Overnight – Stocks bounce as investors call the peak in rates….again

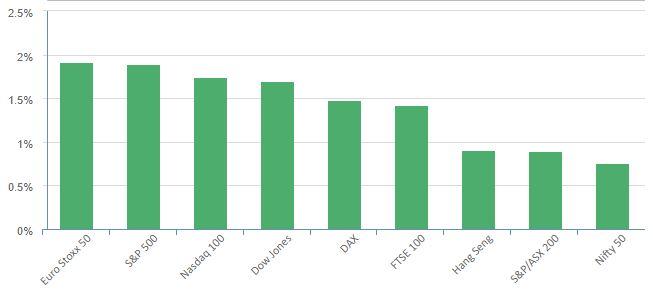

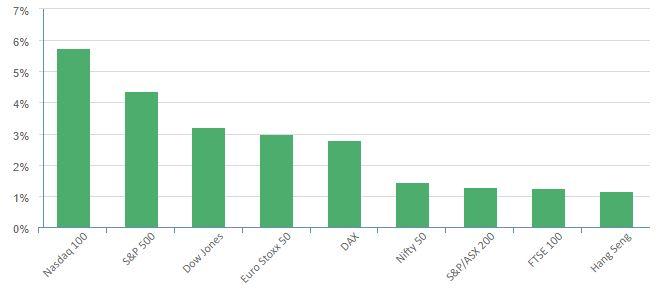

stocks were in a rally mode Thursday, buoyed by a slump in Treasury yields on bets that the Federal Reserve is done raising interest rates after holding its benchmark rate steady for the second meeting in a row.

This positive tone followed the conclusion of the latest policy-setting meeting by the U.S. Federal Reserve, which resulted in the central bank holding interest rates steady, as widely expected.

Fed chairman Powell “kept the door open for a rate hike in December and beyond, noting that the Committee is not confident they have achieved a ‘sufficiently restrictive’ stance, But on the dovish side, Powell “did not sound perturbed by recent data strength, likely reflecting concerns around tighter FCIs and a desire to see more data to determine if these trends are sustained,”

The unchanged decision arrived despite the recent uptick in the economy, stoking hopes that the Fed isn’t likely to hike rates again. Treasury yields added to losses from a day earlier, with the 10-year Treasury yield falling 12.3 basis points to 4.66

The recent rally in bond yields rallying of over 150bps has largely done the job for the Fed in tightening monetary policy and the US Governments irresponsible fiscal management will keep rates high as they issue mountains of t-bills to keep their debt laden govt operating

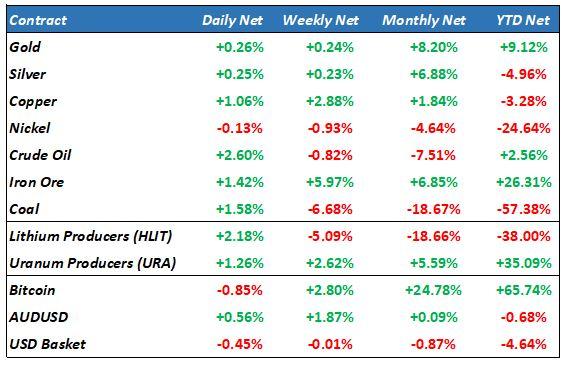

Oil prices rebounded Thursday, snapping a three-day decline, after the Fed kept interest rates on hold, hitting the dollar and helping risk appetite return to financial markets.

Markets largely traded past U.S. inventory data, with official data from the Energy Information Administration showing a slightly smaller-than-expected build in oil inventories over the week to October 27.

Earnings Results

Apple (AAPL) –

Starbucks (SBUX) – rallied more than 10% after the coffee chain reported fiscal fourth-quarter results that topped Wall Street estimates on both the top and bottom lines, underpinned by growth in its key China market.

Moderna (MRNA) – meanwhile, reported wider than expected loss in the third quarter as waning demand for its Covid vaccine led to $3.1B hit from unused vaccines, sending its shares about 8% lower.

S&P 500 - Heatmap

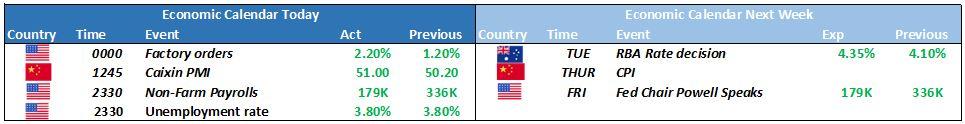

The Day Ahead

ASX SPI 6896 (+0.76%)

The local market should see a solid rally today as the fall in global yields after the Federal reserve rate decision give equities room to bounce after a rough 3 months.

All eyes will be on the upcoming key earning releases from Apple tonight and employment data on Friday night, which will set the sentiment for the coming weeks