What's Affecting Markets Today

Inflation Falls to 4.9% as Clothes, Supermarket Cost Pressures Ease

In October, annual inflation in Australia fell unexpectedly to 4.9% from 5.6%, driven by decreasing clothes prices and supermarket cost pressures. This reduction, lower than the anticipated 5.2%, is attributed to moderated consumer goods demand, according to the Australian Bureau of Statistics. The Reserve Bank of Australia (RBA) is expected to maintain the cash rate at 4.35% in its December meeting, with only an 11% market expectation of a rate hike. RBA Governor Michele Bullock emphasized the need for cautious further tightening to control inflation without excessively impacting the economy and increasing unemployment.

RBNZ Holds Cash Rate at 5.5%

The Reserve Bank of New Zealand (RBNZ) held its official cash rate at 5.5% in its November meeting, a decision aligned with market expectations. The RBNZ expressed confidence in the rate’s effectiveness in restraining demand, though it remains alert to persistent excess demand and core inflation levels. The central bank indicated a potential rate increase if inflationary pressures exceed forecasts. Analysts from Westpac noted comfort with an “on hold” stance due to signs of easing imported inflation.

Oil Extends Climb as OPEC+ Meeting Looms

Oil prices continued to rise ahead of an important OPEC+ meeting concerning supply policies for 2024. Brent crude approached $US82 per barrel, and West Texas Intermediate was below $US77, influenced by a weakening US dollar and expectations of the Federal Reserve ceasing rate hikes. The meeting’s focus includes resolving output quota disputes among some African OPEC+ members. Despite recent gains, oil is predicted to decline monthly due to increased non-OPEC supply, putting pressure on OPEC+ to potentially enact deeper output cuts. The International Energy Agency forecasts a global crude surplus next year.

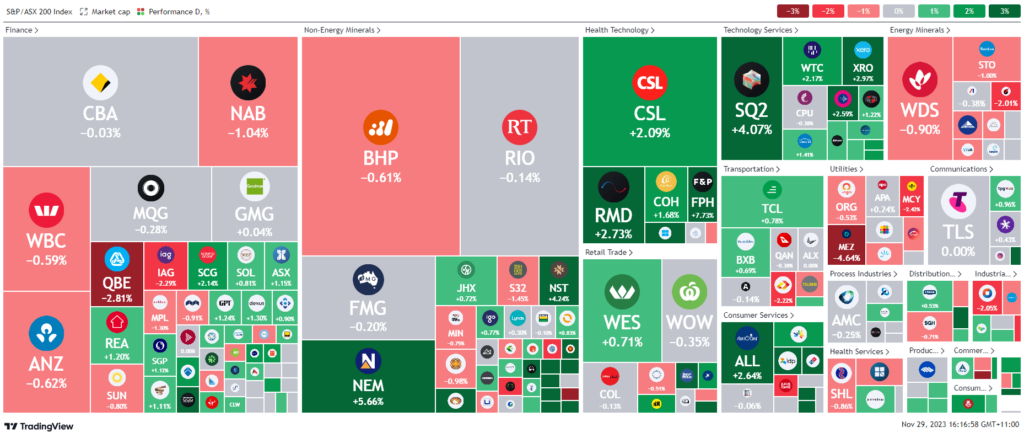

ASX Stocks

ASX 200 - 7,038.9 (0.34%)

Key Highlights:

Australian shares rose following lower-than-expected Consumer Price Index (CPI) data, indicating progress in the Reserve Bank of Australia’s inflation control efforts. The S&P/ASX 200 increased by 0.4% to 7043.9, buoyed by gains in interest rate-sensitive sectors like real estate and technology. The CPI rose 4.9% annually in October, below the forecasted 5.2%, leading to a rally in real estate, tech, and consumer discretionary stocks.

The Australian dollar held steady, strengthened by the widening interest rate gap between the US and Australia. Meanwhile, the Reserve Bank of New Zealand maintained its official cash rate at 5.5%.

Key stock movements included Healius, up by 8.8%, Fisher & Paykel Healthcare rising 7.5%, and EML Payments dropping 30.6% amid profit and revenue expectations adjustments. Codan slightly declined by 0.4% after its acquisition of Wave Central, while Harvey Norman rose 3.1% despite reporting declining sales.

Leader

FPH-Fisher & Paykel Healthcare (+7.73%)

PRU-Perseus Mining Ltd (+5.96%)

EMR-Emerald Resources NL (+5.94%)

NEM-Newmont Corporation (+5.67%)

BGL-Bellevue Gold Ltd (+5.64%)

Laggards

GNC-Graincorp Ltd (-4.95%)

MEZ-Meridian Energy Ltd (-4.64%)

QBE-QBE Insurance Group Ltd (-2.81%)

MCY-Mercury NZ Ltd (-2.42%)

AZJ-Aurizon Holdings Ltd (-2.22%)