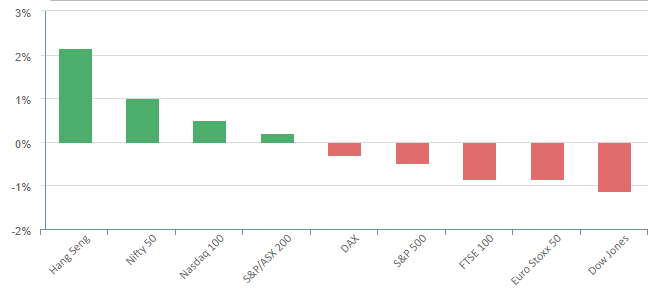

Overnight – Tech bounces, energy weighs on Friday after grim week

Big tech regained some ground after a rough week and the DOW slumped as investors digested contrasting corporate earnings as Amazon and Intel impressed, but underwhelming results from oil majors including Chevron left energy stocks nursing heavy losses.

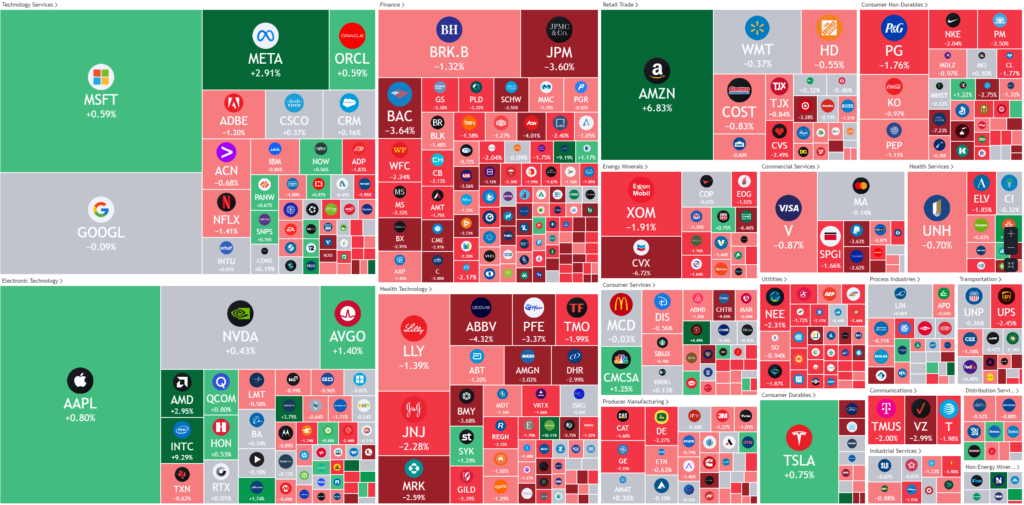

The energy sector weighed on the DOW being dragged down by earnings from the major producers. Exxon Mobil and Chevron fell 2% and nearly 7% respectively.

The S&P 500 has racked up a more than 10% loss from its July peak of 4,588.96 to close in correction territory as tech gave up some gains despite a rally in Amazon and Intel. Amazon rose more than 6% after the tech giant reported third-quarter results that topped Wall Street estimates. Amazon remains one of the best earnings growth stories in the market heading into 2024, as signs are clear that Amazon’s cloud business is set for a reacceleration. Intel, meanwhile, jumped more than 9% as the chipmaker’s blowout Q3 earnings and lift on earnings guidance drew praise from Wall Street.

