Overnight – Microsoft drags Tech stocks higher, eye on Nvidia Earnings

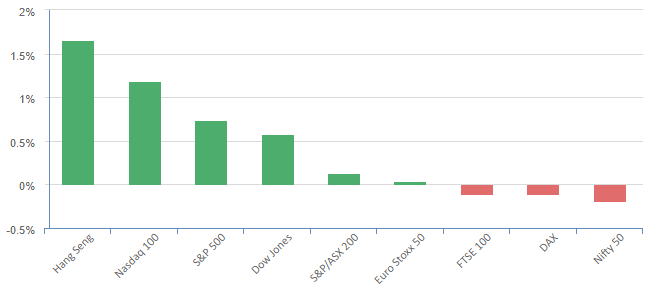

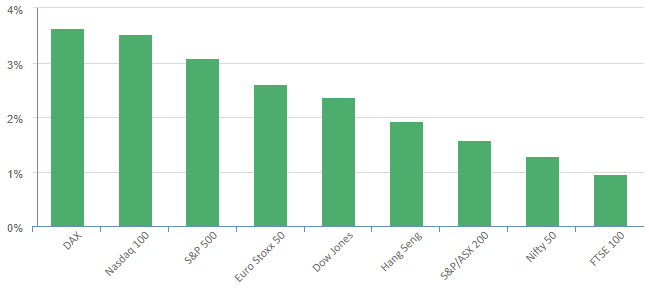

Equities closed higher overnight ahead of the release of minutes from the Federal Reserve’s September meeting and earnings from Nvidia that will likely set the tone for big tech in a holiday-shortened week.

Big tech is set to remain in focus this week, with chipmaker Nvidia set to report quarterly results on Tuesday that have recently served as a barometer of AI demand. The chipmaker’s guidance will be closely watched at a time when many are weighing on impact on demand from U.S. chip restrictions on shipments to China and rising competitions from hyperscale customers including Microsoft, which recently launched its own AI chip.

Microsoft rose 2% after its hired Sam Altman to lead a new advanced artificial intelligence research team, just days after he was forced out as CEO of OpenAI. Reuters reported that OpenAI’s staff has threatened to quit the artificial intelligence startup and join former Altman unless the board resigns. “Altman is now leading the company key AI efforts which we expect many key scientists and developers to leave OpenAI and head directly to Microsoft,” Wedbush said in a note.

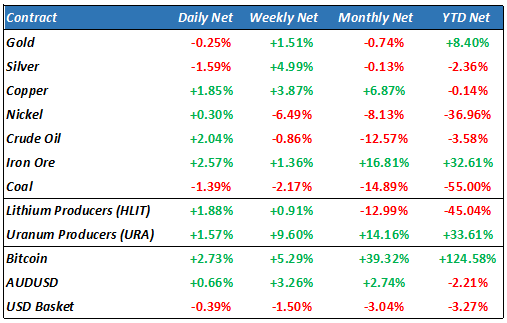

Energy stocks were pushed higher by rising oil prices on bets that major producers could discuss deeper output cuts when they meet later this month.

