Closing Bell

What's Affecting Markets Today

Inflation in Australia: A Domestic Dilemma

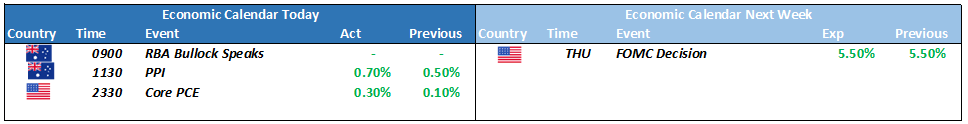

Australia’s inflation is increasingly driven by domestic factors, contrary to Treasurer Jim Chalmers attributing it to global pressures. Rising costs in housing, electricity, food, and wages have intensified the inflation issue, posing significant challenges for the Reserve Bank of Australia (RBA). The RBA now faces tough decisions on whether to raise interest rates in its upcoming November 7 meeting, as it navigates the complexities of these home-grown inflation pressures.

Oil Prices: A Turbulent Journey Amidst Global Uncertainties

Oil prices are set for a weekly decline, influenced by market bearishness and a stronger dollar, despite the ongoing Israel-Hamas conflict. The geopolitical tensions have introduced volatility, with prices initially surging due to conflict fears but later dropping as the war remained contained. The broader financial sentiments and the strengthening dollar have been pivotal in overshadowing the geopolitical risks, directing the oil prices on a path of uncertainty.

ASX Stocks

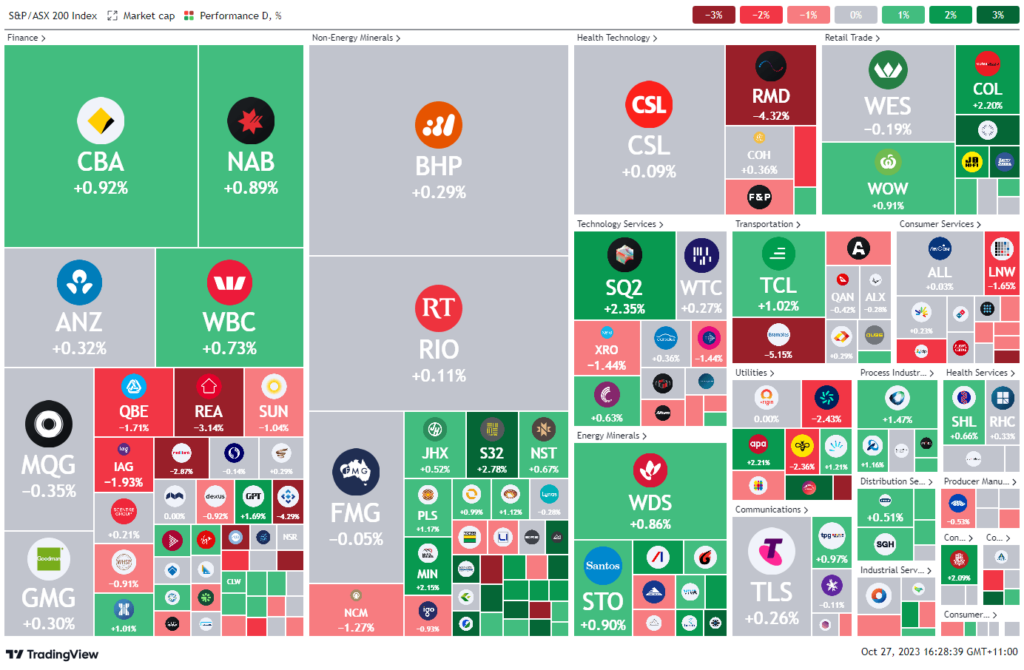

ASX 200 - 6799.1 (-0.81%)

Key Highlights:

Australian shares are showing resilience, maintaining a higher position despite Wall Street’s dip influenced by the latest robust GDP report from the US. The ASX/S&P 200 has risen by 0.5%, with consumer staples leading, boosted by significant gains in Coles and Endeavour. In contrast, the tech sector faces a downturn, mirroring the decline of US tech giants. Domestically, Australia’s producer prices have surged due to increased costs in construction, petrol, and energy, coupled with a rise in service prices, notably in health and childcare.

Globally, the US economy exhibited a 4.9% expansion in its GDP in the third quarter, surpassing expectations, but not significantly impacting the Federal Open Market Committee’s (FOMC) upcoming meeting decisions. Tech giants like Meta faced losses despite strong profits, while Amazon experienced a revenue surge, supported by its retail and cloud computing sectors.

Key stocks to observe include Champion Iron, showing a promising performance, and ResMed, which is experiencing a decline due to increased quarterly costs. Core Lithium and Magellan Financial are also among notable performers in the current market landscape.

Leader

CEN-Contact Energy Ltd (+7.09%)

CIA-Champion Iron Ltd (+6.78%)

SLR-Silver Lake Resources Ltd (+6.67%)

HVN-Harvey Norman Holdings Ltd (+5.35%)

AAC-Australian Agricultural Co. (+5.13%)

Laggards

DYL-Deep Yellow Ltd (-7.97%)

BXB-Brambles Ltd (-5.15%)

AD8-Audinate Group Ltd (-4.71%)

HLS-Healius Ltd (-4.40%)

RMD-Resmed Inc (-4.32%)