Closing Bell

What's Affecting Markets Today

Oil Extends Three Weekly Drops with Focus on Demand Outlook

Oil prices remained on a downward trend for three consecutive weeks, with Brent crude approaching $81 per barrel and West Texas Intermediate below $77. This decline, about 12% over the past weeks, is attributed to growing global demand concerns and the easing of geopolitical tensions following the Israel-Hamas conflict. The upcoming release of oil market reports from OPEC and the International Energy Agency, along with US inventory data, is anticipated to influence market sentiment. Analysts Brian Martin and Daniel Hynes from ANZ Group Holdings suggest that any indications of market tightness in these reports might reverse the current weakened sentiment.

US Fiscal Situation ‘Terrible,’ Dudley Says, Bond Vigilantes to Return

Bill Dudley, addressing the UBS conference in Sydney, expressed concern over the US fiscal situation. He attributed the recent surge in bond yields primarily to the Federal Reserve’s policy of higher and sustained rate increases. However, he emphasized the dire state of the US fiscal health, with a 7% GDP deficit and an unsustainable trajectory exacerbated by high debt service costs, increasing healthcare and social security spending due to the retiring baby boomer generation, and political inefficiencies. Dudley warns of the inevitable return of bond market vigilantes, suggesting market pushback against fiscal mismanagement, though the timing remains uncertain.

Elders Shares Jump

Elders an agribusiness group, saw its shares increase by over 15% as CEO Mark Allison highlighted the company’s resilience amidst challenges like falling fertilizer prices and rising interest rates impacting its real estate division. Allison stressed Elders’ diversified strength and its proactive stance on acquisitions, with 16 potential buyouts in the pipeline. Despite not providing specific forecasts for 2023-24 due to uncertainties like weather conditions affecting summer crops, he assured continued efforts to deliver 5 to 10% earnings growth through various agricultural cycles.

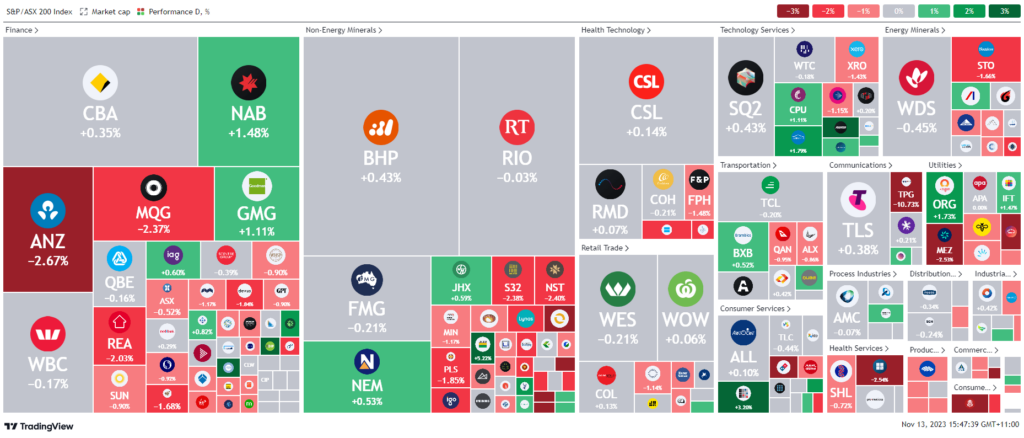

ASX Stocks

ASX 200 - 6,955.6 (-0.30%)

Key Highlights:

In today’s ASX market, energy and bank stocks led a general decline, with the S&P/ASX 200 index falling 0.3% to 6957.8. Energy stocks were impacted by a continued drop in oil prices, with Brent crude approaching $US81 a barrel, influencing declines in companies like Santos, Woodside, and Karoon. In contrast, iron ore futures saw a modest rise.

The banking sector also struggled, exemplified by ANZ’s 3.7% fall after its dividend announcement. Healthcare company Ramsay Health Care also saw a 2.3% decline following the sale of its hospital unit.

The most significant drop was observed in TPG Telecom, falling 11.4% due to halted sale discussions with Vocus. In contrast, Boral rallied 5.3% after updating its earnings guidance, and Metcash slightly increased by 0.3% on acquiring more stake in Total Tools. Elders surged 16.8% despite a drop in its statutory profit.

The Reserve Bank’s Marion Kohler noted the ongoing challenges with high inflation, suggesting a potentially bumpy road ahead for the economy.