Overnight – Stocks ease from year highs, Nvidia beats analysts expectations, but not investors expectations

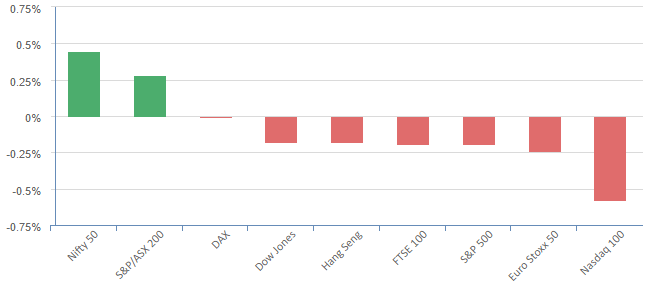

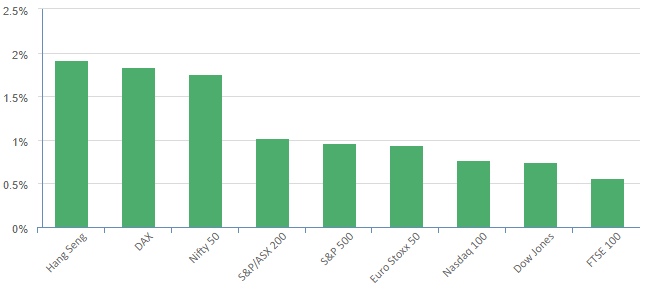

Equities eased from 12-month highs overnight as the release of the minutes from the Federal Reserve’s previous meeting drew a muted reaction, with investor focus now shifting to earnings from chipmaker Nvidia

