Overnight – Rate cut “joy” begins to sour as investors realise it means a cooling economy

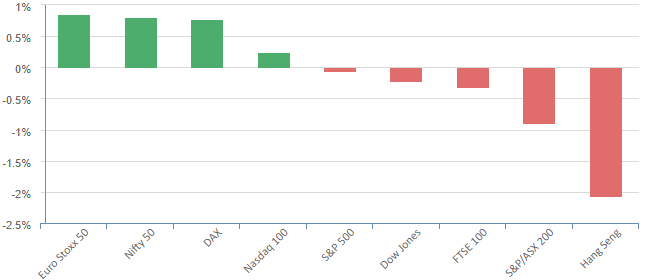

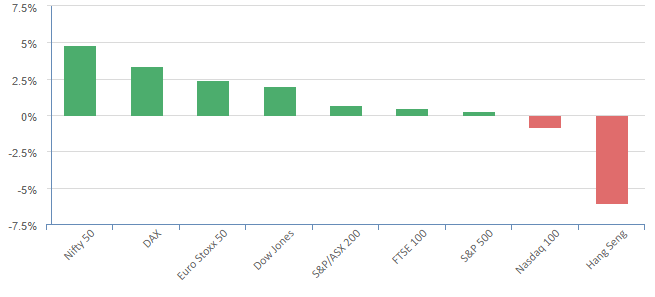

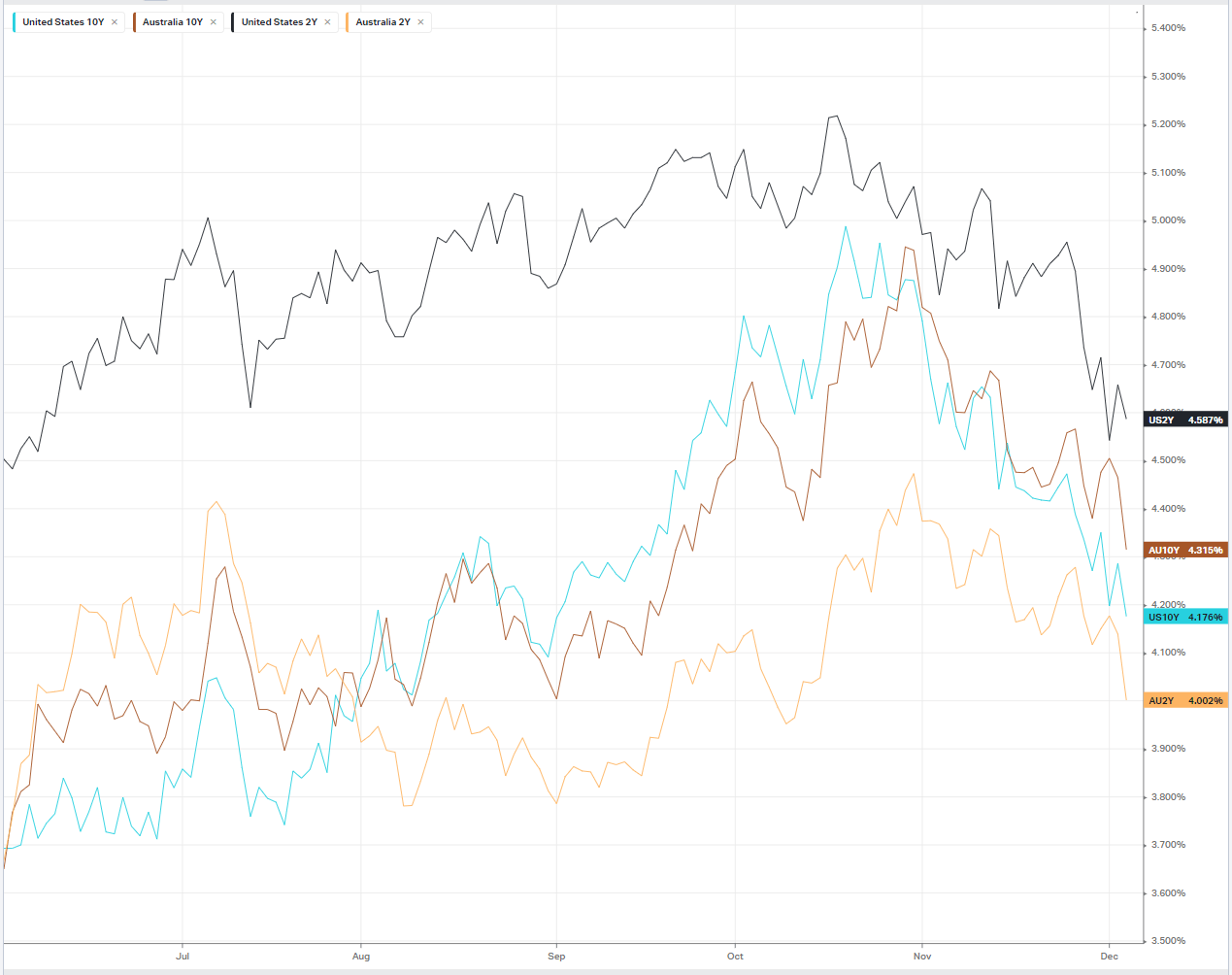

Stocks finished mixed overnight with downside momentum curbed by rising tech stocks as Treasury yields fell after data showed labor demand fell to a two-year low.

A continuation of softening in the labour market stoked bets of a reversal in monetary policy in H1 next year as the JOLTS report showed job openings in the world’s largest economy slipped to 8.7 million on the final day of October, down from 9.553 million on the last day of the prior month, and the lowest level in two-years, however still well above the historical average of 5.5M

On Friday, the more comprehensive non-farm payrolls report for November will offer greater clarity on the state of the labor market.

This triggered a “flight to safety” in the magnificent 7, currently the preferred safe haven bet for US fund managers.

In a Déjà vu moment from the years leading up to the GFC, the top 8 US bank CEO’s fronted congress overnight to convince congress that tighter regulation would hurt the banking industry. Any relaxing in regulation for the banks capital requirements would be of great concern for the broader economic system as history has shown that the banks are reckless in the absence of rules and are “too big to fail” meaning the rest of the economy picks up the tab

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7104 (+0.39%)

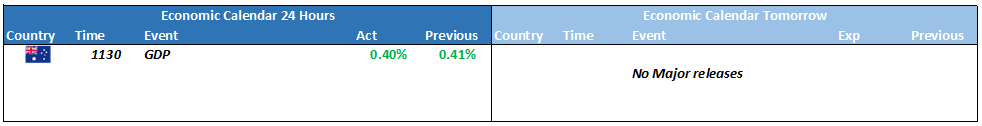

The ASX will likely bounce marginally today as the financial press narrative of yesterdays RBA meeting is largely positive. At 1130 we will see AU GDP, expected at 0.4% for the quarter, where the likelihood is that only a significantly higher number will effect the market.

- Hotels and alcohol retailer Endeavour Group is scheduled to have an investor day.

- Rio Tintois also holding an investor day in Sydney. The mining giant has put a $US6.2 billion($9.46 billion) price tag on its Simandou iron ore project in Guinea.