Closing Bell

What's Affecting Markets Today

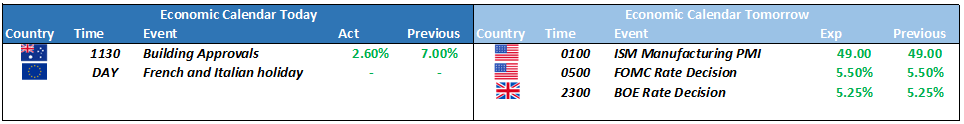

Building Approvals Collapse in September

Australian building approvals saw a significant drop of 4.6% in September, contrary to analysts’ expectations of a 1.3% gain. Data from the Australian Bureau of Statistics revealed that private sector house credit also plummeted by 4.6%, indicating a challenging period for the building sector.

Australian Dollar Faces Steepest Drop Since 2018

The Australian dollar is undergoing a rough phase, currently standing at US63.37¢ after a 0.6% fall on Tuesday. Tensions in the Middle East and global economic health concerns have contributed to the dollar’s 7% drop, marking its most substantial annual fall in five years if it persists.

New Zealand’s Unemployment Rate Rises in Q3

New Zealand’s unemployment rate has escalated to its highest in over two years, reaching 3.9% in Q3, up from 3.6% in the previous quarter. This increase, coupled with a fall in employment and wages growing less than expected, has led to predictions of a halt in interest rate hikes by the Reserve Bank of New Zealand (RBNZ).

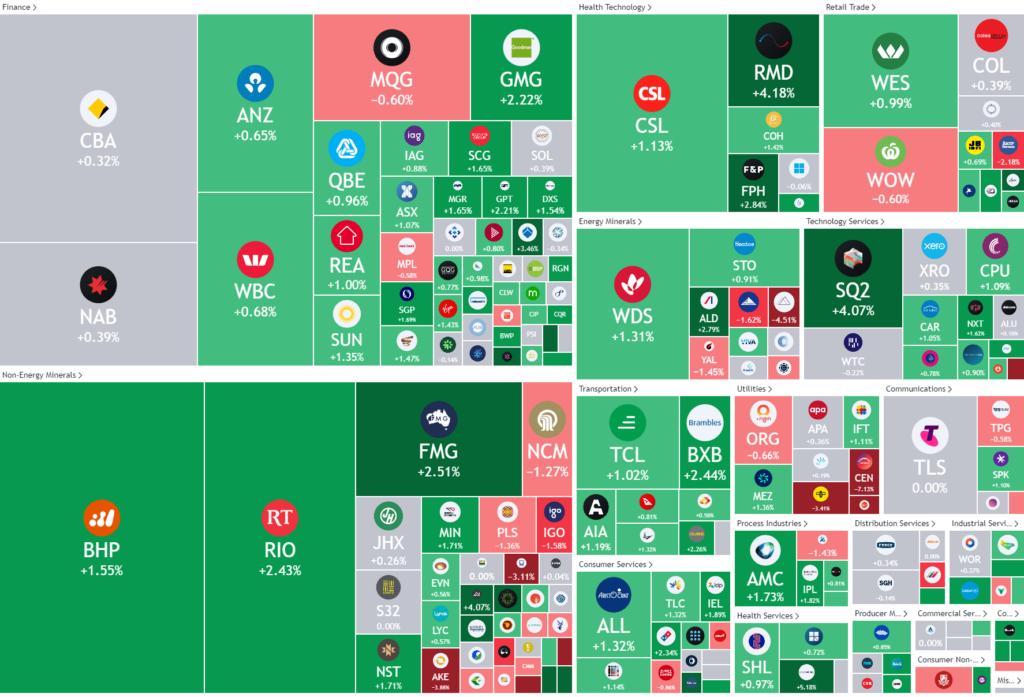

ASX Stocks

ASX 200 - 6,818.8 (0.56%%)

Key Highlights:

The ASX experienced a slight increase, reflecting Wall Street’s rise as investors eagerly await the Federal Reserve policy statement for insights on future interest rate adjustments. Despite recent losses due to global tensions and the anticipation of higher interest rates in Australia, the market saw a 0.3% rise, led by gains in the real estate and materials sectors. Major miners like Rio Tinto and Fortescue experienced rallies, while the big banks showed softer performances. Economic indicators such as building approvals and manufacturing sectors showed contractions, while the Australian dollar remained subdued. Internationally, oil prices saw a modest recovery, and the focus is now on the Federal Reserve’s upcoming policy decisions and potential guidance. In company-specific movements, Regal Partners and Amcor saw significant gains, while Aussie Broadband shares were put on a trading halt following news of a potential equity raising.

Leader

DYL-Deep Yellow Ltd (+9.76%)

CHN-Chalice Mining Ltd (+9.50%)

WC8-Wildcat Resources Ltd (+8.51%)

MAD-Mader Group Ltd (+7.62%)

PDN-Paladin Energy Ltd (+7.41%)

Laggards

CEN-Contact Energy Ltd (-7.13%)

RED-RED 5 Ltd (-5.47%)

NHC-New Hope Corporation Ltd (-5.03%)

SYA-Sayona Mining Ltd (-4.67%)

THL-Tourism Holdings Rentals Ltd (-4.17%)