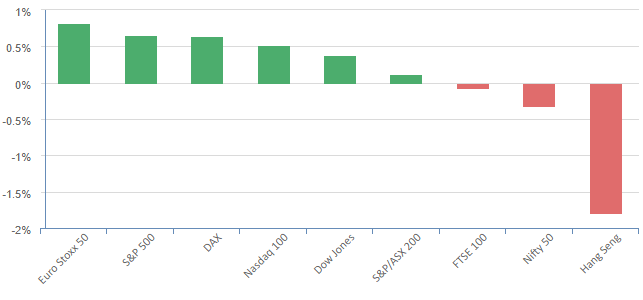

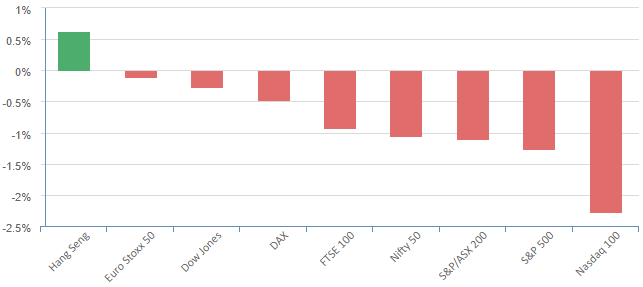

Overnight – Equities book 3rd consecutive monthly loss despite overnight rally, Fed Rate decision eyed

Equities eked out a gain on the final day of trade for October, as investors digested a raft of corporate earnings, but stocks couldn’t avoid racking up a third-straight loss for the first time since March 2020.

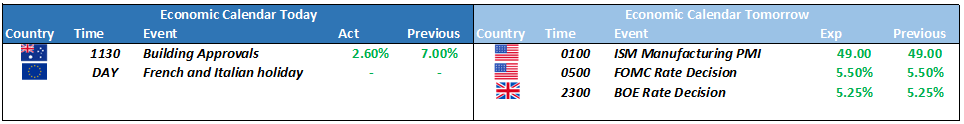

The FOMC rate decision and press conference remarks tomorrow morning will be of key importance to any recovery in the equity market, along with results from the worlds biggest company by market cap, Apple on Friday morning (Sydney time)

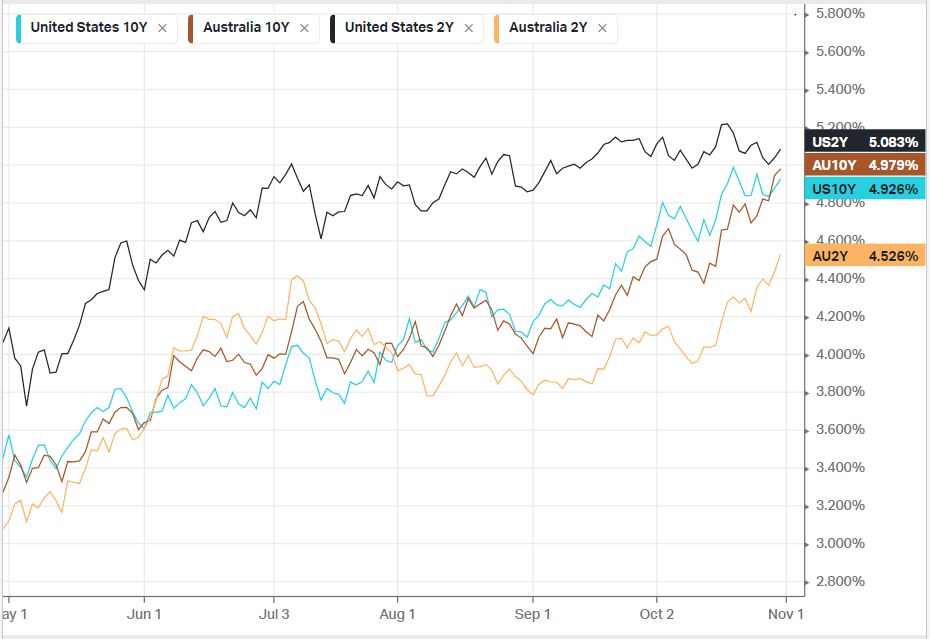

The continued rise in Treasury yields capped any chance of a rally in stocks, sitting perilously close to 5% ahead of the FOMC. Another factor for investors this week is the Treasury refunding announcement due Wednesday after the department on Monday cut its quarterly borrowing estimate for Q4 to $776 trillion from $852 trillion previously. The Treasury’s funding plans have garnered added attention recently following a surge in Treasury yields, which some have attributed increased Treasury supply.

October consumer confidence fell for the third-straight month, although the decline was less than economists had expected as inflation concerns continue to grow. The survey showed that consumers continued to be preoccupied with rising prices in general, and for grocery and gasoline prices in particular.

