Closing Bell

What's Affecting Markets Today

Fed Minutes Anchor Cautious Policy Approach

Federal Reserve officials, in their recent meeting, have collectively agreed on a cautious approach towards raising interest rates, emphasizing the need for further tightening only if progress in reducing inflation is deemed insufficient. Despite experiencing a 4.9% annualized growth in Q3, the US economy faces challenges with high financial market-driven interest rates, potentially hindering economic and job growth. The Fed’s target remains to bring inflation down to 2%.

Oil Holds as All Eyes on OPEC+

Oil prices have remained relatively stable as traders anticipate the outcome of the upcoming OPEC+ meeting. West Texas Intermediate oil is trading near $US78 a barrel. Speculations are high about potential deep supply cuts by Saudi Arabia and its allies. However, recent statements from US President Biden and a forthcoming US Thanksgiving holiday might impact trading activities and oil prices in the short term.

Nvidia Fails to Meet Investor Expectations for AI Boom

Nvidia’s latest quarterly report, surpassing analysts’ expectations with $US20 billion revenue, failed to meet the high expectations of investors betting on a significant AI industry boom. Despite impressive growth, Nvidia’s stock saw a decrease in value, indicating that investor anticipations of explosive sales gains from the AI sector might have led to an overvaluation of the stock. Nvidia has been a top performer in the semiconductor industry, but its recent performance has led to a cautious response from investors.

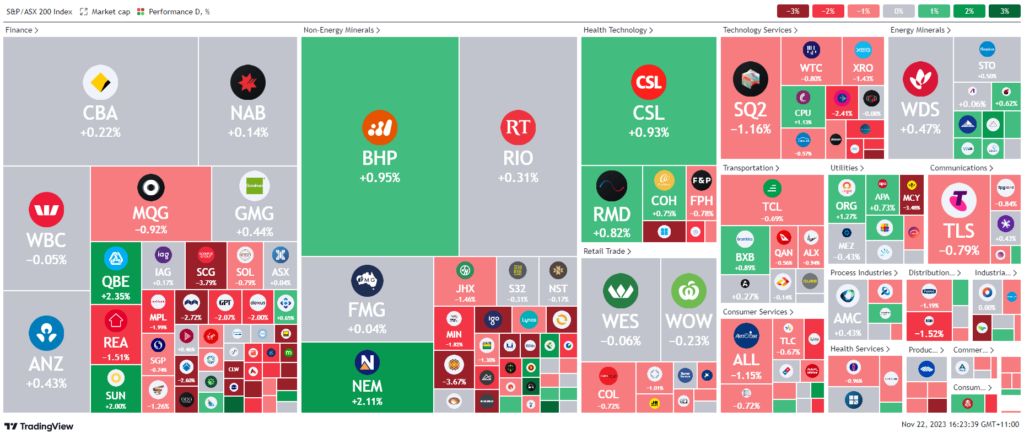

ASX Stocks

ASX 200 - 7,073.4 (-0.07%)

Key Highlights:

Australian shares are experiencing a downturn in the final trading hours, mainly due to a widespread tech sector decline triggered by Nvidia’s US results. The S&P/ASX 200 is slightly down by 0.1%, with the All Ordinaries also dropping 0.2%. Despite Nvidia surpassing analyst expectations, tech stocks fell 1.4% as Nvidia’s Q4 growth outlook didn’t meet investor expectations, particularly those banking on the AI boom. The company reported a significant revenue increase in Q3, but this didn’t alleviate investor concerns.

Energy and materials sectors, initially strong, flattened out by the afternoon. However, utilities are up by 0.6%, supported by a 1% increase in Origin Energy. Healthcare giants CSL and Cochlear also rose by 1%, partially offsetting the tech losses.

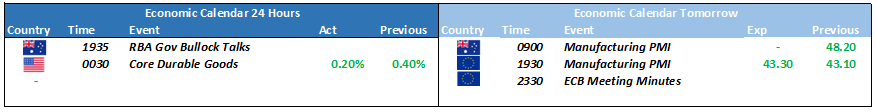

Local investors are focused on the Reserve Bank of Australia, with Governor Michele Bullock scheduled to speak on monetary policy. Globally, the US Federal Reserve’s recent meeting minutes suggest another rate hike could be possible, a sentiment echoed by the Bank of England and the European Central Bank.

Key stock movements include a 34.5% drop in Healius following a share offer, a 22% decrease in Praemium after revealing a weak outlook, and a 3.3% decline in EBOS as their acquisition deal with Greencross failed. Bubs halted its shares ahead of a capital raise, Lovisa reported decreased sales, and PEXA’s shares fell by 5.6% after a cautious economic outlook. Nufarm shares also went ex-dividend, dropping by 1.3%.

Leader

DEG-De Grey Mining Ltd (+4.40%)

PL8-Plato Income Maximiser Ltd (+4.04%)

VSL-Vulcan Steel Ltd (+3.46%)

AAC-Australian Agricultural Ltd (+3.05%)

KAR-Karoon Energy Ltd (+2.83%)

Laggards

HLS-Healius Ltd (-32.70%)

PNV-Polynovo Ltd (-7.47%)

WBT-Weebit Nano Ltd (-5.53%)

EBO-Ebos Group Ltd (-5.43%)

360-LIFE360 Inc (-5.05%)