Closing Bell

What's Affecting Markets Today

Iron Ore Eases After Beijing Intervenes

Iron ore prices fell as Chinese authorities intensified efforts to control speculation in the steelmaking ingredient. The National Development and Reform Commission announced increased monitoring of the iron ore spot and futures market. Despite recent price boosts from China’s property market revival efforts, the impact remains unclear in property data. ANZ’s Daniel Hynes anticipates a decline in steel production due to winter production curbs and softer steel demand from weaker construction activity. In Singapore, iron ore prices dropped 1.2% to $US133.05 a tonne, moving away from a nine-month high. In China, the most-traded January iron ore on the Dalian Commodity Exchange closed 0.9% lower.

Oil Slides Amid Discord Among OPEC+ Members

Oil prices fell due to internal disagreements within OPEC+, leading to a postponed meeting and dampening expectations of further production cuts. Brent crude dipped below $US81 a barrel. The OPEC+ meeting, now scheduled for the end of November, was delayed due to quota disputes among African members, including Angola. The meeting’s delay and expanding output outside OPEC+ have fueled speculation about the alliance’s next steps, possibly extending or deepening production cuts. Europe faces an oil glut, with weak demand and an influx of US cargoes. Market volatility is reflected in the options market, with traders now favoring contracts betting on falling prices.

Japan Core CPI Inflation Grows Slightly Less Than Expected in October

Japan’s core consumer inflation in October grew slightly below expectations at 2.9% year-on-year, just under the anticipated 3%. This rate, still above the Bank of Japan’s (BOJ) 2% target, marks the 19th consecutive month of exceeding this target. Core CPI, excluding fresh food and fuel, rose by 4%, close to 40-year highs. Overall, CPI inflation accelerated to 3.3%. The slight easing in core CPI is attributed to government subsidies on fuel and electricity. Japan’s economy faces challenges from rising import costs, robust retail spending, and a weak yen. The BOJ maintains an ultra-accommodative stance, with no clear indication of policy changes despite rising inflation forecasts.

ASX Stocks

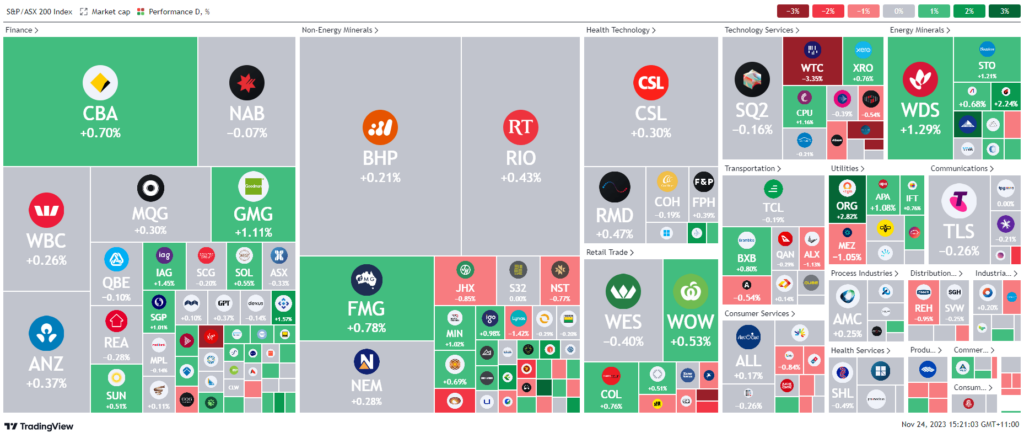

ASX 200 - 7,044.4 (0.22%)

Key Highlights:

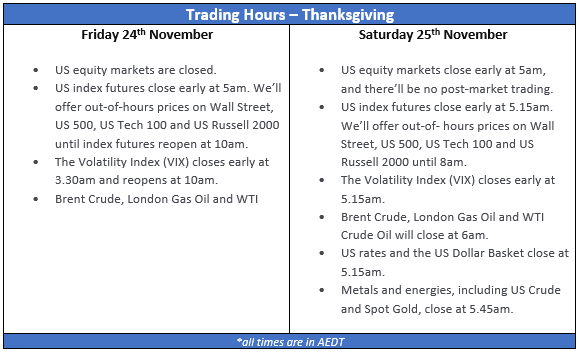

The Australian sharemarket rose on Friday, led by a rebound in energy stocks and anticipation of the OPEC+ meeting. The S&P/ASX 200 index increased by 0.3%, with significant gains in energy and utilities. Despite subdued trading due to the US Thanksgiving holiday, US futures traded higher.

Energy stocks, including Woodside, Santos, and Ampol, recovered from Thursday’s decline, despite lower crude oil prices. Origin Energy advanced 2.5%, amidst ongoing attention on its takeover bid by Brookfield.

European bond yields rose, reflecting modest improvements in the eurozone’s economy and affecting expectations of European Central Bank rate cuts. The Australian dollar strengthened to US65.60¢, influenced by various economic factors.

Notable stock movements included Select Harvest dropping 5.3% due to increased net losses, Star Entertainment rising slightly after a six-month extension in Queensland, and WiseTech falling 3.3% after announcing their chairman’s retirement. Fletcher Building gained 1.2% following leadership changes, while Virgin Money fell 6.3% due to a decrease in annual profit. Several companies, including Adairs and Core Lithium, are set for annual meetings.

Leader

Wildcat Resources Ltd (WC8) (+6.40%)

Whitehaven Coal Ltd (WHC) (+3.55%)

Strike Energy Ltd (STX) (+3.13%)

Origin Energy Ltd (ORG) (+2.76%)

Resolute Mining Ltd (RSG) (+2.74%)

Laggards

Virgin Money UK Plc (-6.08%)

PWR Holdings Ltd (-5.05%)

Temple & Webster Group Ltd (-4.50%)

Heartland Group Holdings Ltd (-3.92%)

Lovisa Holdings Ltd (-3.42%)