Closing Bell

What's Affecting Markets Today

ASX Market Opens Flat Amid Global Dynamics

The ASX is set to open unchanged as positive momentum from Wall Street’s tech stock rally is counterbalanced by disappointing Chinese economic data, leading to a dip in commodity prices. Investors seem to overlook the Fed’s inflation warnings, focusing instead on the mixed signals from the global market.

Oil Prices Hit Three-Month Low Amid Demand Concerns

Oil prices have dropped to a three-month low, with Brent crude nearing $US81, as U.S. gasoline demand is projected to fall. Concerns over China’s economic health and doubts about further Fed tightening contribute to the decline, despite geopolitical tensions easing and Russian oil shipments remaining high.

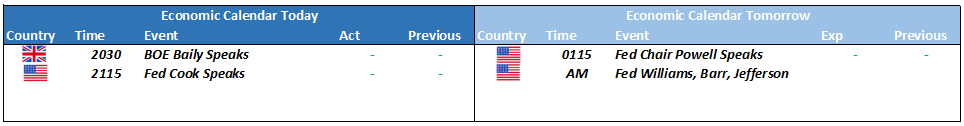

Fed Officials Cautious on Interest Rate Path

Fed officials are cautiously evaluating if the recent spike in Treasury yields will sufficiently slow the economy, potentially reducing the need for further rate hikes. Despite some progress on inflation, the Fed seeks more evidence before deciding on future monetary policy, with the recent yield increase potentially influencing their stance.

ASX Stocks

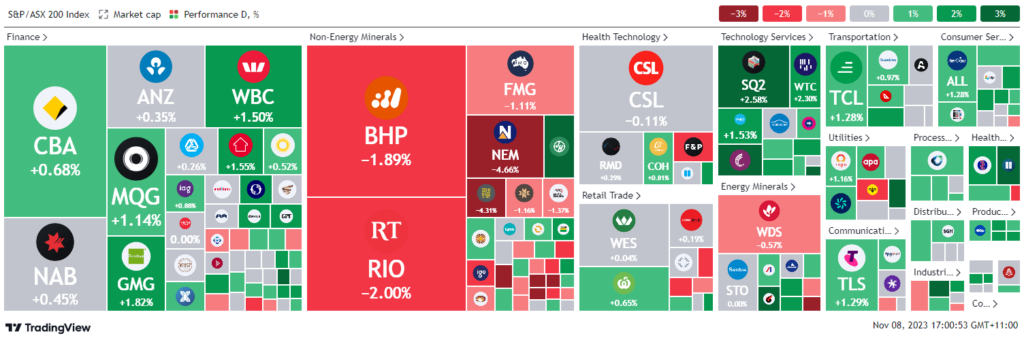

ASX 200 - 6,981.9 (0.07%)

Key Highlights:

The Australian stock market saw a midday recovery, with the S&P/ASX 200 index rising by 0.3% to 6996.8, echoing Wall Street’s uplift led by major tech companies. The All Ordinaries index similarly increased by 0.3%. Tech firms WiseTech, Xero, and Altium saw gains between 1.5% and 1.7%, providing a counterbalance to the mining sector’s downturn. BHP Group, Fortescue Metals, and Rio Tinto faced declines from 2% to 3%, influenced by disappointing Chinese trade data and its implications for global commodity demand.

Overnight, the commodities market experienced a slump, with U.S. oil falling below $US78 per barrel, iron ore dropping 1.2% to $US122.30 a tonne, and gold decreasing by 0.5%. Meanwhile, tech stocks like Zscaler, Crowdstrike, Block, Palo Alto Networks, and Intel surged on Wall Street, with Amazon leading the pack. Uber’s shares also rose by 3.7% following a report of significant growth in trips and operational income.

The U.S. 10-year Treasury yield dipped below 4.60%, amidst Federal Reserve officials’ remarks on the ongoing need to address inflation.

In the Australian market, James Hardie’s stock jumped 12.8% after a positive earnings report and a 15% price hike on its building materials. Conversely, ResMed fell slightly by 0.3% as it traded ex-dividend. Magellan Financial Group saw a modest rise of 0.8% even as it faced shareholder criticism over executive pay.

Leader

JHX-James Hardie Industries Plc (+13.76%)

SYA-Sayona Mining Ltd (+8.75%)

WBT-Weebit Nano Ltd (+6.78%)

REG-Regis Healthcare Ltd (+6.59%)

A4N-Alpha Hpa Ltd (+6.22%)

Laggards

NEM-Newmont Corporation (-4.66%)

OCL-Objective Corporation Ltd (-4.34%)

S32-SOUTH32 Ltd (-4.31%)

CMM-Capricorn Metals Ltd (-4.13%)

ADT-Adriatic Metals Plc (-4.01%)