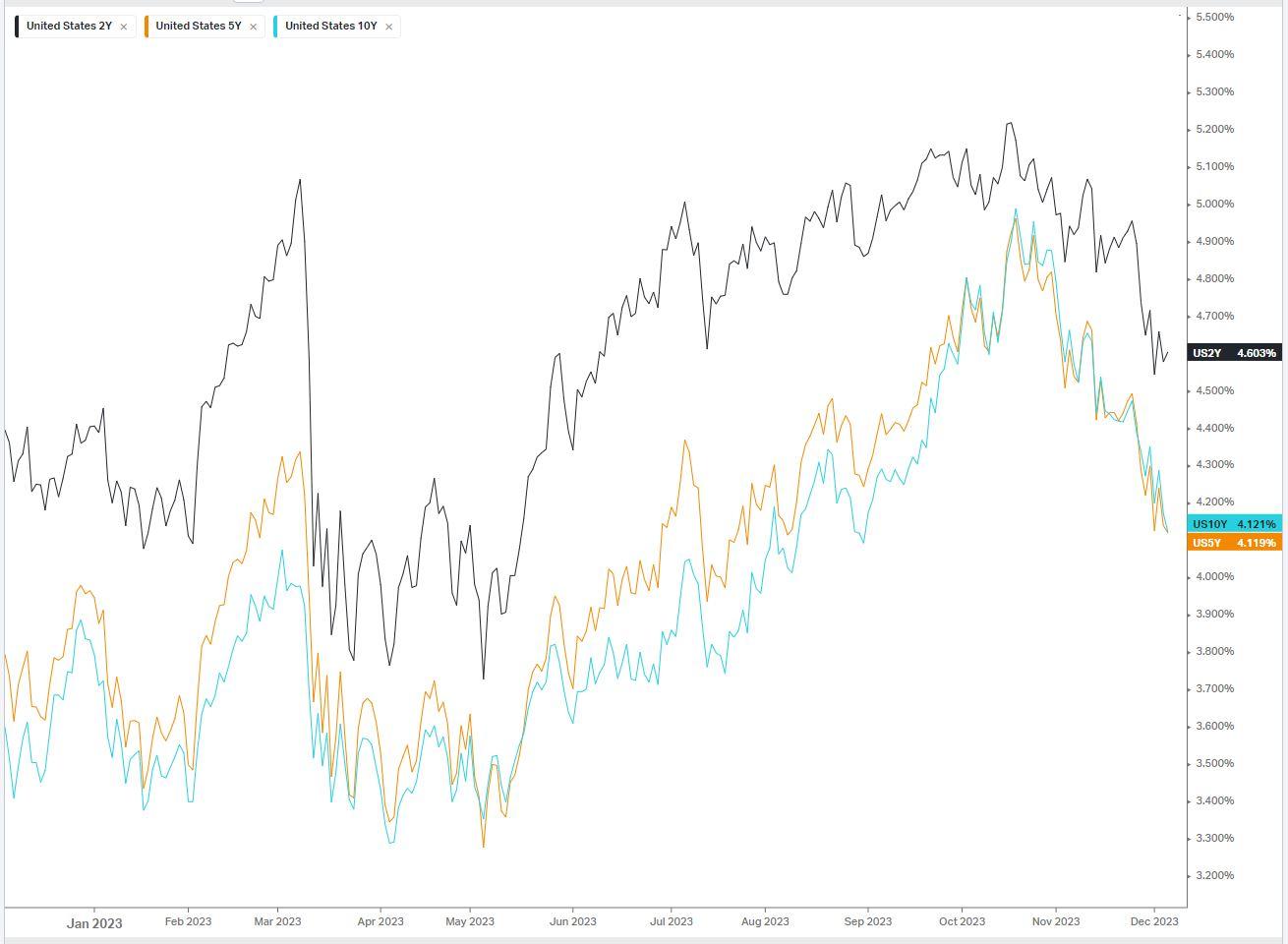

Equities finished lower overnight as investors digested another round of softer jobs data pointing to a slowing economy, boosting hopes that sooner rather later rate Federal Reserve cut is on the horizon.