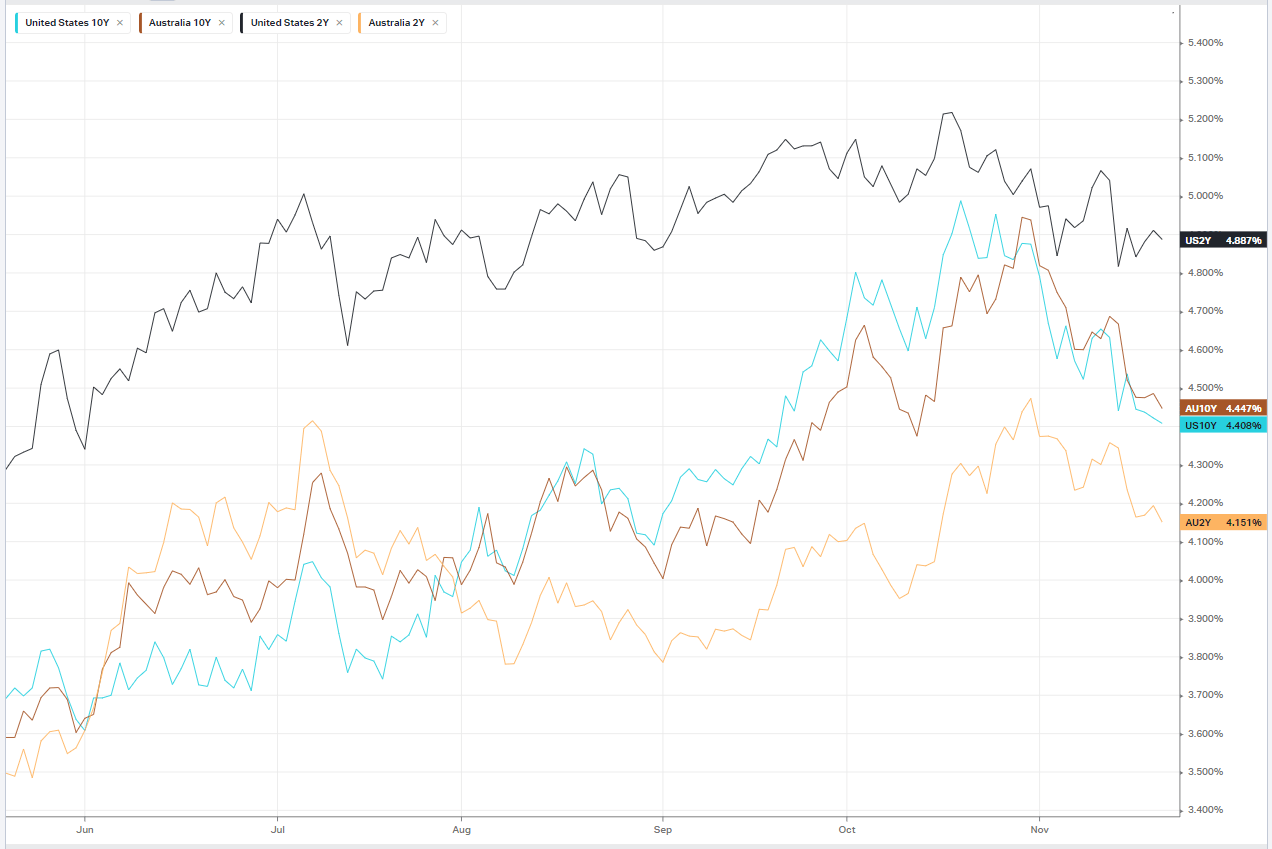

Fed members supported keeping rates at restrictive levels for some time, leaning into their careful approach on monetary policy until clear signs that inflation is clearly on a downward trend, the minutes from the Fed’s Oct. 31- Nov. 1 meeting showed. While the minutes indicated that members are leaning more toward keeping rates steady rather than hiking, there wasn’t any clues that sooner rather than later rate cuts are on the horizon.

Worries about the consumer held back retail stocks as Lowe’s, Kohl’s and Best Buy all traded lower as the retailers warned about the likelihood of a slowdown in discretionary spending heading into the important holiday period. Abercrombie & Fitch stock also retreated despite the fashion retailer lifting its annual guidance, saying it has “confidence” heading into the all-important holiday shopping season.

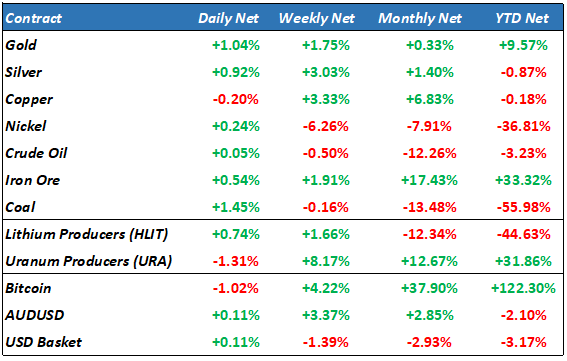

Oil prices fell Tuesday, handing back some of the recent gains as traders became cautious ahead of the weekend’s OPEC+ meeting.

Earnings

Nvidia (NVDA) – the chip company beat on both top and bottom lines against analyst expectations, however much of this was “baked in” as the stock initially fell 3%

Zoom Video Communications (ZM) – Closed marginally higher after lifting its full-year guidance after reporting Q3 results that topped analyst estimates, though some on Wall Street flagged ongoing macroeconomic headwinds as a concern. The better-than-expected 3Q revenue was driven by “steady Enterprise segment execution against low expectations,” Goldman Sachs said, adding that the stock reaction indices that “investors are contemplating a still weak growth backdrop.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 7098 (-0.01%)

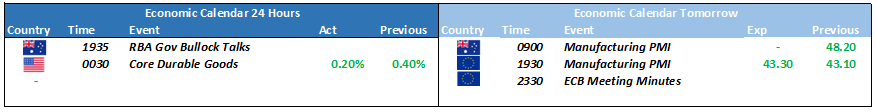

The ASX is likely to have a quiet day with most of the offshore lead in tech not relevant to our index. Iron ore remains elevated, while gold rallied which should see the materials sector buoyed. After the release of the RBA minutes yesterday that had rate hikes still firmly on the table, the focus is squarely on the RBA though Wednesday’s commentary won’t arrive until this evening when governor Michele Bullock speaks about monetary policy the ABE Annual Dinner at 7.35pm in Sydney.

- Webjet will release earnings.

- City Chic Collective, Downer EDI, Lovisa, Medibank Private, Netwealth, Pacific Smiles and Praemiumall are set to host annual meetings.

- Nufarmshares trade ex-dividend.