What's Affecting Markets Today

Gold edges closer to a record high

Gold is nearing its all-time high as investors anticipate the Federal Reserve will reduce interest rates next year. This expectation stems from a prediction of a tough economic downturn and significant Fed policy easing. Speculators in the U.S. Treasury market are now the most bullish since 1991. Following comments from Fed officials suggesting steady rates, bond yields are falling. Gold’s price rise, over 11% since early October, is buoyed by safe-haven buying and declining global bond yields, approaching its pandemic peak. Economic data showing U.S. growth and consumer spending trends are also influencing gold prices.

Inflation is cooling in Europe

Inflation in Europe shows signs of easing, with Germany and Spain reporting unexpected drops in price pressures, indicating possible European Central Bank rate cuts by April. Germany’s inflation slowed due to lower energy and travel costs, while Spain saw a decrease in fuel and tourism costs. RBC Capital Markets forecasts a slower inflation cool down and rate cuts than the market expects, predicting the ECB to maintain rates through 2024. They anticipate short-term growth challenges in the euro area and expect energy inflation to rise again next year, influencing overall inflation rates.

Origin drops 3pc after board rejects ‘plan B’ bid

Origin Energy declined a ‘plan B’ proposal from Canada’s Brookfield and EIG to acquire the company. The board deemed the offer not in the shareholders’ best interest, citing its complexity, conditionality, and uncertainty. The proposal involved selling the Energy Markets business to Brookfield and a takeover bid by EIG for Origin’s shares, contingent on various conditions and approvals. Origin’s shares dropped by 2.9% following the announcement. The ongoing takeover discussion, valuing Origin at about $20 billion, has been postponed until December 4.

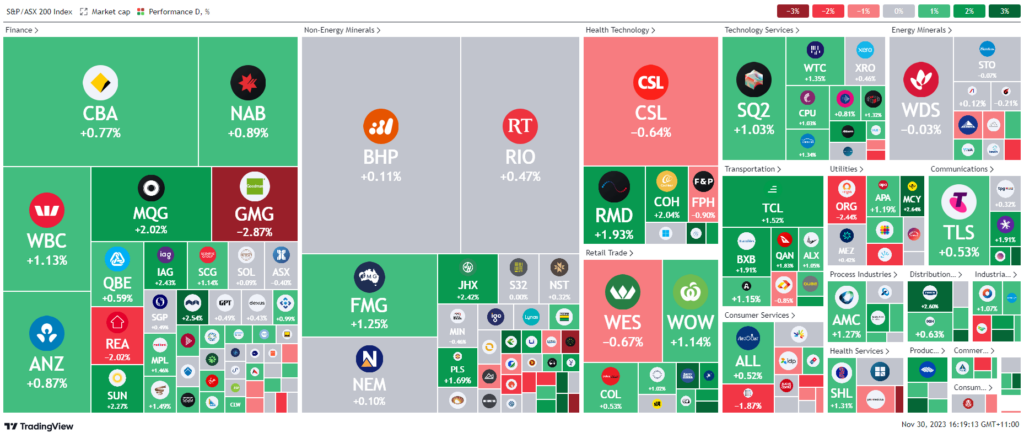

ASX Stocks

ASX 200 - 7,087.3 (0.74%)

Key Highlights:

The Australian S&P/ASX 200 index marginally rose by 0.1% to 7042.6, led by gains in financial and industrial sectors. Major banks like Commonwealth Bank and Westpac saw positive movements, while Iress in the financial sector surged 14.7% after increasing its earnings forecast. Contrastingly, utility stocks struggled, with Origin Energy dropping 2.3% after rejecting a takeover bid from Brookfield and EIG.

The market experienced fluctuations, initially rising with Wall Street’s gains and declining bond yields. Speculations of a Federal Reserve rate cut grew, influenced by the U.S. economy’s 5.2% growth in the third quarter. This speculation led to a rally in equities and bonds, with expectations of a rate cut by May 2024.

Oil prices advanced ahead of an OPEC+ meeting, with West Texas Intermediate settling below $78 a barrel. In stock-specific news, SkyCity Entertainment’s shares increased following a court ruling, while Cooper Metals’ shares soared 61% after promising drilling results. Origin Energy’s board rejected an alternative takeover proposal from Brookfield and EIG, citing its complexity, leading to market speculation about a potential ‘plan C’ from the bidders.

Leader

IRE-Iress Ltd (+14.71%)

TPW-Temple & Webster Group Ltd (+9.34%)

CDA-Codan Ltd (+4.38%)

TLX-TELIX Pharmaceuticals Ltd (+4.24%)

AD8-Audinate Group Ltd (+4.16%)

Laggards

CTT-Cettire Ltd (-9.57%)

SNZ-Summerset Group Holdings Ltd (-5.23%)

RDX-REDOX Ltd (-4.10%)

PDN-Paladin Energy Ltd (-3.98%)

WC8-Wildcat Resources Ltd (-3.87%)