Closing Bell

What's Affecting Markets Today

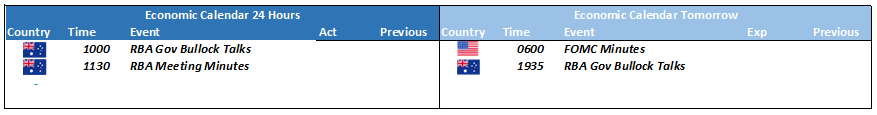

RBA Minutes Indicate Further Rate Rises Dependent on Data

The Reserve Bank of Australia’s November policy meeting minutes revealed considerations for additional rate hikes, contingent on future economic data. The decision to raise the cash rate to 4.35% was influenced by higher-than-expected underlying inflation in the September quarter, broad inflationary pressures, and resilient domestic demand. The RBA noted that bringing demand and supply into balance would take longer than anticipated, necessitating potentially one to two more rate increases. Concerns were raised about rising inflation expectations in financial markets and the mindset among businesses to pass on cost increases to consumers. The RBA emphasized the importance of preventing a significant rise in inflation expectations and acknowledged the varying impacts of their decisions on household finances.

Michele Bullock Addresses Inflation Concerns Amid Economic Optimism

At the ASIC Forum in Melbourne, Reserve Bank governor Michele Bullock expressed optimism about the Australian economy, highlighting the labor market’s inclusivity and businesses’ agility post-pandemic. However, she voiced concerns about inflation, describing the current period as a critical juncture. Bullock’s comments reflect the delicate balance the RBA faces in managing inflationary pressures while maintaining economic growth and stability.

Iron Ore Prices Surge to $US133 a Ton

Iron ore prices experienced a significant increase, reaching $US133.75 per tonne, driven by expectations of easing measures and increased construction activity in China. This surge positively impacted major mining companies like BHP Group, Rio Tinto, and Fortescue Metals, which saw notable gains in their stock prices. The market’s optimism was further bolstered by potential supply disruptions due to industrial action by BHP train drivers. This development indicates a robust demand for iron ore, influenced by China’s economic policies and market dynamics.

ASX Stocks

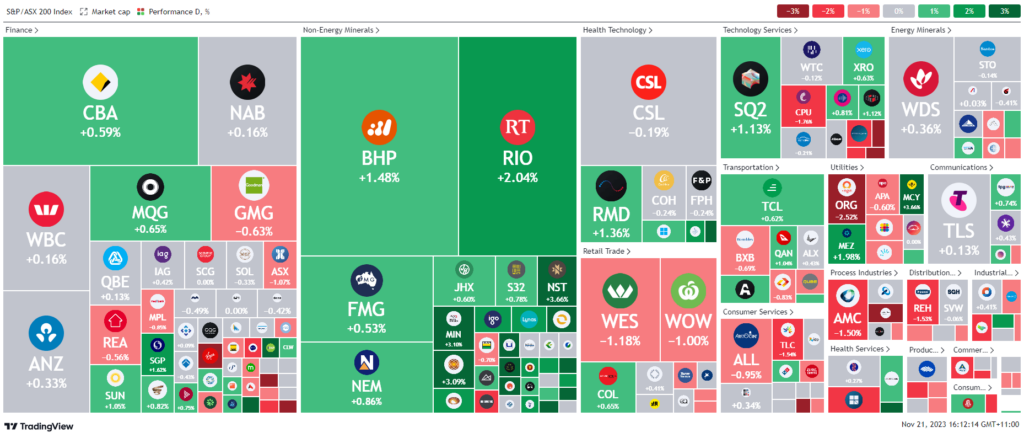

ASX 200 - 7,030.2 (0.32%)

Key Highlights:

The Australian sharemarket experienced a boost in late afternoon trading, primarily driven by significant gains in the mining sector and a surge in iron ore prices. This uptick was a response to news of additional economic stimulus in China. The S&P/ASX 200 index rose by 0.3%, reaching 7082 points, with the materials sector leading the charge. Major mining companies like BHP Group, Rio Tinto, and Fortescue Metals saw increases of 1.6%, 2%, and 1.7%, respectively. Iron ore futures also rallied by 2% to $US133.75 per tonne.

ANZ strategists highlighted the market’s focus on China’s easing measures and anticipated construction activity boost. Additionally, potential industrial action by BHP train drivers could cause short-term supply disruptions, further influencing market sentiment.

In other commodity news, oil prices continued to rise, with West Texas Intermediate climbing 2.3% due to expectations of OPEC+ market intervention. This speculation is centered around the possibility of Saudi Arabia and its allies deepening production cuts.

On Wall Street, the S&P 500 and Nasdaq saw gains of 0.9% and 1.2%, respectively. Microsoft’s stock reached a record high following the hiring of Sam Altman for a new venture after his departure from OpenAI.

In the Australian market, TechnologyOne reported a 16% increase in profit but saw its shares drop by 2.2%. Star Entertainment’s shares edged up slightly after finalizing a tax agreement with the NSW government. Brickworks announced an increased dividend, yet its shares fell by 2.7%. AGL Energy avoided a “second strike” on executive pay, while Origin Energy’s shares declined by 2.2% amidst a potential takeover bid by Brookfield and EIG Partners, facing opposition from its largest shareholder, AustralianSuper.