Closing Bell

What's Affecting Markets Today

Apple reassures market as investors worry about Huawei

Apple reported Thursday fiscal fourth-quarter results that topped Wall Street estimates as better-than-expected services revenue boosted results.

Apple was down 3.48% in afterhours trading.

The beat on top and bottom lines comes as sales growth in Americas and Europe helped ease the hit to revenue from a 2.5% fall in China sales following a rise in competition from rivals including Huawei.

iPhone revenue rose 3% to $43.81B from a year earlier, in-line with Wall Street estimates of $43.81B.

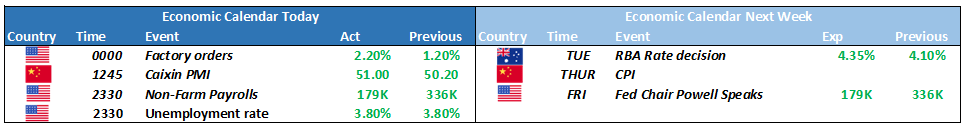

Asian equity markets

Encouraged by strength on Wall Street and increased bets that the Federal Reserve was done with its run of interest rate hikes, although focus still remained on key U.S. payrolls data due later in the day.

Technology-heavy indexes were the best performers for the day, tracking consensus-beating results from iPhone maker Apple while a further decline in Treasury yields also aided the sector.

Chinese stocks rally despite weak service PMI

China’s indexes rose about 1% each, even as a private survey showed that Chinese service sector activity grew less than expected in October.

But the reading still improved slightly from September, amid some strength in foreign demand.

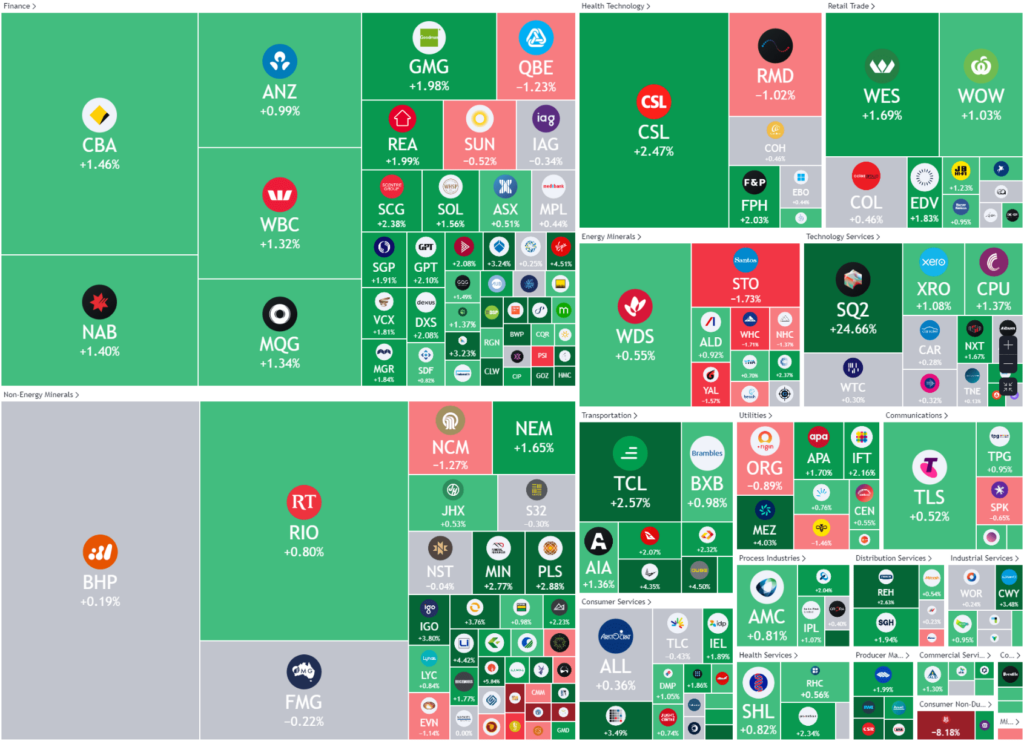

ASX Stocks

ASX 200 - 6,978.2 (+1.14%)

Key Highlights:

The AU market moved higher, tracking strong gains on Wall Street, as hopes the Federal Reserve may finally be done with raising interest rates gathered momentum.

The benchmark S&P/ASX 200 index rose 1.2 per cent, or 83 points to 6980.9 at midday, buoyed by ten out of the 11 sectors. The interest rate sensitive real estate and technology stocks were the best performing. Goodman increased 1.7 per cent and Charter Hall climbed 3.8 per cent.

Macquarie Group shares rebounded 0.8 per cent. The stock had initially dropped after it reported a 39 per cent drop in half-year net profit to $1.4 billion and declared an interim dividend of $2.55 a share. Revenue was booked at $7.9 billion.

Property developer Lendlease added 1.8 per cent following the news that the company and Google will end its agreement to help develop the internet giant’s four major districts in the San Francisco Bay Area.

Afterpay parent Block climbed 23.4 per cent after the company boosted projections for adjusted profit. The company forecasts adjusted earnings before interest, taxes, depreciation and amortisation for 2023 to be in the $US1.66 billion ($2.58 billion) to $US1.68 billion range.

Hedge fund Regal Partners acquired PM Capital, the 25-year-old Sydney-based investment firm, a move that will boost its assets under management to $10.8 billion.

Penfold’s owner Treasury Wine Estate tumbled over 8 per cent after it completed the institutional component of its entitlement offer. The winemaker announced on Tuesday that it was buying 100 per cent of US Daou Vineyards.

Qantas share rallied 2.4 per cent after the airline conducted its annual general meeting.