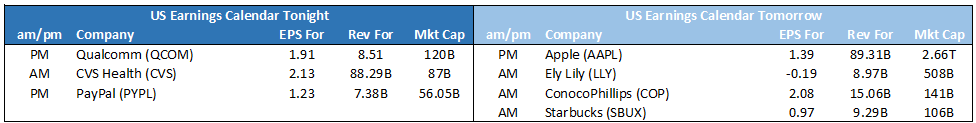

Earnings Results

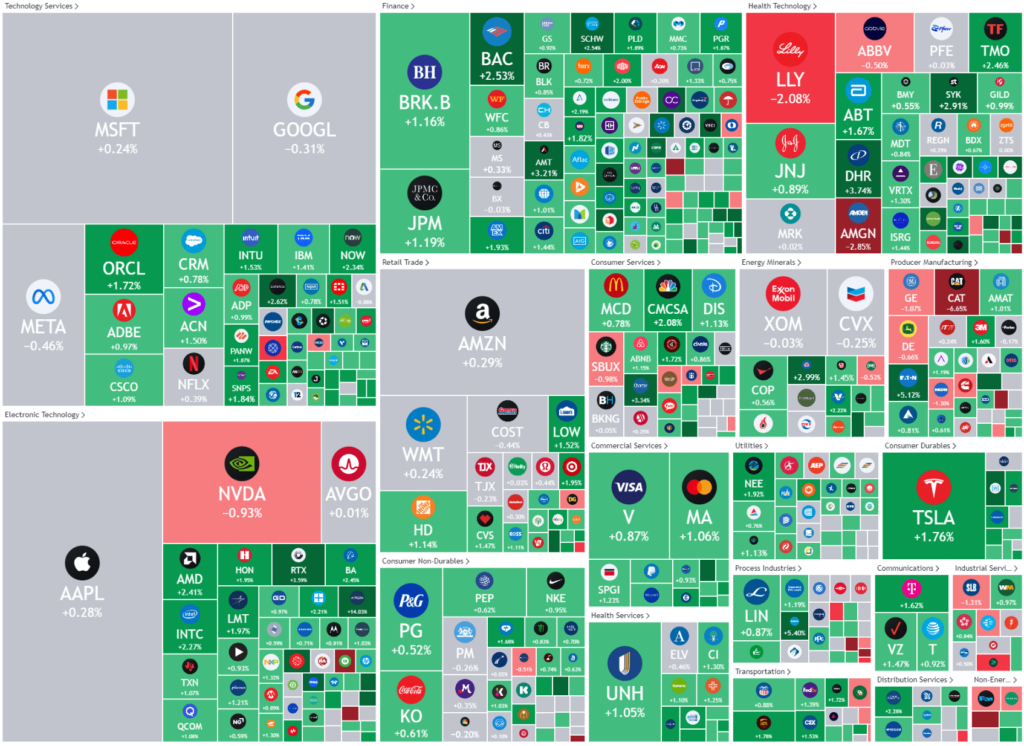

Caterpillar (CAT) – fell nearly 7% after the industrial equipment maker’s order backlog narrowed, stoking worries about slowing equipment demand and offsetting Q3 results that topped on both the top and bottom lines.

JetBlue Airways (JBLU) – was also punished for weaker-than-expected quarterly results and the airline cut its annual guidance, citing a “challenging operation backdrop.” Its shares fell about 10%.

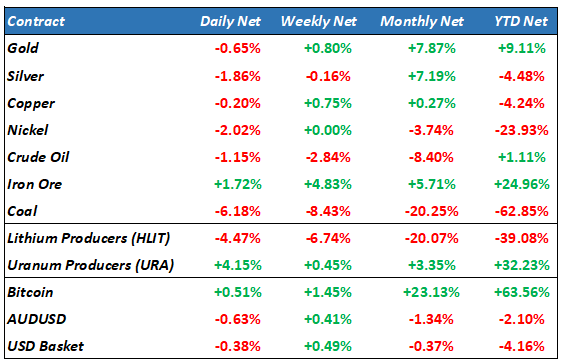

Cameco (CCJ) – Canadian uranium-fuel provider Cameco saw a significant increase in nuclear energy demand, driven by global calls for clean, secure, and affordable energy.

S&P 500 - Heatmap

The Day Ahead

ASX SPI 6818 (+0.51%)

the ASX200 high weighting to materials and financials will help the index higher today as the spike in Iron ore prices to fresh 7-month highs and a firm offshore lead in the banks to assist the rally. Uranium stocks should see another push higher with Cameco

BHP will host its annual meeting at 10am in Adelaide. Other AGMs include Charter Hall Retail REIT, Cromwell Property Group, Domino’s Pizza, Megaport, Sims and Vicinity.

Amcor and Janus Henderson release earnings results.