Pre-Market Pulse 20th November – Retailers results help equities to positive finish

Overnight – Retailers results help equities to positive finish

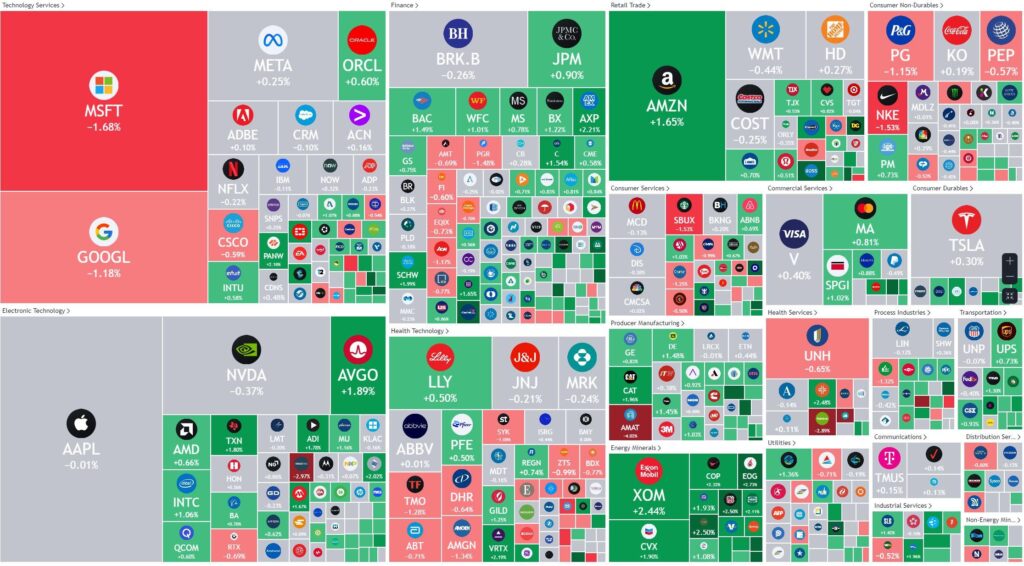

Equities finished slightly higher Friday, notching their third-straight weekly win as stocks were buoyed by slowing inflation data earlier this week that fueled optimism that Federal Reserve rate hikes has peaked.

Retailer Gap helped drive the retail sector higher, delivering earnings in Q3 that markedly beat analyst estimates and cautious guidance into the key holiday season quarter, sending its shares more 30% higher.

In big tech Microsoft fell more than 1% on news that OpenAI chief executive Sam Altman had departed after losing the board’s confidence. Microsoft has a 49% stake in OpenAI, the creator of generative AI application ChatGPT. While Amazon said on Friday that it was cutting losses at its Alexa voice assistant business to focus its efforts on generative AI. Amazon closed more than 3% higher, bucking a fall in the broader tech sector, though some on Wall Street continue to talk up further gains in tech.

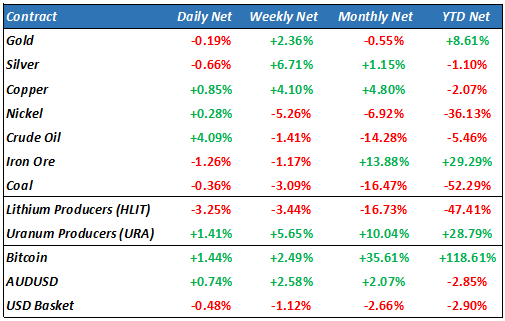

Energy stocks rose more than 2% recouping losses from a day earlier, supported by a jump in oil prices, though that wasn’t enough to prevent a fourth straight negative week of decline amid signs of increased supplies and fears of worsening global demand. This week’s sharp decline was mainly triggered by a steep rise in U.S. crude inventories and production sustaining at record levels.

Treasury yields resumed their slide, underpinning the broader market move higher, as optimism that the Fed interest rates have peaked continue to support investor sentiment following data earlier this week showing easing inflation. Additionally, weekly jobless claims rose while U.S. retail sales fell for the first time in seven months in October, pointing to slowing demand at the start of the fourth quarter. On the housing front, October housing starts of 1.372 million were slightly ahead of expectations and higher than the prior month, while building permits of 1.487 million were also higher than expected.

Earnings Results

GAP (GPS) – driven by by a “significant acceleration in trend at the Old Navy brand and broad-based margin outperformance,” Goldman Sachs said in a note, as it lifted its price target on the stock to $18 from $13 as tailwinds from lower promotion activity and commodity costs can continue into next year.

Ross Stores (ROST) – surged more 7% after delivering Q3 results that beat on both the top and bottom lines amid improving margins.

S&P 500 - Heatmap

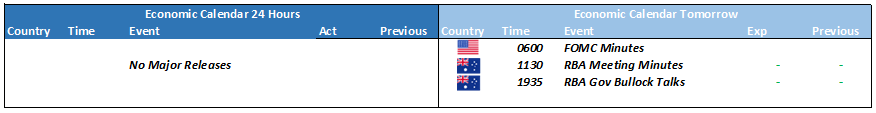

The Day Ahead

ASX SPI 7104 (+0.39%)

We are likely to see a positive start to the week for the ASX with energy stocks looking at a bounce after the rally in oil and uranium on Friday. This week will see updates from a range of central banks, including the RBA. Also we will see the release of global manufacturing data.

The recent recovery of the broad small-cap index, the Russell2000 should see the bounce in small to mid-cap companies from oversold levels