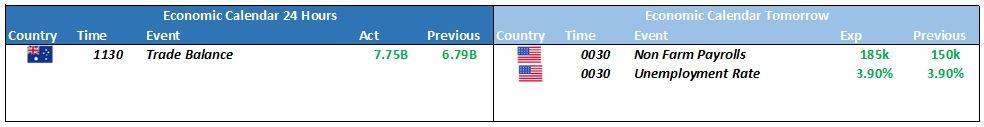

Data from payroll processor ADP showed that private U.S. employers added just 103,000 jobs last month, down from a revised mark of 106,000 in October. Economists had forecast an increase of 130,000 jobs. The data arrived a day after job openings dipped to their lowest mark in over two years in October and point to a slowing job market that could not only slow the economy but also force the Fed a rate cut early next year. The slew of the jobs data will continue on Thursday and Friday with release of weekly initial jobless claims and nonfarm payrolls, respectively.

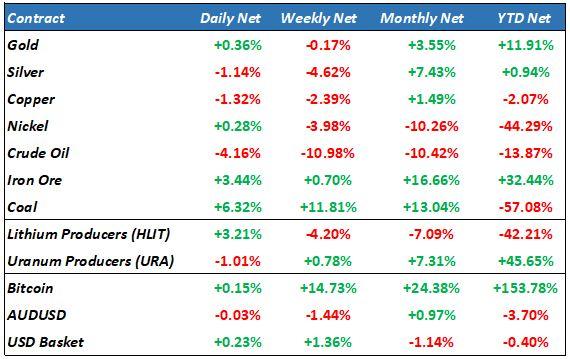

Oil prices below $70 a barrel to the lowest level since June on Wednesday after weekly U.S. petroleum data showed a larger-than-expected draw in weekly U.S. inventories, but also a much larger in build in gasoline supplies at time when U.S. crude production climbed to record highs.

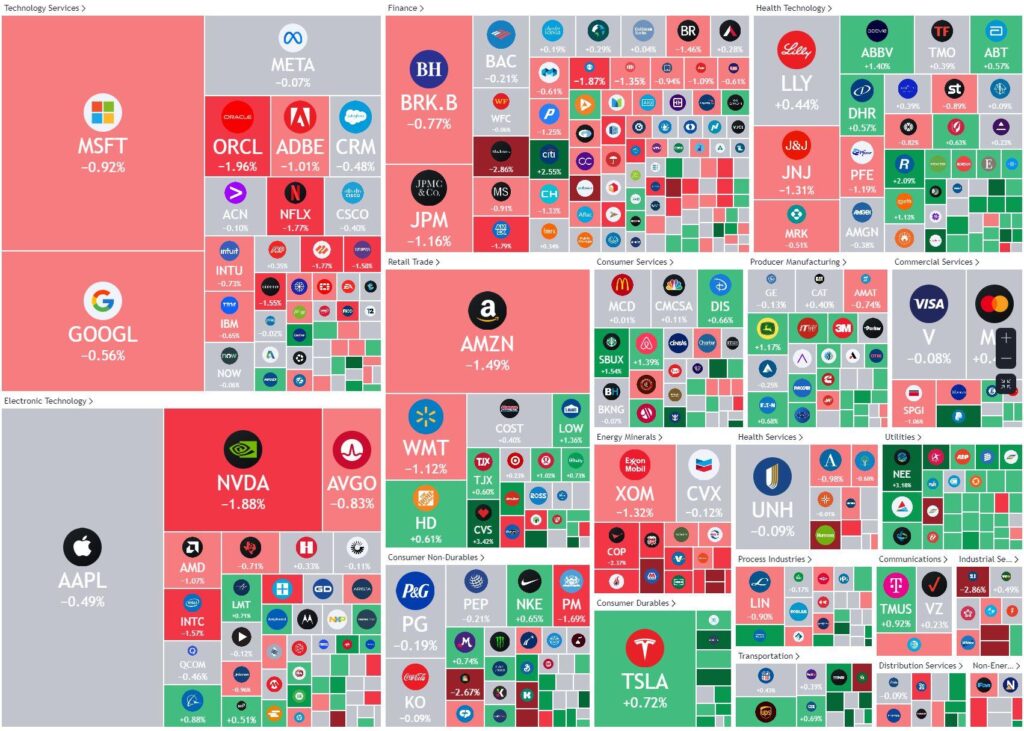

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7171 (-0.53%)

The local market will take a breather after one of the best rally’s in months yesterday. The market will be nervous leading into Friday night payrolls numbers in the US, with a poor number likely to see a significant drop in the US indices.

- Mesoblastearnings are expected on Thursday and CSR is set to pay a dividend.

- Perpetualshares jumped 6.3 per cent to $23.76 on Wednesday after investment conglomerate Washington H. Soul Pattinson made a $3 billion offer to acquire Perpetual and break the funds management business up.