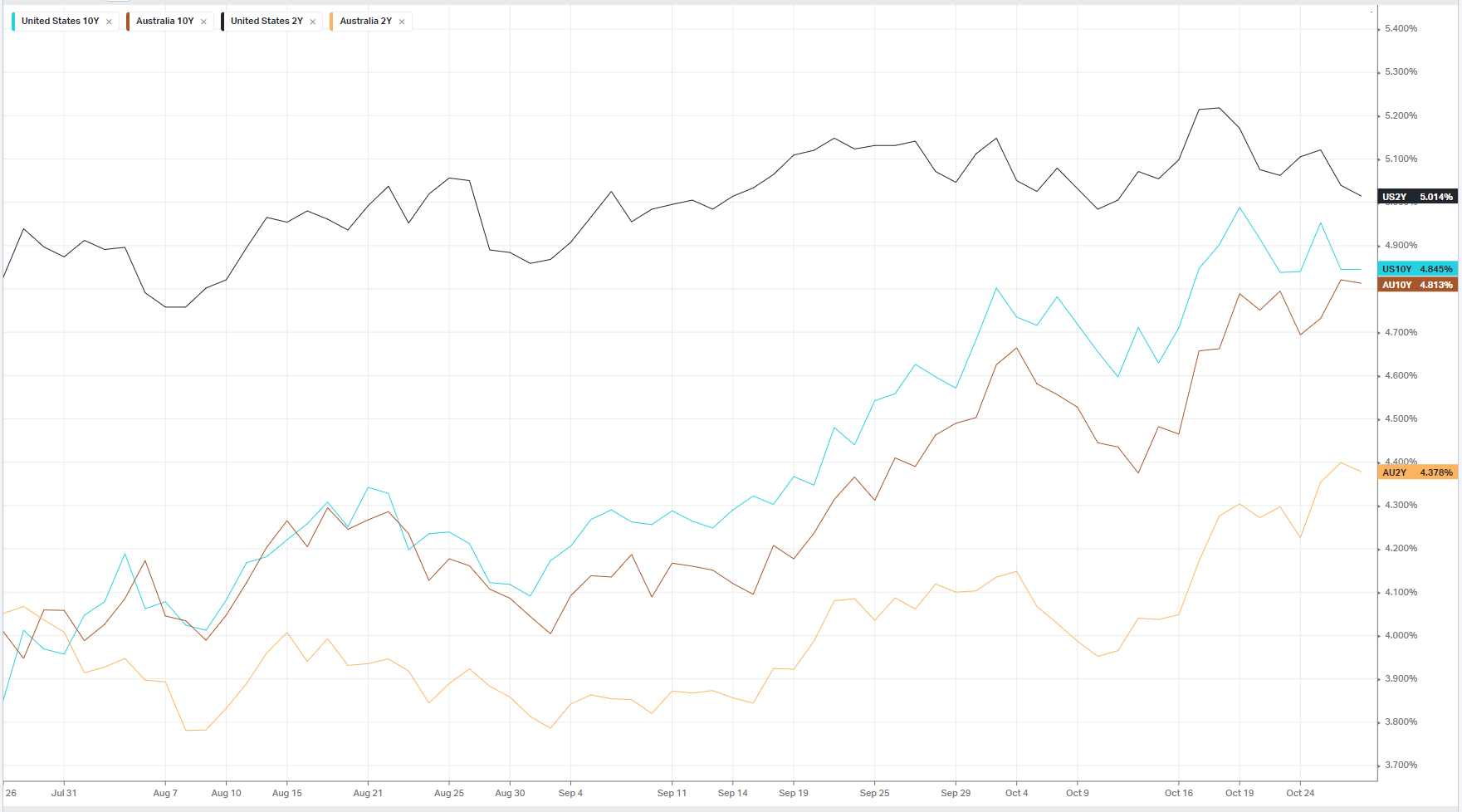

In Macroeconomic news, core PCE, a measure of inflation closely watched by the Fed, slowed to 3.7% in the 12 months through September, as expected, from a 3.9% pace the prior month. While ongoing signs of the slowing inflation will provide the Fed with further evidence that its restrictive monetary policy measures are having the desired impact, the stronger-than-expected pace of consumer spending seen last month could muddy the Fed’s thinking on policy.

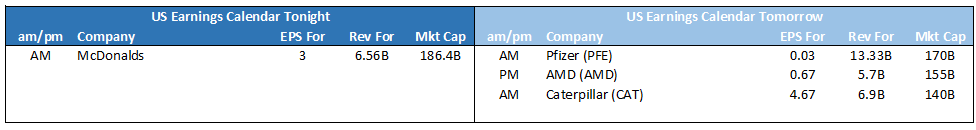

Earnings Results

Exxon Mobil (XON) – missed Wall Street estimates on both the top and bottom lines, wedged down by weaker performance in its upstream segment, which includes the exploration and production stages

Chevron (CVN) –reported a miss on earnings as lower margins on refining business.

S&P 500 - Heatmap

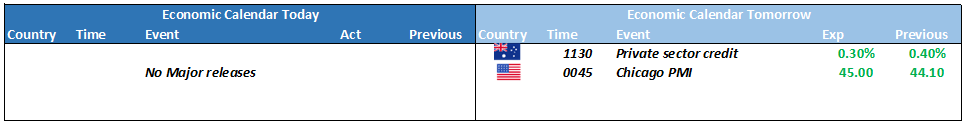

The Day Ahead

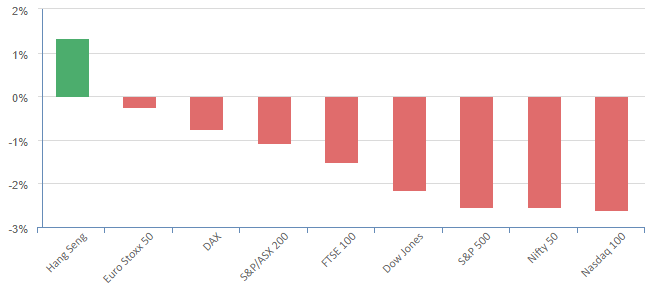

ASX SPI 6772 (-0.97%)

The ASX is in for another rough start to the week with a weak offshore lead compounding the poor technical finishing for the index on Friday close to 52-week lows. With little good news on the macroeconomic front, the technical front or the geopolitical front, markets will struggle to bounce leading into the Fed meeting on Thursday morning.

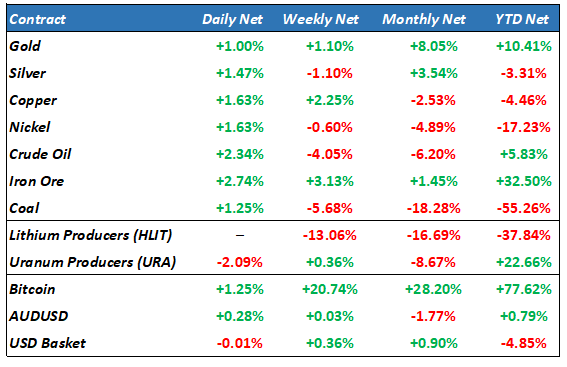

The 1.5% rise in gold and commodity prices coupled with a 2.94% jump in iron ore prices to 7-month highs will provide some relief from the selling, while energy will be mixed as oil rallied but oil companies were weaker on earnings