What's Affecting Markets Today

Bond Traders Pare Rate Rise Chance After Drop in Retail Sales

Bond traders have reduced expectations for a Reserve Bank of Australia (RBA) cash rate increase following an unexpected decline in retail sales. This shift gives the RBA more room to evaluate the impact of its previous 13 rate hikes. Market predictions now show a 68% likelihood of a rate rise to 4.6% by June, down from 77% earlier. RBA Governor Michele Bullock, at a conference in Hong Kong, noted that while monetary policy can’t directly address rising costs in energy, rent, and insurance, these factors necessitate a response from the central bank.

Australian Dollar Climbs Above US66¢

The Australian dollar surpassed US66¢ for the first time since August, driven by a weakening US dollar, which is on track for its worst month in a year. The rise in the Australian dollar, now at US66.13¢, is supported by differing interest rate trajectories between the US Federal Reserve and strong iron ore prices, fueled by expectations of Chinese stimulus aiding the property sector. The Australian dollar is heading for its best month in a year with a 4.2% increase, while the US dollar weakens against major currencies amid forecasts of potential Fed rate cuts next year.

Iron Ore Falls Over 2% After Intervention by Chinese Authorities

Iron ore prices fell, with Dalian futures hitting a one-week low, following continued Chinese government intervention to control market prices. The most-traded January iron ore contract on the Dalian Commodity Exchange saw a 2.3% drop to 954 yuan ($US133.41) per metric tonne, marking the largest decline in two weeks. Similarly, the December iron ore contract on the Singapore Exchange decreased by 3.1% to $US132.69 a ton. China’s state planner announced increased supervision of iron ore at ports to prevent hoarding and speculation, aiming for market stability. This follows recent surveys on commodity price indices and repeated warnings from the Development and Reform Commission about iron ore market supervision.

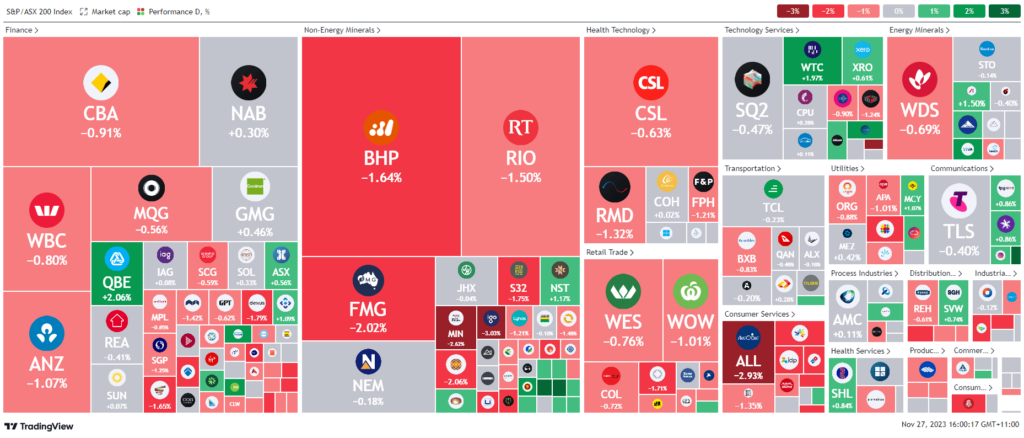

ASX Stocks

ASX 200 - 7,015.1 (0.39%)

Key Highlights:

The Australian sharemarket rebounded, with the S&P/ASX 200 index rising 0.7% amid gains in real estate and gold sectors. The Australian dollar remained above US66¢, reflecting expectations of sustained high local interest rates. October’s retail sales dropped by 0.2%, indicating consumer spending pressure from high borrowing costs and inflation. This trend aligns with the Reserve Bank’s strategy to control inflation by 2025.

Energy stocks declined due to falling oil prices, despite potential OPEC production cuts. Gold miners rallied as gold prices exceeded $US2000, anticipating a slowdown in the US Federal Reserve’s rate hikes. Major banks and mining shares also gained.

Key company movements included Collins Foods’ near 10% surge after dividend increase announcements, while Origin Energy fell 0.6% due to LNG shipment delays. Plenti’s stock soared 71% following acquisition news by NAB. Endeavour Group and Westgold Resources reported gains, Synlait Milk dropped 2.1%, Imugene surged 21% on FDA Fast Track designation, and PointsBet rose 3.7% with positive revenue growth projections for FY2024.

Leader

Collins Foods Ltd (CKF) – +9.01%

Alpha Hpa Ltd (A4N) – +6.59%

Healius Ltd (HLS) – +6.39%

Perenti Ltd (PRN) – +6.06%

Regis Resources Ltd (RRL) – +5.01%

Laggards

Core Lithium Ltd (CXO) – -4.55%

Maas Group Holdings Ltd (MGH) – -3.49%

Deep Yellow Ltd (DYL) – -3.08%

Energy Resources Ltd (ERA) – -2.94%

Sayona Mining Ltd (SYA) – -2.90%