Closing Bell

What's Affecting Markets Today

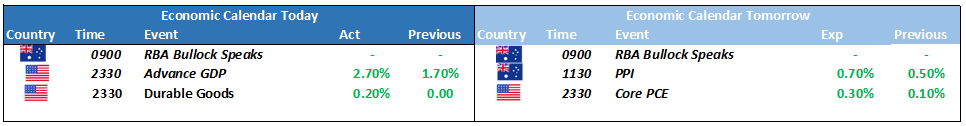

Bullock Unsettled by Persistent Services Inflation

RBA Governor Michele Bullock expresses discomfort over the persistent services inflation, despite a slight CPI increase of 1.2% in July-September. Bullock cites electricity prices, rents, and wages as significant contributors to the ongoing inflation in the services sector, emphasizing the durability of this trend, which aligns with global observations.

China’s Property Downturn: A Significant Economic Hazard

Michele Bullock acknowledges the stability in iron ore demand but identifies China’s turbulent property sector as a substantial risk to economic outlooks. The Chinese government’s focus on aiding property buyers over creditors, amidst efforts to reduce sector leverage, underscores the precarious nature of the property market’s influence on global economic trajectories.

Yen Plummets, Stirring Intervention Concerns

Japan’s yen descends to a near 33-year low against the US dollar, fueling speculation of potential intervention by Tokyo authorities. The currency’s vulnerability, exacerbated by a widening yield gap with the US, has prompted heightened vigilance, with Japan’s historical intervention practices underscoring the seriousness of the yen’s current position.

ASX Stocks

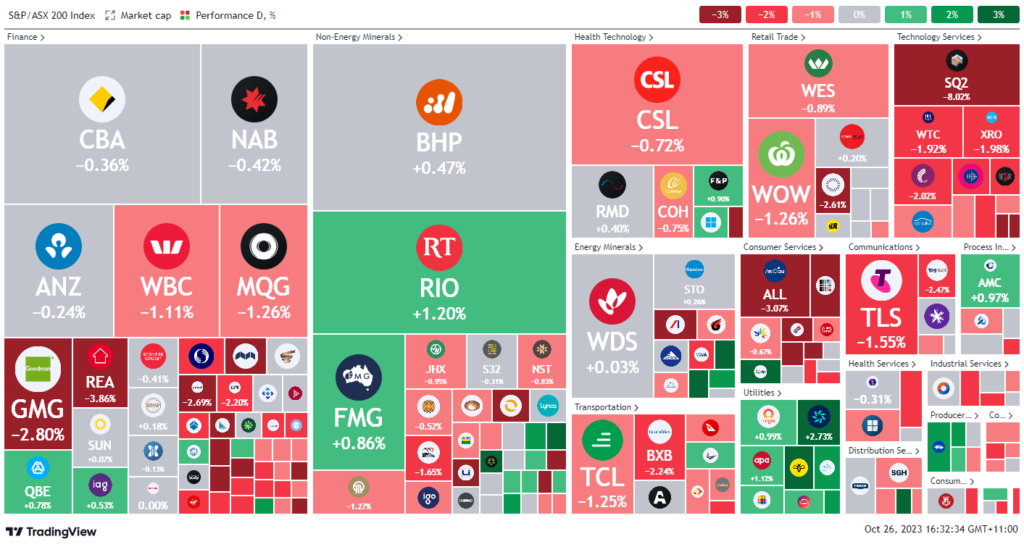

ASX 200 - 6799.1 (-0.81%)

Key Highlights:

The Australian sharemarket faced a decline, influenced by Wall Street’s mixed profit reports from tech giants like Microsoft and Alphabet, and a drop in tech stocks locally. The S&P/ASX 200 fell by 1%, with the tech sector suffering a 3.6% loss, marked by significant drops in companies like Megaport and WiseTech. Contributing to the market’s pressure was the rise in Treasury yields and the Reserve Bank of Australia’s (RBA) potential interest rate hike, as indicated by Westpac’s chief economist following higher-than-expected CPI reports.

Various stocks experienced movement; Westpac saw a 0.9% drop due to significant forthcoming losses, while Pilbara Minerals faced a decline due to weaker lithium prices and lower production volumes. In contrast, Azure Minerals witnessed a 43% rally following a substantial buyout agreement, reflecting the ongoing deal momentum in the Australian lithium sector. The market’s overall performance mirrors global economic intricacies and domestic financial strategies and forecasts.

Leader

IEL-Idp Education Ltd (+5.92%)

SUL-Super Retail Group Ltd (+4.59%)

BPT-Beach Energy Ltd (+3.38%)

ILU-Iluka Resources Ltd (+2.71%)

PDN-Paladin Energy Ltd (+2.33%)

Laggards

MP1-Megaport Ltd (-17.20%)

SQ2-Block Inc (-7.90%)

LNW-Light & Wonder Inc (-5.63%)

EMR-Emerald Resources NL (-5.42%)

BOQ-Bank of Queensland Ltd (-5.02%)