Closing Bell

What's Affecting Markets Today

‘Inflation Fever Has Broken’ in the US

Global stock markets are rallying as US inflation slows, with the Consumer Price Index rising just 3.2% year-on-year in October, down from 3.7% in previous months. This deceleration, marked by flat prices compared to the previous month, signals a significant shift. Wall Street responded positively, with the Nasdaq and S&P 500 both seeing substantial gains, led by companies like Tesla and Nvidia. In the bond market, US 10-year note yields fell notably, reflecting a change in investor sentiment and expectations.

Australian Wages Record Highest Quarterly Growth

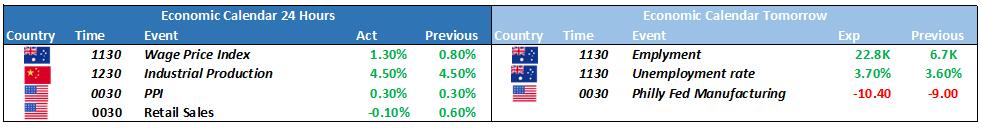

Australia’s wage growth hit a record high in the third quarter, with a 1.3% increase, bringing the annual rate to 4%. This surge, the highest in the 26-year history of the Wage Price Index, is a key driver of inflation, currently exceeding the Reserve Bank’s target range. The recent pay rise for aged care workers significantly contributed to this growth. With the upcoming Labour Force data release, these figures will likely influence the Reserve Bank’s future rate decisions.

Iron Ore Prices Soar on Chinese Demand and Stimulus Hopes

Iron ore futures in Singapore reached $US130 per tonne for the first time since March, driven by increasing steel demand in China and potential stimulus measures for its property sector. The commodity’s price has risen by a third since May, boosted by reports of substantial financing for housing programs in China. While there’s optimism about restocking ahead of the Lunar New Year, concerns remain over the Chinese property sector’s downturn and potential government interventions in iron ore pricing. The Dalian and Shanghai markets also saw significant increases in iron ore and steel prices.

ASX Stocks

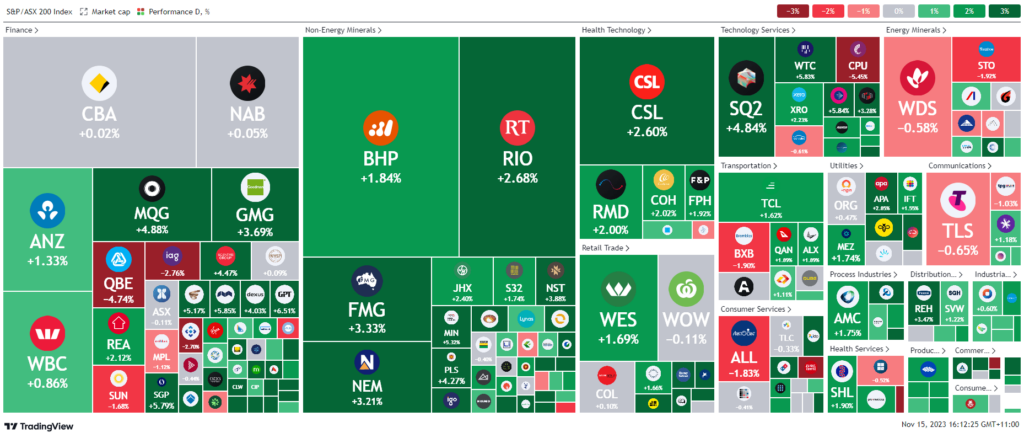

ASX 200 - 7,105.3 (1.41%)

Key Highlights:

The Australian stock market is nearing a two-month high, with the S&P/ASX 200 up 1.4% to 7106.8, driven by optimism from the latest US inflation report suggesting a potential peak in interest rates. This positive sentiment is mirrored in the All Ordinaries index, which gained 1.5%. Contributing to this rally are gains across ten of the ASX’s 11 sectors, notably the real estate sector, which rose by 4.4%, and advances in materials and technology stocks.

This uplift in the market comes despite local data indicating a record 1.3% wage growth in the third quarter. Additionally, the Australian dollar has surged above US65¢, reflecting broader market confidence.

Globally, stocks are rallying after the US Consumer Price Index showed a year-over-year increase of 3.2% in October, a decrease from previous months. Wall Street saw significant gains, with the Nasdaq up 2.4% and the S&P 500 climbing to its highest in over two months.

In individual stock movements, Nufarm soared 9.7% after a strong full-year profit report, and Life360 climbed 7.9% on robust quarterly revenue. Seek rose 5.9%, maintaining its fiscal 2024 outlook, while Allkem rallied 5.7% following regulatory approval for a major merger. Conversely, Aristocrat Leisure dropped 3%, and Karoon Energy fell 10.4% before a trading halt. Additionally, Platinum faced shareholder dissent over its remuneration report but still saw its shares increase by 1.7%.

Leader

CNI-Centuria Capital Group (+12.25%)

CHC-Charter Hall Group (+10.03%)

APM-APM Human Services (+9.32%)

PNI-Pinnacle Investment (+8.78%)

NUF-Nufarm Ltd (+8.76%)

Laggards

KAR-Karoon Energy Ltd (-10.42%)

IMU-Imugene Ltd (-6.82%)

CPU-Computershare Ltd (-5.41%)

SNZ-Summerset Group Holdings Ltd (-5.22%)

QBE-QBE Insurance Group Ltd (-4.68%)