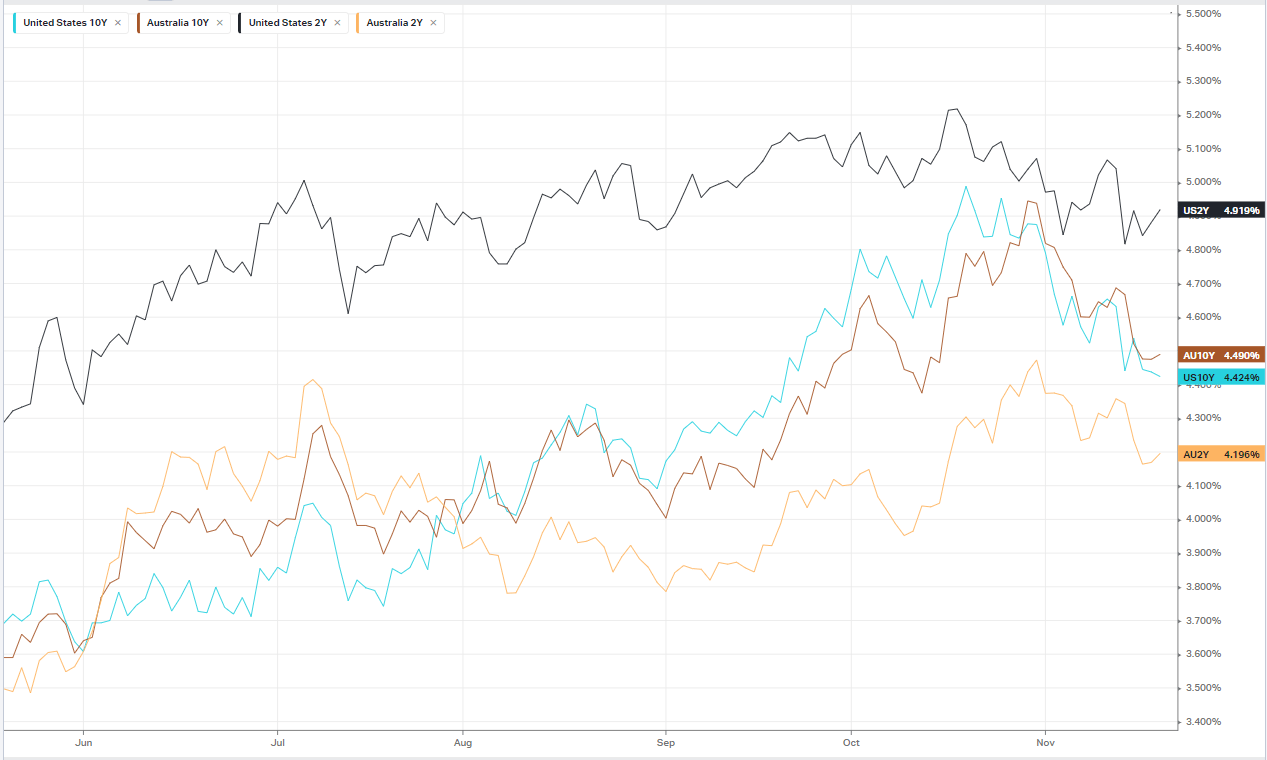

With the focus very much on what the policymakers at the U.S. central bank are going to do next with interest rates, the minutes from its Oct. 31-Nov. 1 meeting on Tuesday, a day earlier than usual, due to this week’s Thanksgiving holiday, will be in the spotlight. Details in the minutes, however, are likely to stale on arrival following the recent flurry of Fed speak.

S&P 500 - Heatmap

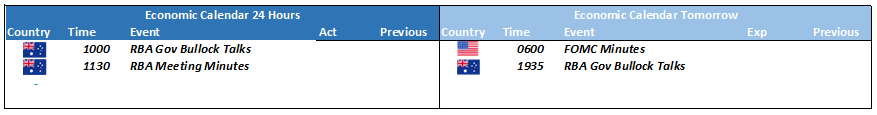

The Day Ahead

ASX SPI 7101 (+0.26%)

Despite the lethargic reaction from overnight SPI futures, we should see positive market today as the strength in Iron Ore, Oil and the US bank stocks should be enough catalyst to drag the market higher. As the US hits 52-week highs, we note that the ASX200 is 7% from its year high and while most of the US gains are in the tech sector, they lean on of soft landing outlook which will also benefit our market

- Technology Oneis scheduled to release earnings.

- Companies scheduled to hold annual general meetings include AGL Energy, BlueScope Steel, Brickworks, Fortescue Metals, Monadelphousand Perseus Mining

- Elders and Amcor trade ex-dividend.