Closing Bell

What's Affecting Markets Today

October Retail Sales and CPI Key Data Points

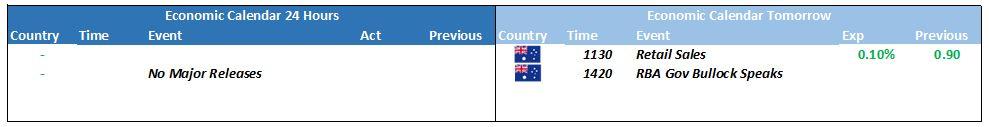

This week, investors are keenly awaiting the release of October’s retail sales and the monthly Consumer Price Index (CPI). NAB predicts a 0.4% decline in retail sales for October, contrasting with the consensus of a 0.2% increase. This forecast attributes the decline to seasonal shifts due to Black Friday and Cyber Monday sales in November. For the CPI, NAB anticipates a decrease to 5.2% year-on-year in October, down from 5.6%, with expectations of a further drop below 5% in November. Factors influencing this include a reduction in fuel prices and the impact of energy subsidies on electricity costs. NAB’s projections align with the Reserve Bank of Australia’s (RBA) forecasts for Q4 inflation.

RBNZ’s ‘Higher for Longer’ Stance

The Reserve Bank of New Zealand (RBNZ) is expected to maintain its official cash rate at 5.5% during this week’s meeting. UBS forecasts that the RBNZ will lower its near-term CPI outlook but won’t significantly alter its Official Cash Rate (OCR) trajectory. Despite positive inflation trends, the RBNZ is cautious about signaling premature rate cuts. UBS anticipates the RBNZ to start reducing rates in August 2024, with a total of 200 basis points of cuts by 2025. The bank is also expected to lower its headline CPI forecast for Q4-24 and maintain its unemployment peak forecast at 5.3%. UBS believes that New Zealand’s inflation expectations will re-anchor once unemployment exceeds 4.5%-5%.

Adore Beauty Board Rejects THG Offer

Adore Beauty’s board has declined THG’s cash offer of $1.25 to $1.30 per share, deeming it undervalued and not in the shareholders’ best interests. This decision follows a non-binding indicative offer from the British e-commerce retailer THG, as reported by the Australian Financial Review’s Street Talk column. The board’s rejection reflects its commitment to the company’s valuation and shareholder interests.

ASX Stocks

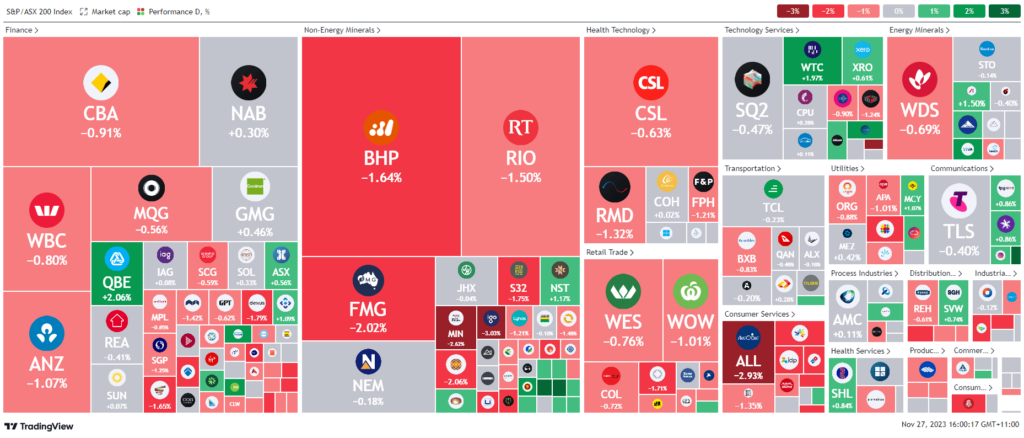

ASX 200 - 6,995.4 (-0.65%)

Key Highlights:

The Australian sharemarket experienced a downturn in afternoon trading, primarily due to a sell-off in commodity stocks. The S&P/ASX 200 index fell by 0.5%, or 33.5 points, to 7007.8 around 2:20 pm AEDT, with the materials sector and consumer stocks contributing significantly to the decline. Major mining companies like BHP, Fortescue Metals, and Rio Tinto saw their shares drop, tracking the decrease in iron ore prices. This decline in iron ore was influenced by Beijing’s intensified market supervision efforts to control price increases.

In the commodities market, oil prices stabilized after a three-day fall, with Brent crude trading near $US81 a barrel. This steadying comes amidst expectations that OPEC+ might deepen production cuts in its upcoming meeting. Investors are closely monitoring new inflation data and potential changes in oil production, which could influence the Reserve Bank’s interest rate decisions.

In individual stock movements, QBE Insurance saw a 1.1% increase after projecting a 10% growth in gross written premium for the 2023 financial year. Healius shares climbed 6.2% following the announcement that chairwoman Jenny Macdonald would not seek re-election. Gold producer Perseus Mining rose 1.5% after increasing its stake in OreCorp. Adore Beauty’s shares surged 17.8% after the board rejected a cash offer from THG. Meanwhile, IGO’s shares fell by 2.5% despite the company reaffirming its decision to appoint Ivan Vella as CEO. Additionally, Jennifer Westacott was named chairwoman of the ASX-listed philanthropic vehicle Future Generation Global.